BNB at the moment dominates the change token section and attracts capital inflows from establishments and the group.

If the present development continues, BNB might stay on the middle of the following altcoin wave. Nevertheless, short-term volatility and profit-taking strain are components that want shut monitoring.

Dominant Place within the Section

Binance Coin (BNB) reached its all-time excessive (ATH) on the finish of July. Though BNB’s value has barely corrected from its earlier ATH, it’s nonetheless buying and selling at $811 on the time of writing.

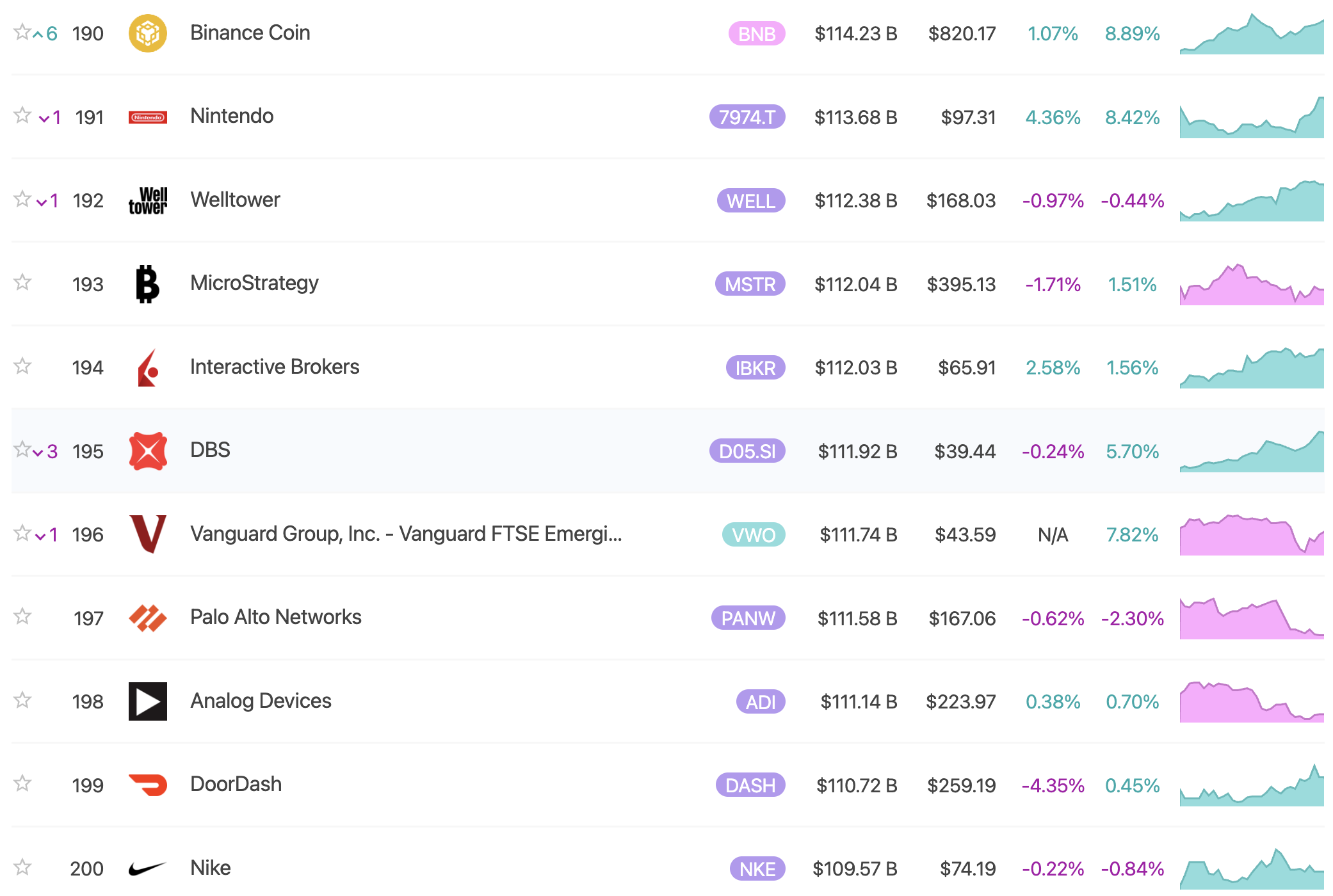

This has pushed BNB’s market capitalization to $114.36 billion, formally surpassing Nike and MicroStrategy.

“That power isn’t beauty — it powers each Binance and BNB Chain, and the continuing burn tightens provide as on-chain exercise grows,” commented X person Daniel Nita.

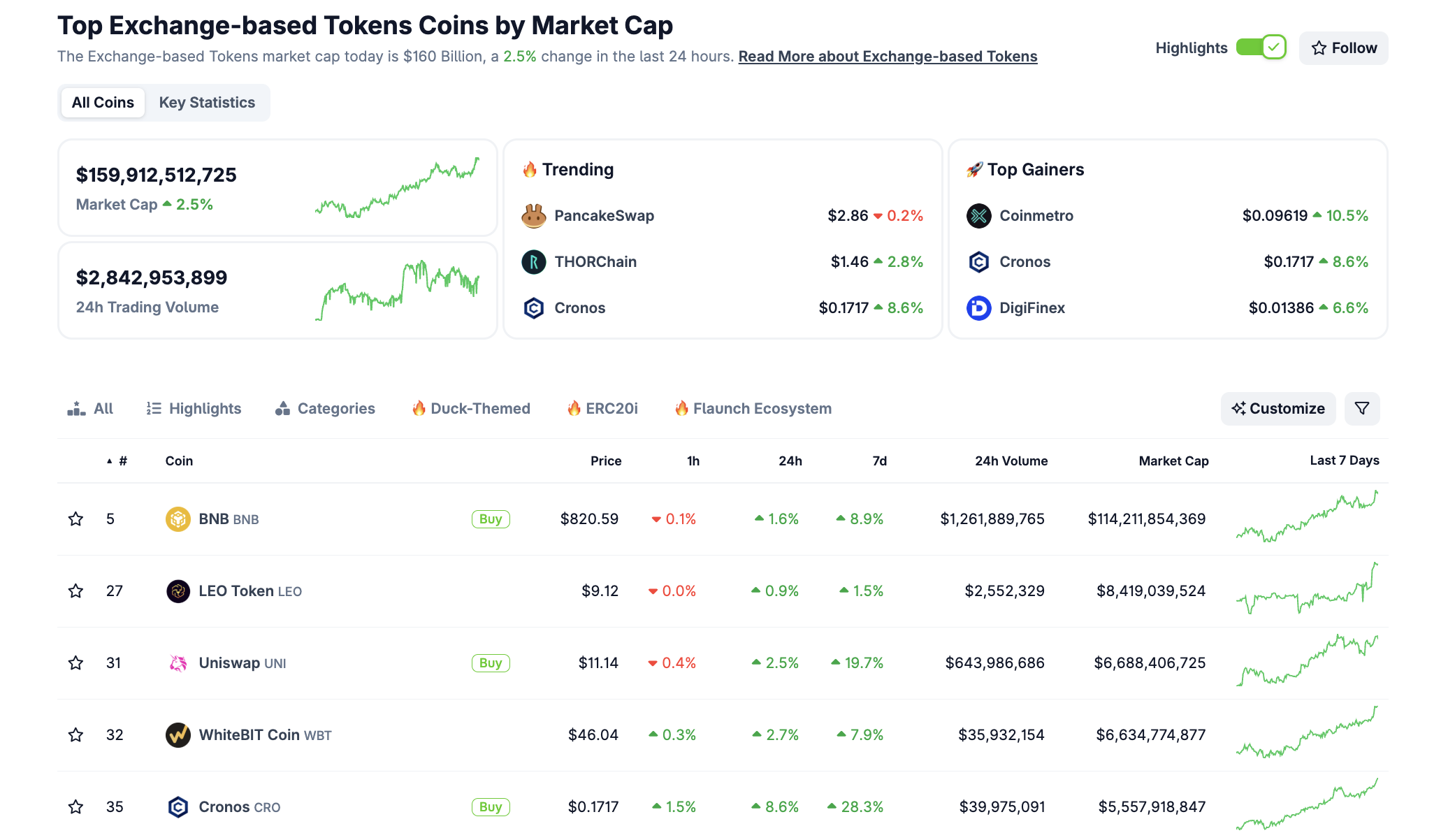

With this sturdy progress, BNB dominates the change token section. It at the moment accounts for 81% of the whole market capitalization of all exchange-based tokens.

This displays Binance’s model power and the enchantment of the BNB Chain ecosystem in DeFi, NFTs, and RWAs.

PancakeSwap, the biggest DeFi protocol on BNB Chain, additionally advantages from this value rally. BNB’s ATH has attracted new capital inflows into CAKE, because of the shut liquidity and market sentiment relationship between the 2 tokens.

Past Bitcoin and Ethereum, BNB has develop into a goal for establishments seeking to construct strategic reserves. Just lately, Nasdaq-listed firm BNC (previously Vape) spent USD 160 million to buy 200,000 BNB, making BNC the biggest institutional holder of BNB globally.

Beforehand, Windtree Therapeutics was additionally searching for to lift USD 520 million to construct a BNB reserve. This might mark the enlargement of the “BNB treasury” development amongst companies.

Potential to Rise to $1,200

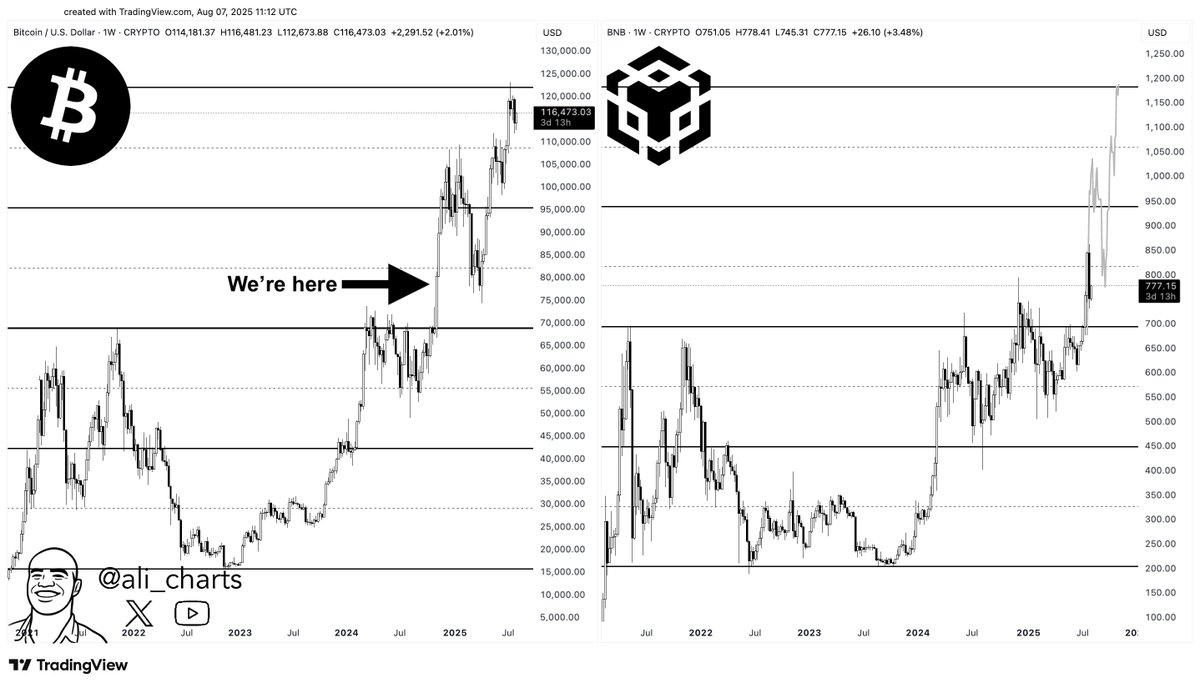

Furthermore, crypto analyst Ali shared on X that Binance Coin’s value construction mirrors Bitcoin’s value motion. Based mostly on this statement, Ali believes BNB might enter the early section of a rally towards the $1,200 mark.

Whereas the long run value outlook for BNB seems optimistic, BeInCrypto noticed that when BNB just lately hit its new ATH, some medium-term holders started promoting off their BNB, creating sure promoting strain. Consequently, buyers needs to be cautious with their leveraged positions to keep away from liquidation throughout BNB’s sturdy rallies.

The submit Binance Coin (BNB) Eyes $1,200 After Overtaking Nike in Market Capitalization appeared first on BeInCrypto.