Stellar (XLM) has been quietly shifting increased, up 10% up to now week and three% within the final 24 hours, however the tempo is way from explosive. That is regardless of the token breaking out of a bullish sample on the day by day chart earlier this month.

If the construction stays bullish, why hasn’t value surged? The reply lies in a tug-of-war between provide and demand that’s taking part in out on-chain and on the charts.

Provide Aspect Strain: Alternate Balances at Report Ranges

The primary clue comes from XLM’s alternate balances. Over the previous 12 months, these have climbed to a document 1.03 billion XLM (virtually $469.7 million), with the July–August studying of 1.02 billion XLM marking one of many highest factors in historical past.

In observe, excessive balances imply extra tokens are sitting on exchanges, available for merchants to promote.

This creates a ceiling impact: each push increased dangers assembly a wave of promote orders. That offer overhang could clarify why, even after a bullish breakout, the Stellar value hasn’t but adopted via with the form of rally seen in different altcoins.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

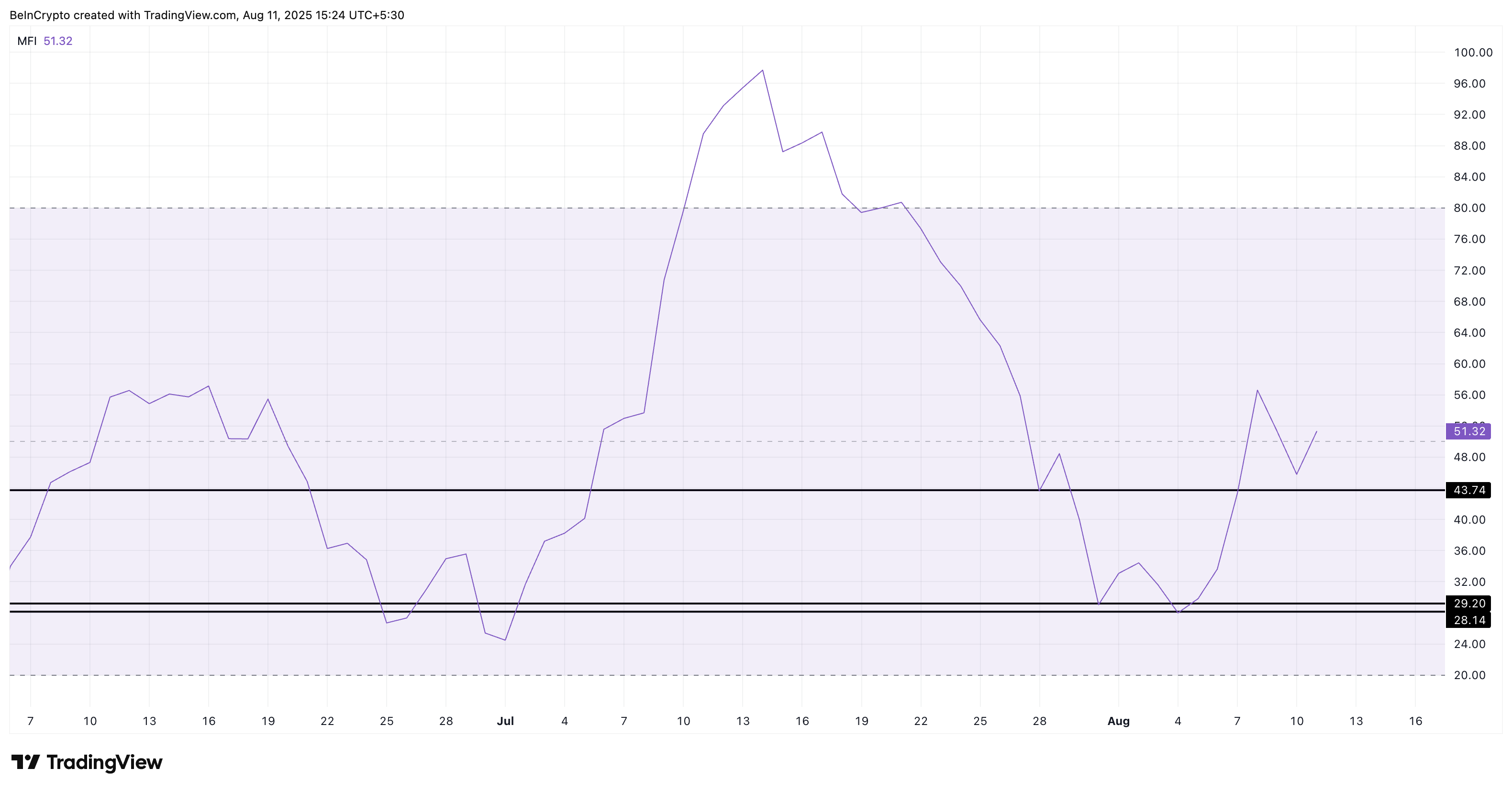

Demand Aspect Pushback: Cash Movement Index Curling Up

In opposition to this heavy provide backdrop, shopping for stress hasn’t vanished. The day by day Cash Movement Index (MFI), which blends value motion with quantity to trace actual capital flows, is holding above 50 at 51.32, and has lately curled increased after avoiding a retest of July’s lows close to 29.

This implies that whereas sellers are parked and prepared, there’s nonetheless significant influx into XLM. Patrons are energetic sufficient to maintain costs from breaking down, however not but robust sufficient to overpower the document provide. This steadiness of forces is conserving the market in a holding sample.

Zooming In: 4-Hour Stellar Value Chart Reveals a Bullish Construction With Fading Momentum

To see if this buyer-seller impasse is near breaking, we flip to the 4-hour chart. Right here, the XLM value is holding inside an ascending triangle; a bullish continuation setup, with key assist at $0.44 and resistance ranges at $0.46 and $0.47.

But momentum is displaying cracks. The RSI on this timeframe has printed a decrease excessive whilst the worth hit a better excessive, hinting at short-term exhaustion. Mixed with the excessive alternate balances, this slowdown explains why Stellar remains to be range-bound regardless of a bullish construction.

A break above $0.47 might propel the Stellar (XLM) value to new highs, as that may additionally imply a clear sample breakout. That stage additionally aligns with the short-liquidation cluster.

If the worth manages to succeed in $0.47, shorts getting liquidated would be capable to push the XLM costs increased, extra like a cascading rally.

However then, based on the chart, if the worth corrects and dips under $0.43, the bullish construction could be in danger—even from the long-side positions that get liquidated at $0.43 and decrease.

The put up XLM’s Bullish Setup Holds—However Stellar Positive aspects May Stall for Now appeared first on BeInCrypto.