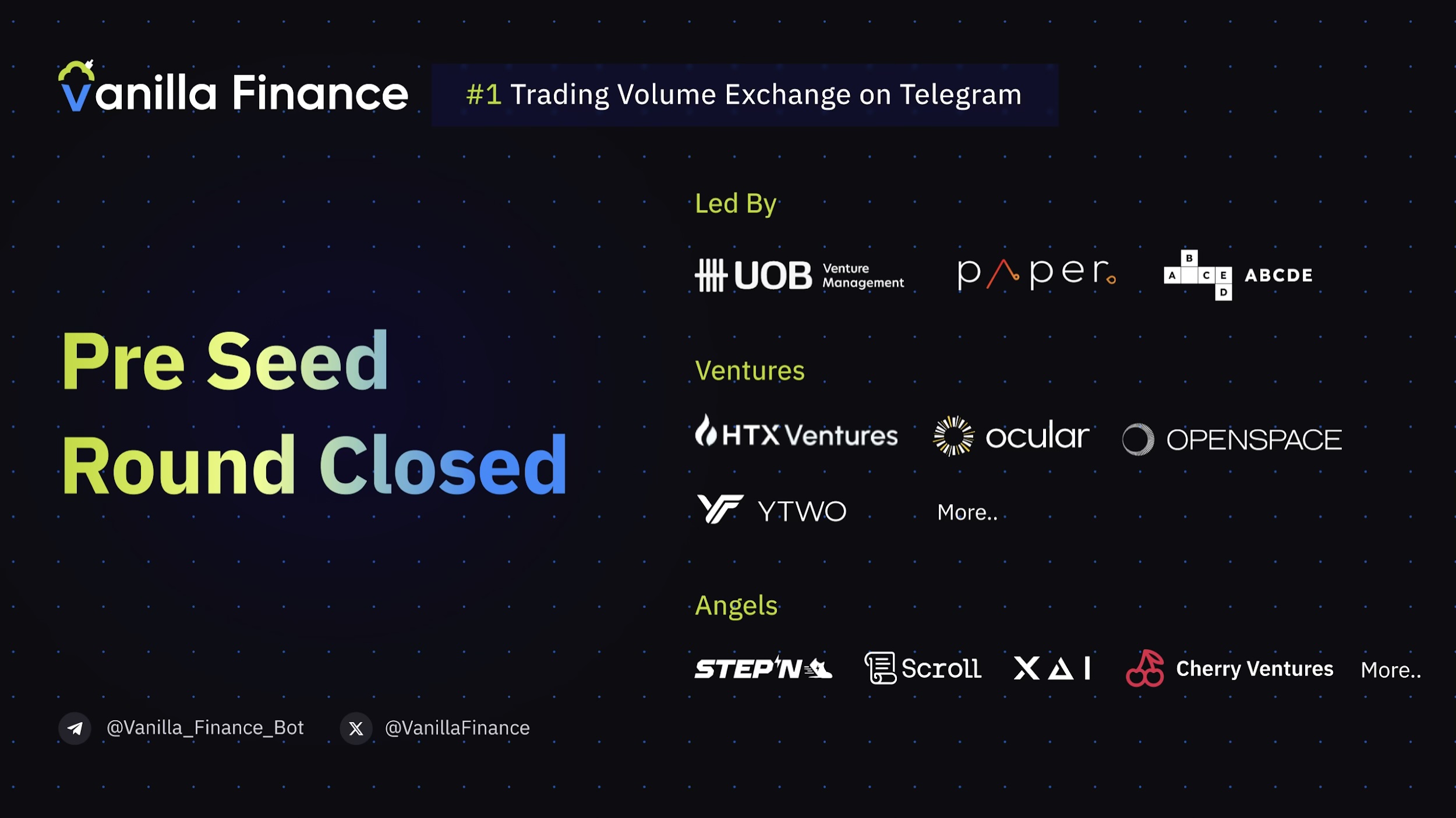

Vanilla Finance the number-one change by buying and selling quantity on Telegram immediately introduced the profitable closure of their pre-seed funding spherical led by Paper Ventures, UOB Ventures and ABCDE Labs amongst different top-tier ventures and traders, together with HTX Ventures, Ocular, Openspace, Y2 Ventures and Signum Capital, in addition to angel traders from STEPN, Scroll, XAI, Cherry Ventures and extra.

This important funding spherical coincides with Vanilla Finance’s notable achievements within the digital asset sector, the place it has shortly risen to grow to be the number-one change by buying and selling quantity on Telegram, amassing over $8 billion in USDT buying and selling quantity inside the first 60 days of launching.

A landmark achievement

Vanilla Finance has additional solidified its place by successful the Binance MVB (most beneficial builder) season eight an accolade that not solely celebrates its revolutionary buying and selling options but in addition acknowledges its market management and success.

Imaginative and prescient for the long run

Vanilla Finance, having closed its spherical, is now poised to redefine the consumer expertise in crypto buying and selling.

- Redefining consumer Expertise The platform will concentrate on turning into extra intuitive, safe and user-friendly, using new options to simplify and improve the buying and selling course of for newbies and consultants alike.

- Increasing market choices anilla Finance plans to launch its spot market within the coming weeks, significantly specializing in meme buying and selling pairs, which have seen a surge in reputation. Moreover, they intend to introduce a meme creator platform, staking merchandise and futures buying and selling to diversify their choices and cater to a broader consumer base.

With a strategic concentrate on Southeast Asia and APAC, Vanilla Finance is gearing as much as faucet into the area’s quickly rising digital economic system.

The platform goals to seize the following 100 million customers by providing localized companies, together with help in native languages and integration with regional fee programs.

Strategic investments and market management

The funding from UOB Ventures a enterprise arm of considered one of Asia’s main banks and Paper Ventures recognized for its concentrate on tech-driven monetary options alerts sturdy institutional backing.

A spokesperson from UOB Ventures stated,

“We’re thrilled to help Vanilla Finance. Their revolutionary strategy to buying and selling on Telegram mixed with their imaginative and prescient for the long run aligns completely with our funding philosophy in fostering leaders in finance.”

Danish Chaudhry, GP of Paper Ventures, added,

“Vanilla Finance’s technique to increase into the Southeast Asia and APAC areas aligns completely with the large progress potential in digital finance.

“We see these markets as the way forward for funding alternatives.”

Trying forward

As Vanilla Finance strikes ahead with its formidable plans, the corporate stays dedicated to sustaining the safety and integrity of its platform whereas pushing the boundaries of what a crypto change can provide.

The mixing of community-driven options, like meme spot buying and selling and change merchandise, may set a brand new commonplace in how digital belongings are traded and engaged with.

Vanilla Finance is not only constructing a buying and selling platform it’s crafting an ecosystem the place innovation drives consumer engagement and progress.

With this new funding, the long run seems promising not only for Vanilla Finance however for the numerous customers it goals to serve in Southeast Asia and past.

Contact Vanilla Finance

X | Telegram | Vanilla Finance Bot

This content material is sponsored and needs to be considered promotional materials. Opinions and statements expressed herein are these of the writer and don’t mirror the opinions of The Every day Hodl. The Every day Hodl shouldn’t be a subsidiary of or owned by any ICOs, blockchain startups or firms that publicize on our platform. Traders ought to do their due diligence earlier than making any high-risk investments in any ICOs, blockchain startups or cryptocurrencies. Please be suggested that your investments are at your individual danger, and any losses you could incur are your accountability.

Observe Us on Twitter Fb Telegram