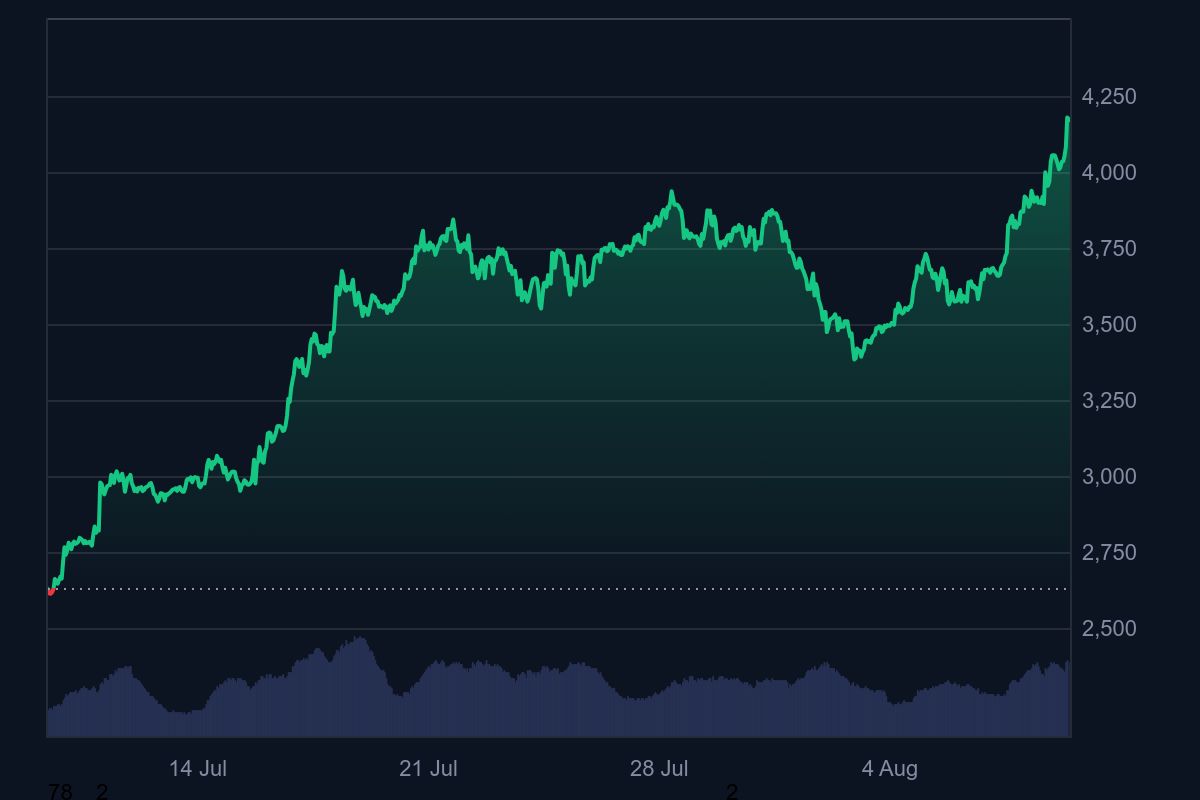

Ethereum has outpaced the broader crypto market, climbing 6.36% up to now 24 hours and racking up positive factors of +19% weekly and +48% during the last month.

The transfer comes as Bitcoin dominance dips, highlighting ETH’s management within the present rally.

A $105 million brief squeeze on August 9 proved to be the spark. As soon as ETH broke the $4,100 barrier, bears had been compelled to cowl positions, accounting for over half of crypto’s each day brief losses.

This shopping for strain echoed the same sample from December 2024, when ETH rallied 28% after a comparable squeeze.

Institutional curiosity can be intensifying. Since July 9, ETFs and whales have acquired 540,460 ETH ($1.99B), with BlackRock’s ETHA ETF alone attracting $727 million in a single day. Provide on exchanges has fallen to simply 12.3M ETH — the bottom since 2018 — signaling potential shortage forward.

Technically, ETH has damaged long-standing resistance, with momentum indicators mirroring pre-2021 bull run setups. Whereas the RSI at 71 suggests overbought situations, the breakout opens room towards $4,425. Analysts warning {that a} pullback may check assist at $3,740, however sustained institutional accumulation might preserve the uptrend intact.