- SharpLink Gaming introduced a $400M institutional deal to broaden ETH holdings, aiming for over $3B in worth.

- Inventory dipped 6.6% on the information however stays up almost 190% in 2025 after aggressive ETH accumulation.

- Firm has raised virtually $1B in every week, holding 598,800 ETH as Ethereum trades close to its highest stage in years.

SharpLink Gaming, as soon as identified primarily as a sports activities betting advertising and marketing agency, has been making waves within the crypto area — and never in a small means. The corporate introduced a $400 million cope with 5 institutional traders to bulk up its Ether (ETH) holdings, with expectations of exceeding $3 billion in worth. Shares for this newest sale went for $21.76 every, and the deal was set to shut the next day, pending closing situations.

This transfer cements SharpLink’s place because the second-largest public ETH holder, proper behind BitMine Immersion Applied sciences. With Ethereum co-founder Joseph Lubin serving as chair, the agency has leaned closely into the crypto treasury play, becoming a member of a rising listing of corporations elevating vital capital for digital asset accumulation.

Inventory Volatility Follows the Information

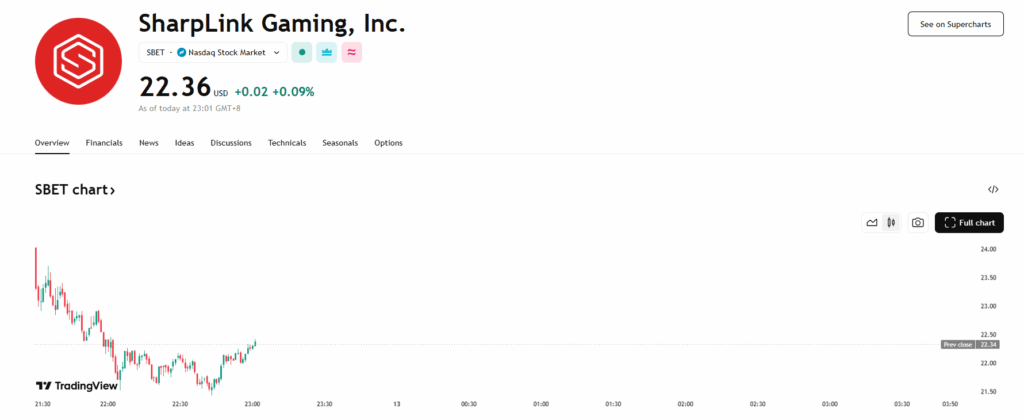

The market’s response was combined. SharpLink’s inventory (SBET) closed Monday down over 6.6% at $22.34, although it clawed again almost 3.5% in after-hours buying and selling to $23.10. This got here after shares had climbed above $28 earlier within the day — a surge partly fueled by current momentum. Regardless of the dip, SBET stays up 17.5% in simply 5 buying and selling days and a staggering 189% year-to-date, largely because of its ETH shopping for spree since Could.

SharpLink’s buying and selling historical past hasn’t been with out drama. In mid-June, the corporate’s inventory plummeted 73% in a single after-hours session after submitting to doubtlessly resell 58.7 million shares — prompting Lubin to publicly make clear it was routine process.

Almost $1 Billion Raised in One Week

The $400 million increase wasn’t a standalone occasion. Actually, SharpLink has pulled in near $900 million over the previous week alone. This features a $200 million deal introduced simply final Thursday and one other $264.5 million from an earlier at-the-market providing on August 5. Co-CEO Joseph Chalom stated the speedy capital inflow “underscores the market’s confidence” of their ETH treasury technique and Ethereum’s long-term potential.

At the moment, SharpLink holds 598,800 ETH value roughly $2.57 billion, with BitMine’s 1.15 million ETH ($5 billion) nonetheless forward within the rankings. There’s additionally $200 million in contemporary capital nonetheless ready to be deployed.

Ethereum’s Worth Provides Gas

ETH itself has been on a tear, climbing from beneath $3,000 to over $4,300 in simply the previous month — a 44.5% acquire. Whereas it’s buying and selling flat over the past 24 hours, it’s now solely about 12% shy of its all-time excessive of $4,878 from November 2021. This resurgence has solely added extra weight to SharpLink’s bullish technique.