Bitcoin is buying and selling round key ranges after reclaiming the $115,000 mark, with bulls firmly in management regardless of ongoing consolidation beneath the $120,000 threshold. The development stays bullish, supported by regular shopping for curiosity and robust technical positioning.

Associated Studying

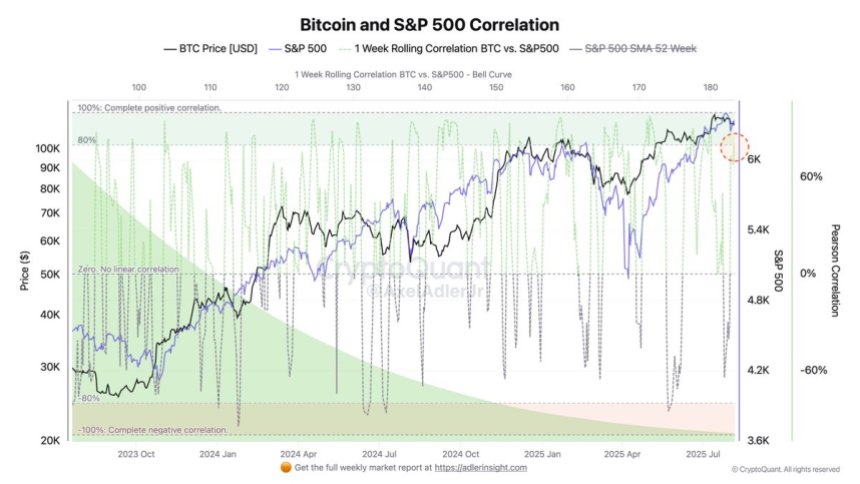

Key knowledge exhibits that the correlation between Bitcoin and the S&P 500 has surged to 80%. On this high-correlation regime, a continued rally in US equities may present Bitcoin with a tailwind towards new highs, whereas an fairness pullback may amplify draw back volatility.

With the S&P 500 at the moment in a bullish section, BTC seems to be monitoring the identical trajectory. Nonetheless, market watchers warning that such excessive correlation ranges are sometimes short-lived and susceptible to sharp reversals. For now, merchants are carefully monitoring each fairness and crypto charts, understanding that any shift in danger urge for food throughout conventional markets may rapidly ripple into Bitcoin’s value motion.

S&P 500 Correlation Strengthens Bitcoin’s Macro Hyperlink

In accordance with prime analyst Axel Adler, the current 80% correlation between Bitcoin and the S&P 500 underscores how deeply macroeconomic forces are influencing the crypto market. On this surroundings, key drivers comparable to rate of interest expectations, liquidity situations, and the broader risk-on/risk-off sentiment are immediately transmitted to BTC’s value motion.

Underneath this regime, a sustained restoration in US equities will doubtless present a supportive backdrop for Bitcoin. Conversely, if inventory markets expertise a downturn, the unfavourable sentiment may rapidly spill over into the crypto area, amplifying sell-offs and triggering broader market weak spot.

Adler factors out that the present studying is predicated on a 1-week rolling correlation metric, which is inherently unstable. Traditionally, such correlation spikes are hardly ever sustained for lengthy intervals. The current degree, whereas vital, is unlikely to carry for quite a lot of weeks earlier than reverting towards its imply.

Regardless of the short-term nature of this spike, the analyst emphasizes that the expansion of crypto adoption within the US—from institutional merchandise like ETFs to company treasury allocations—units the stage for a bullish long-term outlook. Nonetheless, merchants should stay conscious that macroeconomic downturns, tightening liquidity, or shifts in Federal Reserve coverage may quickly reverse market sentiment.

Associated Studying

Bitcoin Value Evaluation: Bulls Defend Key Assist

Bitcoin (BTC) is buying and selling round $116,565, holding regular after reclaiming the $115,724 assist degree, which coincides with a key horizontal zone from late July. On the 4-hour chart, BTC just lately broke above the 50-day, 100-day, and 200-day SMAs, signaling short-term bullish momentum. These shifting averages, now converging close to $116,000, may act as a robust assist cluster if examined once more.

The speedy upside goal stays the $122,077 resistance, final examined in mid-July. Nevertheless, BTC has confronted promoting stress close to $117,000, indicating short-term consolidation earlier than a potential push greater. Quantity has tapered barely after the breakout, suggesting that consumers may have recent momentum to maintain the transfer.

Associated Studying

If BTC holds above $115,724 and the shifting common cluster, bulls may try a breakout towards the $118,000–$122,000 zone. Nevertheless, rejection would possibly set off a retest of $115,724, with a deeper pullback.

Featured picture from Dall-E, chart from TradingView