Beforehand a distinct segment device for crypto, stablecoins are progressively changing into a fixture of mainstream finance. Circle and Tether now have bigger US debt portfolios than a number of sovereign nations.

The current passage of the GENIUS Act legitimized stablecoin use, supercharging curiosity from banks, fee processors, and Fortune 500 firms.

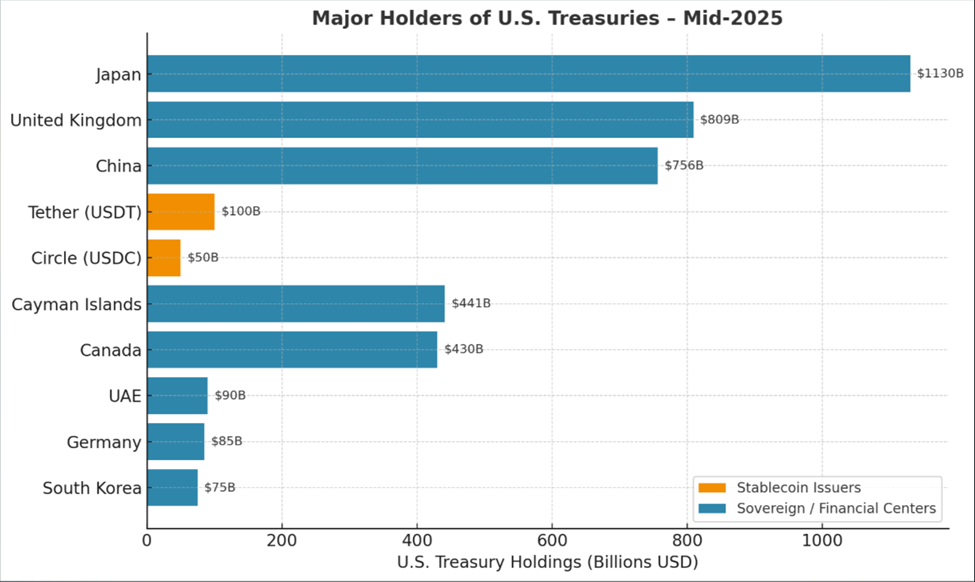

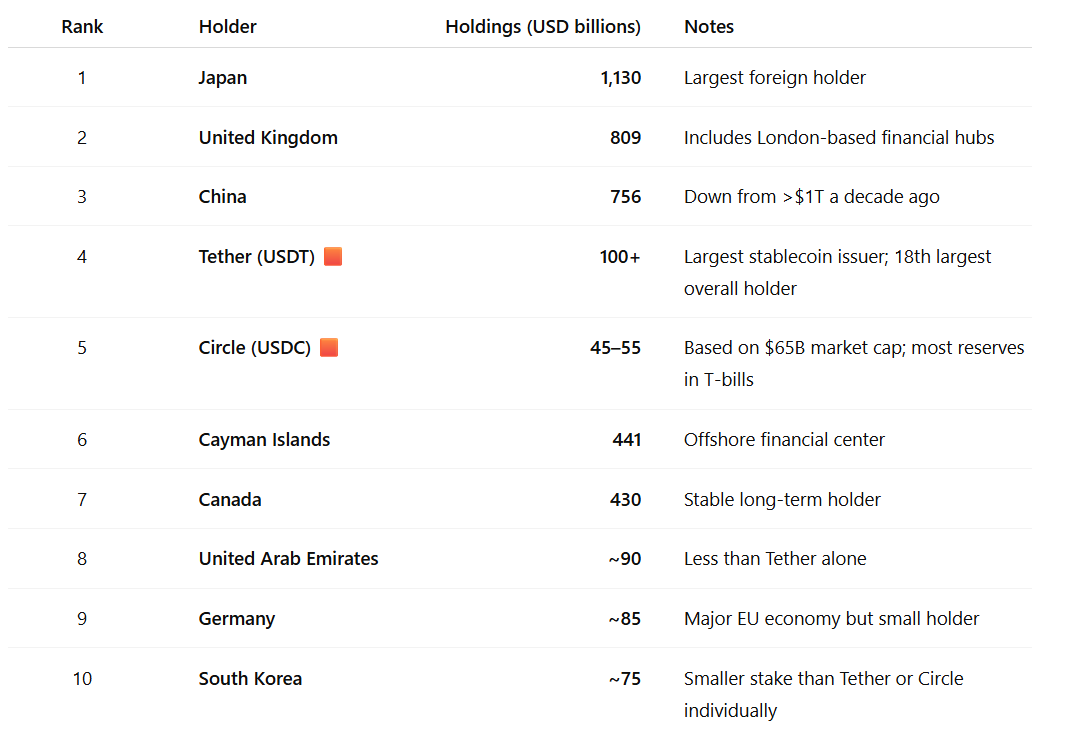

Circle and Tether Quietly Amass Extra US Debt Than Germany, South Korea, and the UAE

Stablecoins are digital tokens pegged to the US greenback and backed by reserves, usually in US Treasury payments (T-bills). The construction ensures that one token can reliably be redeemed for one greenback.

This stability makes them engaging for cross-border funds and as a settlement layer for the crypto ecosystem.

Two main stablecoin issuers, Tether (USDT) and Circle (USDC), maintain extra US authorities debt than a number of main nationwide economies. This consists of Germany, South Korea, and the United Arab Emirates.

Tether, the most important stablecoin issuer, now holds over $100 billion in T-bills. In line with knowledge from the Treasury Division, it ranks because the 18th-largest general holder of US debt, above the UAE ($85 billion).

Circle, the issuer of USDC, holds between $45 billion and $55 billion in T-bills, placing it forward of South Korea (roughly $75 billion) if measured individually.

Mixed, the 2 firms surpass all three nations, with a current Apollo report highlighting simply how shortly the sector is rising.

“Nearly 90% of stablecoin use is crypto buying and selling, which is able to doubtless proceed to develop. The massive breakthrough will probably be if US greenback stablecoins are used for international retail funds. If the US greenback stablecoin market grows into the trillions, demand for US T-bills will considerably improve. There are monetary stability dangers as a result of cash will probably be moved round shortly if depositors lose confidence in a stablecoin issuer,” learn an excerpt within the Apollo report.

The stablecoin business is now the 18th largest exterior holder of Treasuries, with projections suggesting it might develop from its present $270 billion market cap to $2 trillion by 2028.

The market cap of USDC alone has surged 90% previously 12 months to $65 billion. It was fueled by institutional adoption and Circle’s high-profile IPO in June.

Transaction Volumes Rival Conventional Fee Giants

In the meantime, the adoption story goes past reserves. In early 2024, stablecoin transaction volumes exceeded Visa’s, largely on account of their use in crypto buying and selling. Growing use in international cash transfers additionally contributed to the traction, with a BeInCrypto report indicating 49% of establishments use stablecoins.

With near-instant settlement and low charges, stablecoins are being pitched as a sooner, cheaper different to SWIFT and different legacy fee rails. Stripe’s $1.1 billion acquisition of the stablecoin startup Bridge in October marked one of many first main fintech bets on the know-how.

The rise of stablecoin issuers as main T-bill patrons comes when conventional international holders are scaling again. China’s holdings have dropped from over $1 trillion a decade in the past to $756 billion.

Whereas nonetheless the most important international holder at $1.13 trillion, Japan has additionally signaled a extra cautious strategy. This creates a gap for stablecoin issuers to function a constant supply of demand for US debt.

“Having stablecoin issuers at all times be there’s a huge enhance by way of giving confidence to the Treasury [Department] about the place to put debt,” Fortune reported, citing Yesha Yadav, a Vanderbilt Legislation Faculty professor who research the intersection of crypto and the bond market.

Proponents argue that stablecoins might assist cement the greenback’s dominance globally, very like the offshore “Eurodollar” market did within the twentieth century.

Additionally they recommend a rising demand for T-bills from stablecoin companies might assist decrease long-term rates of interest and strengthen US sanctions enforcement overseas.

Skeptics, nonetheless, warning towards overhyping the numbers, with the US cash market fund (MMF) sector, for instance, dwarfing stablecoin holdings at roughly $7 trillion.

In the meantime, banking lobbyists warn that stablecoins might drain deposits from banks, doubtlessly lowering lending capability.

“Citi forecasts locations Stablecoins amongst the highest holders of US T-Payments, if US debt climbs and T-Payments wobble, so does the belief in digital greenback. Creating a short lived shift to different currencies,” one person wrote, citing Citibank.

Business executives counter that related fears about MMFs many years in the past proved unfounded.

Nonetheless, if stablecoins hold absorbing massive quantities of short-term Treasuries, it might disrupt how Wall Avenue manages liquidity and danger.

However, the expansion of Circle and Tether alerts that the US debt market has a brand new class of heavyweight patrons born within the risky crypto area fairly than in conventional banking halls.

The submit Tether and Circle Now Maintain Extra US Debt Than A number of Nations appeared first on BeInCrypto.