Solana is as soon as once more within the highlight. Blockchain information by Arkham Intelligence reveals that an Alameda Analysis staking account has unstaked $35 million price of SOL. Alameda Analysis initially locked up the SOL in late 2020. A convicted fraudster, Sam Bankman-Fried, based Alameda Analysis, as soon as a distinguished quantitative cryptocurrency buying and selling agency and the sister firm of the now-defunct FTX change.

Associated Studying

The connection immediately raises eyebrows, given the agency’s notorious collapse in late 2022. On the time, each Alameda and FTX had been pressured into chapter 11 following revelations of fraudulent practices, together with the misuse of billions in FTX buyer funds. These occasions marked one of many largest scandals in crypto historical past, sending shockwaves by way of the trade and prompting years of authorized proceedings and asset restoration efforts.

The latest unstaking has fueled hypothesis amongst merchants and analysts, with some viewing it as a possible sign of forthcoming market exercise involving SOL. Whereas the switch doesn’t essentially suggest an instantaneous sale, the motion of such a considerable quantity may affect short-term value dynamics and sentiment.

Alameda Analysis SOL Unstake Raises Questions

In response to blockchain analytics platform Arkham Intelligence, the $35 million price of Solana lately unstaked from an Alameda Analysis account had an preliminary worth of simply $350,000 when it was locked in late 2020 — a outstanding 100x enhance. This staggering development in worth underscores Solana’s meteoric rise over the previous few years. Arkham raises an vital query: Will these funds lastly be returned to FTX collectors? Whereas the reply stays unsure, the transfer means that some exercise is underway within the ongoing restoration and redistribution course of tied to Alameda’s chapter.

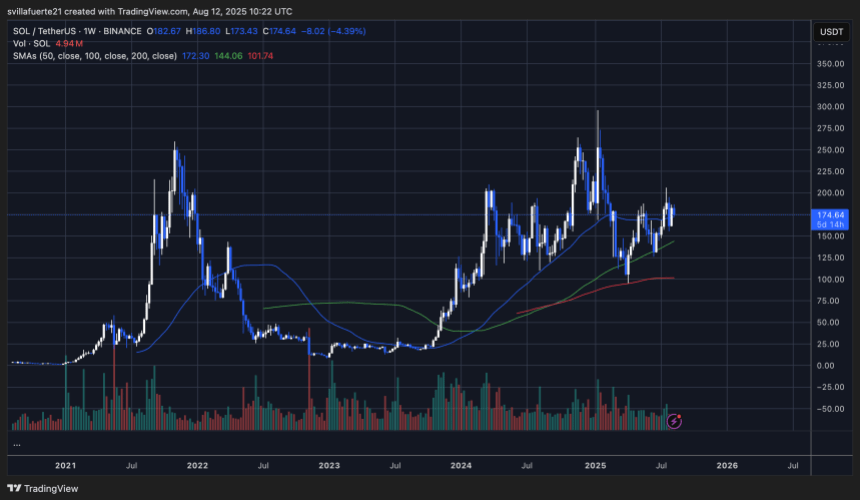

From a value motion perspective, Solana has been consolidating beneath the $200 degree since February, unable to interrupt by way of this key resistance regardless of sustaining robust community exercise. The sideways pattern has saved SOL comparatively quiet in comparison with different main cryptocurrencies. In comparison with Ethereum, the distinction is notable — Ethereum has seen stronger value momentum lately, main some analysts to name the present market section “Ethereum season.”

Nonetheless, others argue that Solana’s quiet section could also be setting the stage for a breakout. Traditionally, large-cap altcoins like SOL usually comply with within the wake of Ethereum rallies, catching momentum as soon as ETH’s surge begins to chill.

Associated Studying

Solana Consolidates Beneath Key Resistance

On the weekly chart, Solana (SOL) is buying and selling at $174.64, down 4.39% within the newest session, because it continues a multi-month consolidation section beneath the essential $200 resistance degree. Since February 2025, SOL has repeatedly examined this psychological barrier with out securing a sustained breakout, highlighting robust promoting strain at larger ranges.

The 50-week easy shifting common (SMA) at $172.30 is performing as instant dynamic assist, with the 100-week SMA ($144.06) and 200-week SMA ($101.74) positioned effectively beneath, reflecting a still-healthy longer-term uptrend. The present value construction reveals SOL holding above each the 50-week and 100-week SMAs, a bullish sign that implies patrons stay in management regardless of latest pullbacks.

Associated Studying

Nonetheless, buying and selling volumes haven’t matched the peaks seen throughout prior rallies, indicating a extra cautious market tone. A decisive breakout above $200 would doubtless open the door to retests of the $250–$260 zone, whereas failure to clear resistance may prolong the consolidation or result in a retracement towards the 100-week SMA.

Featured picture from Dall-E, chart from TradingView