Ethereum (ETH) has surged above the $4,000 mark for the primary time since final December, signaling a robust return of bullish momentum. After a number of days of heightened volatility and market uncertainty, consumers have regained management, pushing costs to ranges not seen in months. The breakout displays a mixture of bettering market sentiment, sturdy fundamentals, and rising institutional curiosity within the main sensible contract platform.

Associated Studying

On-chain knowledge from CryptoQuant provides additional gas to the bullish narrative, exhibiting that ETH change reserves proceed to say no steadily. This development means that buyers — significantly giant holders — are transferring their cash off exchanges, lowering out there liquidity within the open market. With demand for ETH rising throughout decentralized finance (DeFi), real-world belongings (RWA), and staking actions, the situations for a possible provide shock are forming.

Market analysts level to this tightening provide, coupled with constant shopping for stress, as a catalyst for additional good points. If the development continues, Ethereum might begin a sustained rally, bringing the subsequent main resistance ranges into focus. For now, merchants are intently watching whether or not ETH can preserve its place above $4,000 and construct a stronger base for a possible run towards its all-time highs.

Ethereum Sensible Cash Drains Liquidity

In line with the most recent knowledge from CryptoQuant, solely 18.8 million ETH stays on centralized exchanges — a historic low that underscores the rising shortage of Ethereum within the open market. This isn’t the results of retail merchants making small withdrawals. As an alternative, it displays a deliberate transfer by institutional gamers and “sensible cash” to build up and safe giant quantities of ETH off exchanges.

This accelerated outflow is creating a transparent provide squeeze. With fewer cash out there for spot buying and selling, upward worth stress is more likely to construct, particularly if demand continues its present trajectory. The tempo of accumulation means that these giant holders are positioning for a long-term play, lowering market liquidity and setting the stage for vital worth volatility to the upside.

Including to the bullish outlook, public firms are starting to undertake Ethereum as a part of their treasury methods. Sharplink Gaming, for instance, has lately bought substantial quantities of ETH, becoming a member of a rising record of corporations diversifying into digital belongings. In the meantime, growing authorized readability in the USA is opening the door for broader adoption, reducing obstacles for each institutional and company participation within the Ethereum ecosystem.

Associated Studying

These converging elements — institutional accumulation, lowered change reserves, and regulatory inexperienced lights — are forming a market setting in contrast to something seen earlier than in Ethereum’s historical past. If the development persists, analysts count on the approaching months to ship unprecedented worth motion, fueled by an ideal storm of tightening provide and rising demand. In such situations, Ethereum couldn’t solely maintain its place above $4,000 but in addition make a decisive push towards new all-time highs.

ETH Breaks $4,000, Assessments Key Weekly Resistance

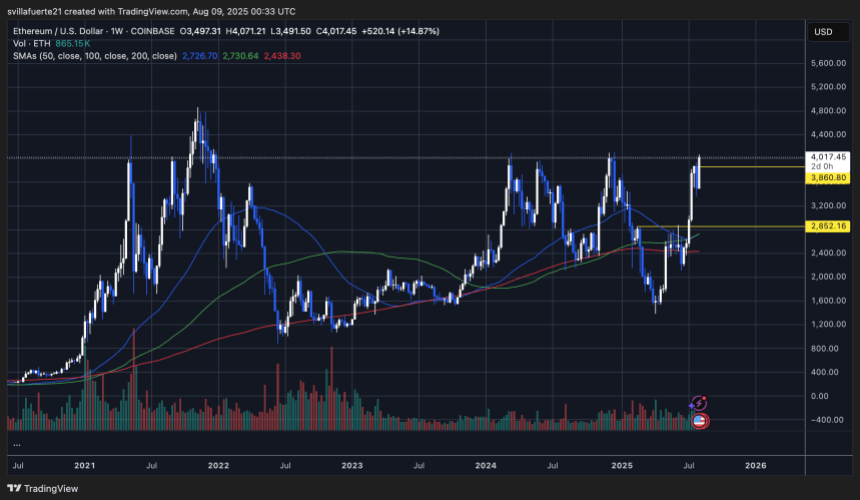

Ethereum’s weekly chart reveals a decisive breakout above the $3,860 resistance degree, pushing the value to $4,017 — its highest degree since December 2024. This surge marks a 14.87% weekly achieve, highlighting sturdy bullish momentum following weeks of accumulation and restoration from the $2,852 assist zone.

The present worth motion is supported by the 50, 100, and 200-week SMAs trending beneath the market, with the 50-week SMA at $2,726 reinforcing the power of the long-term uptrend. Quantity has additionally spiked considerably, indicating that the breakout is pushed by actual shopping for curiosity fairly than speculative noise.

Featured picture from Dall-E, chart from TradingView