Economist Henrik Zeberg is cautioning that Bitcoin’s surge could also be far much less unbiased than many consider.

Regardless of hovering close to file highs, he argues the cryptocurrency’s efficiency has been tightly sure to the Nasdaq, benefiting from bullish tech sentiment however leaving itself weak if markets reverse.

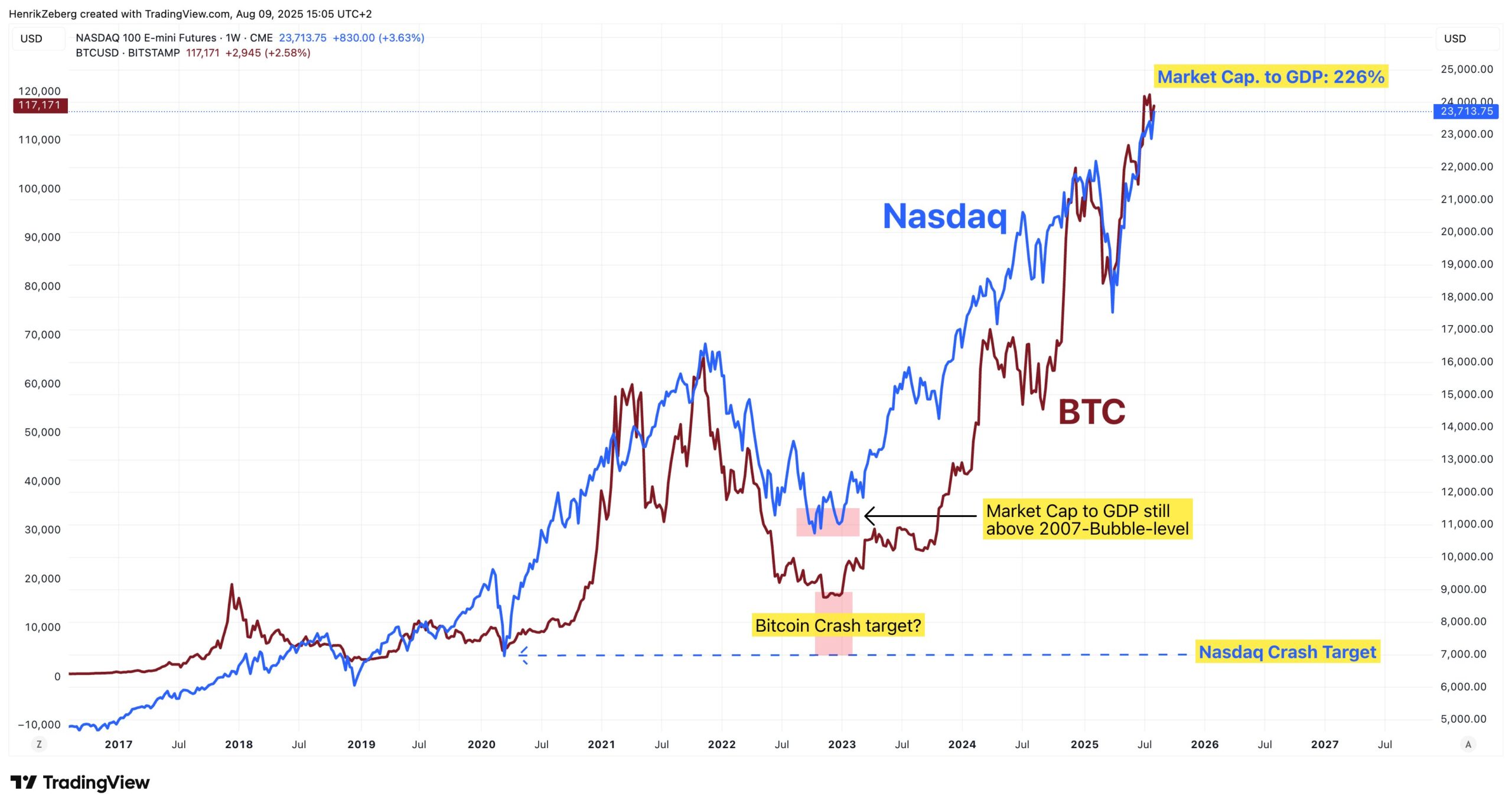

Zeberg describes the present setting as a “second tech bubble,” pushed by investor euphoria and inflated valuations. He notes the U.S. market cap-to-GDP ratio has climbed properly past historic norms, even exceeding pre-2008 disaster ranges – an indication, in his view, of brewing instability.

As an alternative of performing as a safe-haven asset, Bitcoin has tracked the boom-and-bust cycles of high-growth shares for years. Zeberg warns {that a} important drop within the Nasdaq, particularly throughout an financial slowdown, may spark a speedy sell-off in crypto.

For now, Bitcoin stays above $110,000 alongside file fairness highs. However Zeberg believes this may very well be the ultimate stage of the rally, with any bubble burst probably wiping out beneficial properties far quicker than they have been made.