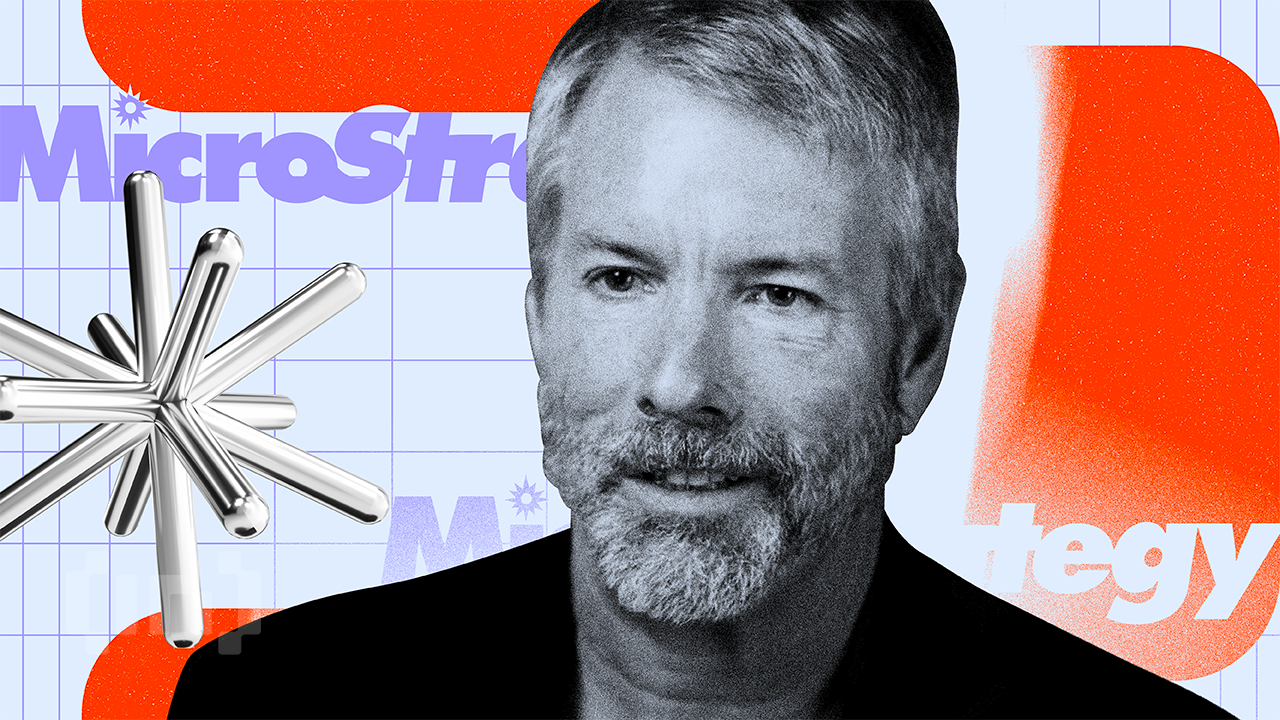

Amid the rise of altcoin-focused treasury firms, Technique (previously MicroStrategy) co-founder Michael Saylor reaffirmed that he stays dedicated to Bitcoin.

Removed from worrying, Saylor views the rising adoption of altcoins as a part of a broader ‘explosion of innovation’ within the digital asset house—one which he believes finally strengthens the complete sector, together with Bitcoin.

Bitcoin Over Every little thing: Michael Saylor’s Focus Amid Altcoin Frenzy

In an interview with Bloomberg, Bitcoin maximalist Saylor burdened that regardless of rising curiosity in altcoins, many of the capital remains to be going into Bitcoin.

“So I’m laser like targeted on Bitcoin,” he mentioned.

The Technique co-founder revealed that the variety of firms including Bitcoin to their treasuries has greater than doubled in simply six months, leaping from roughly 60 to 160. Moreover, Saylor labeled Bitcoin as ‘digital capital.’

He forecasted that it could surpass the S&P 500 in efficiency over the long run

“I believe it’s the clear international financial commodity on the planet proper now. So it’s the bottom threat, highest return, most simple technique if you wish to outperform the S&P and if you wish to inject vitality and efficiency into your steadiness sheet,” Saylor added.

His newest remarks got here after Technique introduced its third-largest Bitcoin buy. Between July 28 and August 3, the corporate purchased 21,021 BTC for $2.46 billion. The agency, the biggest public holder of BTC, has 628,791 BTC value $74.33 billion.

Technique’s Bitcoin wager has additionally confirmed profitable. In Q2, the agency reported a web revenue of $10.02 billion, a shift from the losses posted within the first quarter.

The Finish of Bitcoin-Solely Treasuries? How ETH is Stealing the Highlight

Whereas Saylor’s conviction in Bitcoin stays unshaken, Ethereum is turning into the following most popular selection for a lot of institutional gamers. Furthermore, their conviction shouldn’t be with out cause.

Trade leaders level to its adaptability, evolving ecosystem, and numerous purposes—from tokenization to enterprise options—as elements driving long-term confidence. The truth is, Commonplace Chartered’s Geoff Kendrick argued that Ethereum-focused treasury firms “make extra sense” than their Bitcoin counterparts. The explanation, he defined, is

“Because of staking yield, DeFi leverage. And from a regulatory arbitrage perspective, they make extra sense than their BTC equivalents, too.

As well as, Shawn Younger, Chief Analyst at MEXC Analysis, not too long ago instructed BeInCrypto that the business has moved past the period of Bitcoin-only company treasuries.

“Corporations are more and more diversifying throughout ETH, SOL, BNB, and TON, treating them as strategic belongings aligned with the evolving construction of digital finance. This marks a major departure from the normal institutional finance playbook. Companies are starting to align their treasury portfolios with the operational logic of crypto-native ecosystems, prioritizing liquidity, programmability, and publicity to on-chain progress sectors, Younger talked about.

He defined that companies publicly disclosing their digital asset holdings are setting a brand new benchmark. In response to Younger, firms integrating cryptocurrencies into their treasuries in the present day might assist form the brand new company customary within the coming years.

The publish MicroStrategy’s Saylor Says Altcoin Company Treasuries Will Assist Bitcoin appeared first on BeInCrypto.