After failing to decisively break above the $120,000 degree in mid-July, Bitcoin (BTC) may face additional value corrections as whales proceed to extend BTC inflows to the Binance crypto change.

Is Bitcoin Dropping Its Bullish Momentum?

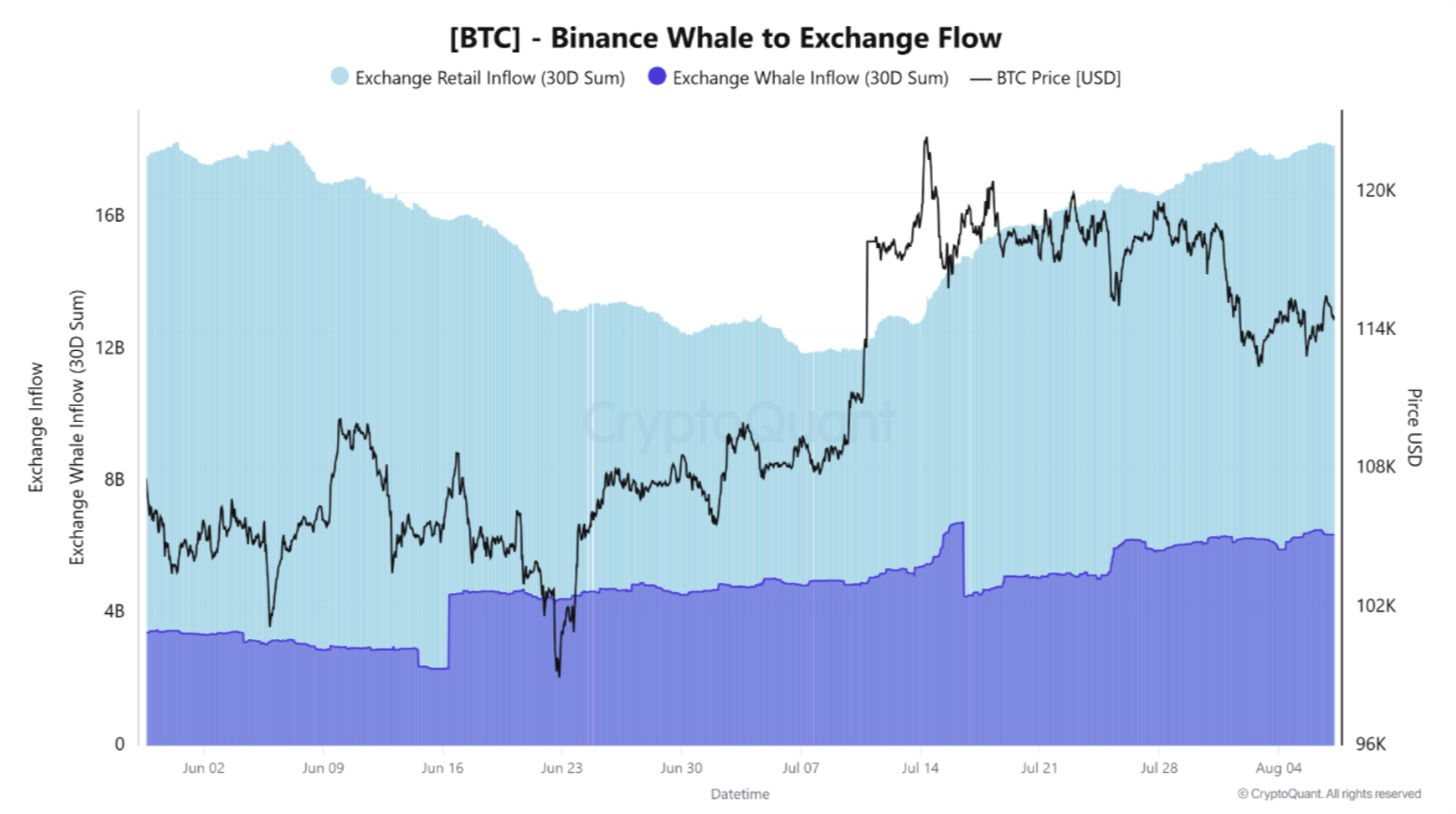

In accordance with a latest CryptoQuant Quicktake publish by contributor Arab Chain, recent information from the Binance Whale-to-Trade Movement indicator means that BTC might quickly expertise extra draw back strain.

Associated Studying

The analyst famous that regardless of rising retail participation within the BTC market, persistently excessive whale inflows into Binance – mixed with a declining Bitcoin value – sign that the market might be getting into a technical correction section.

Arab Chain shared the next chart, the place the purple zone exhibits that whale inflows to Binance remained persistently excessive all through July and early August. On the identical time, the drop in BTC value displays a distribution sample, the place whales start unloading BTC on exchanges following a pointy rally.

Though there have been no excessive spikes, whale inflows into Binance stayed elevated within the $4 billion to $5 billion vary, indicating that these giant holders are actively shifting BTC onto the change – typically a precursor to main sell-offs.

The truth that these inflows stay excessive on Binance regardless of the drop in BTC value means that both whales are nonetheless promoting their holdings on the change, or they’re ready for a value rebound to exit the market.

Equally, the sunshine blue space within the chart exhibits a notable improve in retail inflows to Binance throughout late July and early August. Traditionally, such late-stage retail participation typically marks the ultimate section of a bullish cycle, offering exit liquidity for whales. The analyst concluded:

Regardless of the rise in retail participation, the market exhibits indicators of inner weak spot, with sustained whale inflows to Binance and lack of upward momentum. If this habits continues, the market could also be getting into a medium-term correction section.

Traders Nonetheless Optimistic About BTC

Whereas alerts counsel the present BTC rally could also be overextended, some traders stay assured, using methods like Good Greenback-Price Averaging (DCA) to build up BTC in anticipation of additional value good points.

Associated Studying

Fellow CryptoQuant analyst Oinonen famous that whereas the latest pullback in BTC value might have raised considerations about additional declines, the asset’s historic This autumn efficiency may propel it to a brand new all-time excessive of $200,000 by the tip of 2025.

After hitting a latest low round $111,800, BTC has recovered a part of its losses and is now buying and selling close to $116,500. Nonetheless, some analysts warning traders in opposition to “extreme optimism.” At press time, BTC was buying and selling at $116,501, up 0.2% over the previous 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com