China airs 30-minute US crypto satire

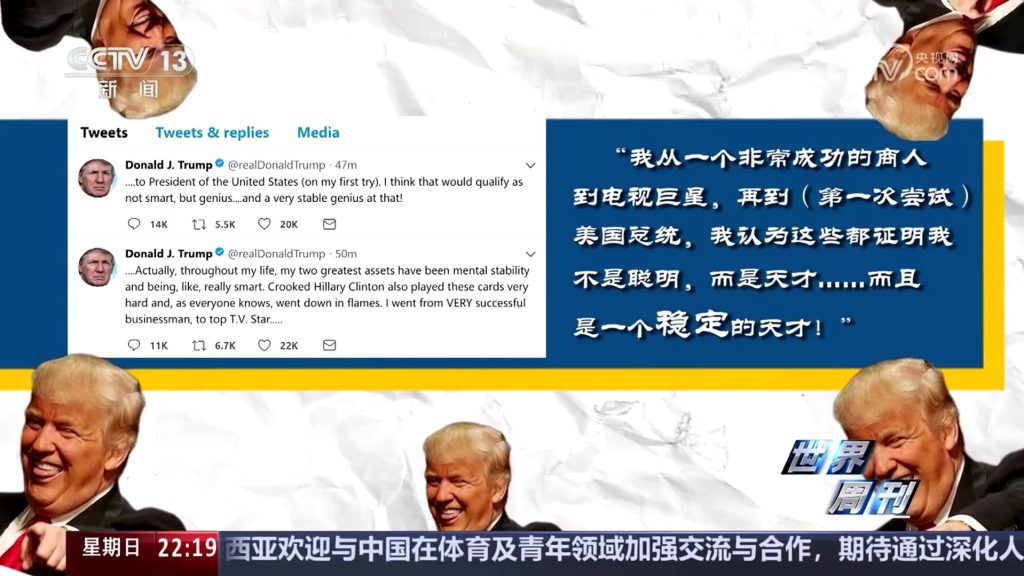

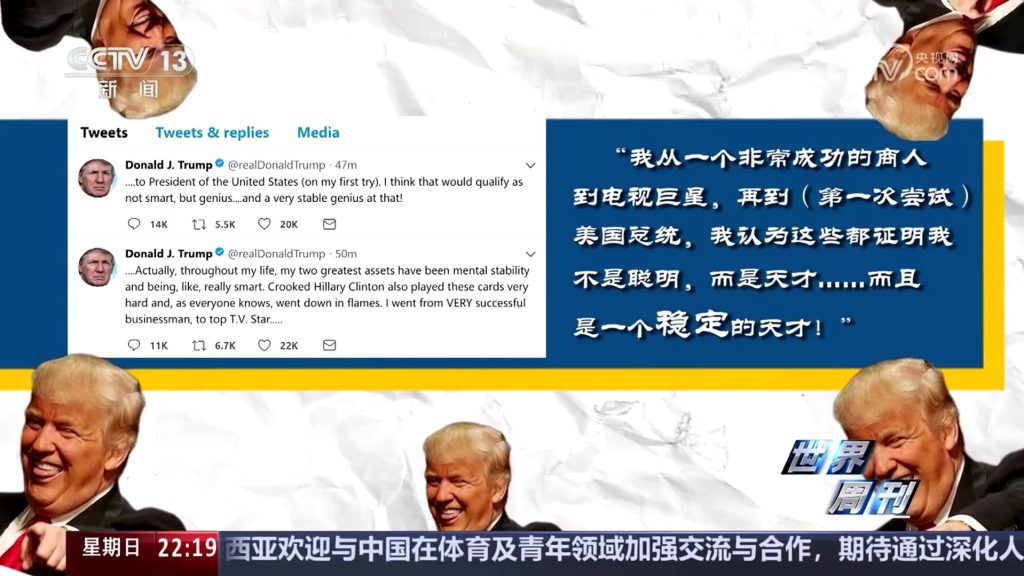

CCTV, China’s state broadcasting mouthpiece, aired a half-hour particular on cryptocurrencies and the way the US is trying to solidify greenback dominance with stablecoins.

The July 27 broadcast framed the brand new US stablecoin laws GENIUS Act, as a geopolitical turning level. CCTV pinpointed that the brand new guidelines explicitly ban a Federal Reserve-issued central financial institution digital forex (CBCD) whereas permitting stablecoins to export US debt in digital type.

The broadcaster mentioned stablecoins backed by US Treasury bonds characterize the third part of greenback hegemony after Bretton Woods gold and Center Japanese oil. On this mannequin, crypto customers throughout the globe change into oblique holders of US authorities debt, whereas stablecoin issuers emerge as the following technology of bond superbuyers. This system warned that this digital infrastructure may displace weaker currencies.

This system tied the laws to Trump and spent a portion of its presentation dissecting his battle with Fed Chair Jerome Powell, portray a dysfunctional scene whereas portraying cryptocurrencies as instruments of elite pursuits. CCTV cited a Reuters article to assert that crypto companies financed the president’s household’s debt compensation for a Wall Avenue workplace constructing.

The precise Reuters report didn’t single out crypto. It reported: “The president’s golf and resort companies have carried out effectively lately, throwing off numerous money. In current months, his household enterprise has struck profitable licensing offers with builders and opened a number of beachheads in cryptocurrencies, which have yielded tons of of hundreds of thousands of {dollars} in charges and different income.”

A bit of the TV particular targeted on crypto crime, similar to social engineering scams, impersonation assaults and high-profile digital heists. These had been offered as signs of lax oversight and deregulation. China can also be going through a serious $1.8 billion crypto rip-off scandal, which was not mentioned within the broadcast.

The particular additionally omitted China’s CBDC mission, its crypto bans or Hong Kong’s personal stablecoin regulation, which is ready to take impact on Aug. 1.

In a separate report on Thursday, state-backed outlet Nationwide Enterprise Day by day printed an interview with Music Ke, the manager dean of social sciences at Renmin College. Ke mentioned that China’s CBDC and Hong Kong dollar-backed stablecoins can cut back greenback reliance. He added that the brand new guidelines can open paths for digital yuan integration into the stablecoin economic system.

Tudou and Xinbi take fallen Huione’s place as darknet market leaders

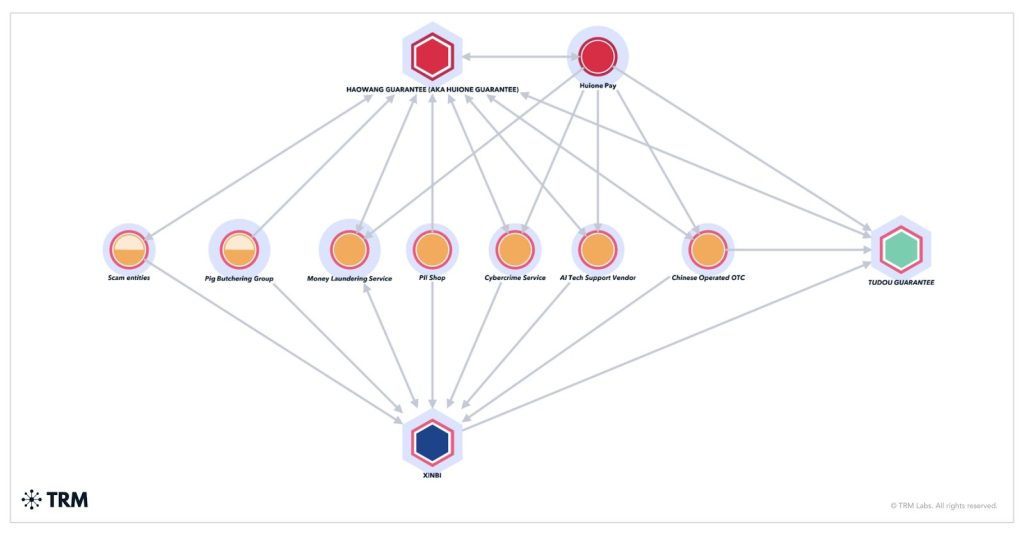

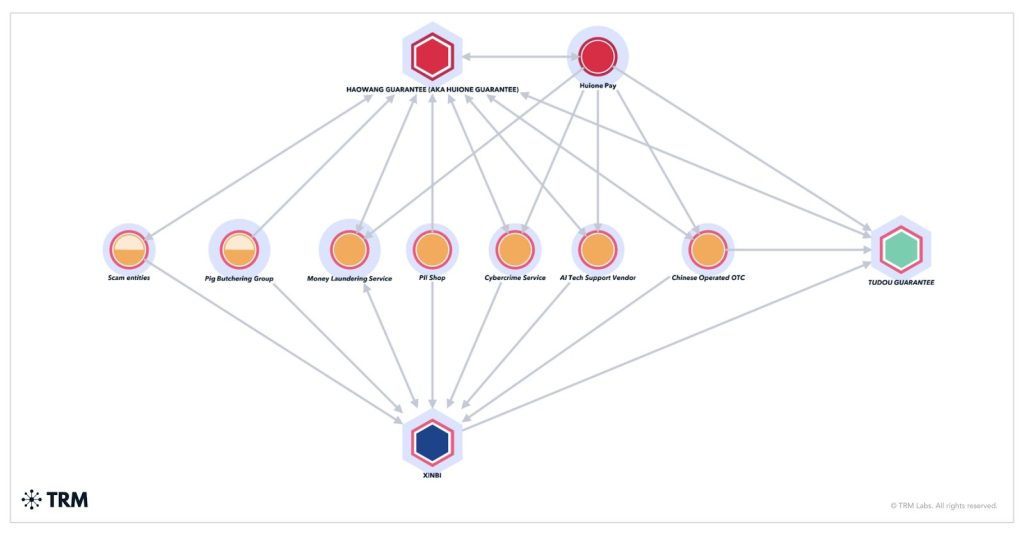

Tudou Assure and Xinbi Assure have emerged as the brand new leaders amongst Southeast Asia’s illicit crypto escrow market, following Telegram’s Might takedown of Huione Assure channels.

The US Treasury’s Monetary Crimes Enforcement Community labeled Huione Group, which allegedly operated Telegram illicit market Huione Assure and crypto cost platform Huione Pay, a main cash laundering concern in Might. The operation was discovered to be tied to Cambodia’s ruling Hun household by blockchain analytics platform Elliptic in 2024.

TRM Labs mentioned in a report on Wednesday that the shake-up didn’t dismantle the area’s underground monetary system, however accelerated a shift. Tudou’s each day incoming transaction quantity surged almost 70-fold since Might 11, when Huione Assure introduced it could droop its escrow operations. TRM analysts discovered distributors previously lively on Huione at the moment are working on Tudou utilizing the identical pockets infrastructure.

Xinbi Assure additionally recovered quickly. After being briefly faraway from Telegram, it returned beneath the identical ID and noticed a 90% improve in each day inflows.

In the meantime, Huione Pay, Huione’s cost arm, stays lively. After the ban, its common each day transaction quantity rose by 50% earlier than stabilizing about 10% above earlier ranges. TRM’s evaluation reveals overlapping infrastructure between Huione Pay and Huione Assure, with historic flows from Huione Pay withdrawal wallets into Huione Assure’s deposit wallets.

TRM mentioned that the crackdown triggered “fragmentation, not collapse.” Regardless of sanctions and platform bans, Huione and its community proceed working via Tudou and different associates, distributing danger whereas sustaining operations. In the meantime, Xinbi seems to be increasing and benefiting in its place platform following Huione’s shutdown.

Learn additionally

Options

Unstablecoins: Depegging, financial institution runs and different dangers loom

Options

How Activist Traders May Change The Crypto Panorama

South Korea to let crypto exchanges freeze suspicious funds

South Korea is getting ready to provide cryptocurrency exchanges the authorized authority to freeze consumer funds suspected of being tied to phishing and different on-line scams, as a part of a broader nationwide push in opposition to digital crime.

The Monetary Providers Fee revealed the plan on Wednesday throughout a high-level coverage assembly chaired by Prime Minister Kim Min-seok. The assembly targeted on public security, with proposals aimed toward curbing rising scams and counterfeit items.

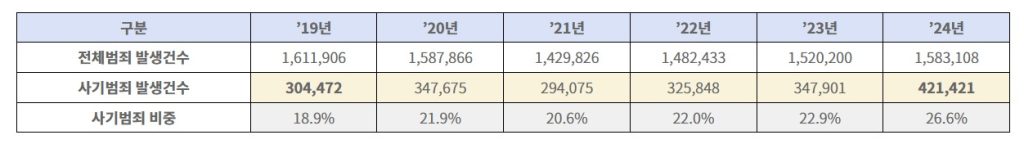

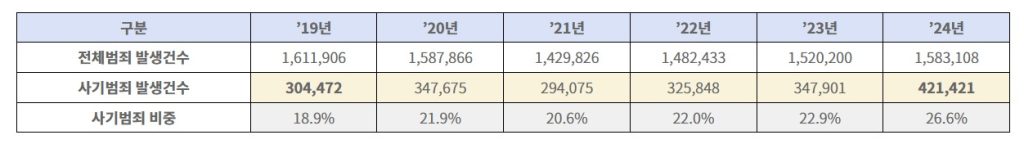

Scams now make up greater than 1 / 4 of all prison instances in South Korea, and crypto-related fraud has surged in tandem. Final yr, authorities busted a $232 million crypto Ponzi scheme that included the arrest of 215 suspects.

Voice phishing alone has spiked by 39% over the previous 5 years, with over 421,000 instances reported in 2024.

As a part of its response, the federal government says it’s going to roll out an AI-based system to detect scams early and enhance compensation procedures for victims. The FSC additionally mentioned it’s going to launch new pointers within the coming months outlining the obligations of exchanges and extra consumer protections.

Learn additionally

Options

Will Robinhood’s tokenized shares REALLY take over the world? Professionals and cons

Options

Investing in Blockchain Gaming: Why VCs Are Betting Massive

Japan’s crypto trade pushes tax reform plan

Japan’s main crypto trade teams have submitted a tax reform proposal to the federal government, looking for to align the therapy of crypto property with that of shares and different monetary devices.

In June, Japan’s Monetary Providers Company proposed reclassifying cryptocurrencies as “monetary merchandise” to carry them in step with conventional monetary property. The company additionally recommended a 20% tax on digital property. Native crypto trade teams submitted their very own proposal on Wednesday, together with further requests.

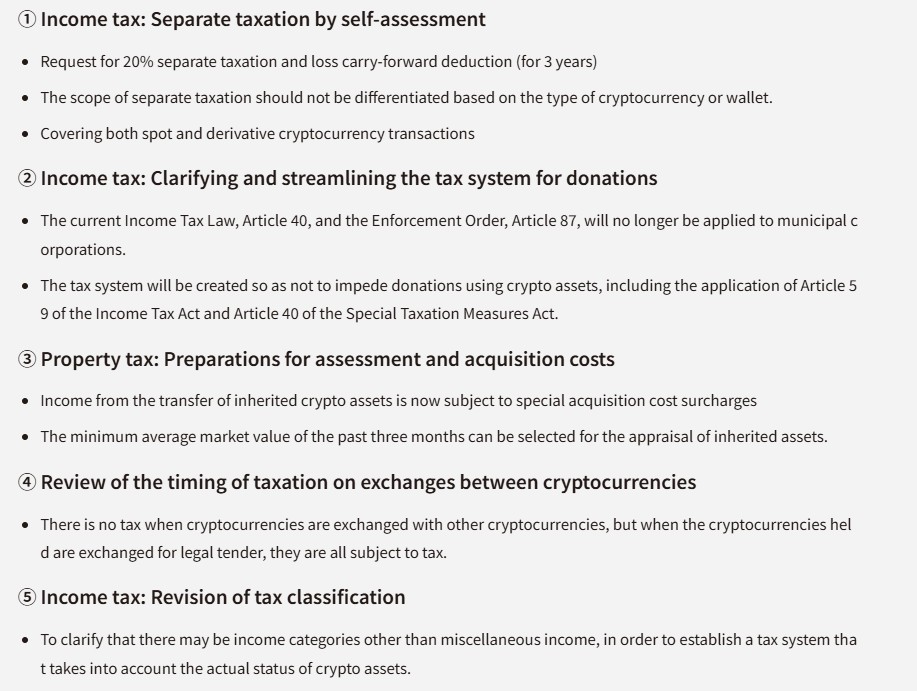

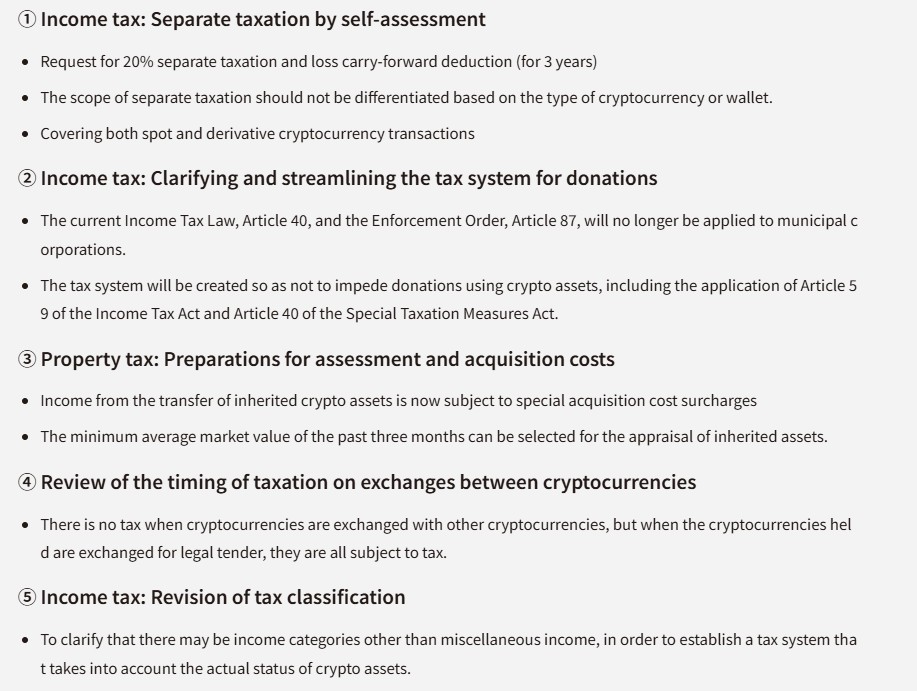

The Japan Digital Foreign money Alternate Affiliation and the Japan Cryptocurrency Enterprise Affiliation collectively referred to as for a 20% separate self-assessment tax on crypto revenue, together with loss carry-forwards for 3 years and constant tax guidelines throughout various kinds of crypto property and wallets.

The proposal additionally urges the federal government to modernize outdated tax guidelines. Particularly, it requires exemptions on crypto donations, use of the bottom common market value over the previous three months when valuing inherited crypto, and deferring taxes on crypto-to-crypto swaps till property are transformed to fiat.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist masking blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has lined Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.

Learn additionally

Hodler’s Digest

BTC hits $100K, Trump faucets Paul Atkins for SEC chair, and extra: Hodler’s Digest, Dec. 1 – 7

Editorial Employees

8 min

December 7, 2024

This week Bitcoin reached $100,000 for the primary time ever, Trump nominates pro-crypto Paul Atkins to exchange Gary Gensler: Hodler’s Digest

Learn extra

Hodler’s Digest

Bakkt inventory goes parabolic, GBTC outpaces BITO ETF and Tom Brady gives 1 BTC for 600th landing ball: Hodler’s Digest, Oct. 24-30

Editorial Employees

9 min

October 30, 2021

The very best (and worst) quotes, adoption and regulation highlights, main cash, predictions and rather more — one week on Cointelegraph in a single hyperlink!

Learn extra