At this time kicked off with Aptos unlocking 11.31 million APT cash value roughly $51 million, rising its circulating provide.

With the surge in provide, mixed with the dip within the broader market, and the rising need amongst merchants to make a revenue, APT faces elevated promoting strain that might worsen its value fall.

Aptos Worth Weakens Amid Rising Promoting Exercise

APT presently trades at $4.58, noting a 2% decline over the previous 24 hours. Throughout this similar interval, its buying and selling quantity has elevated by 10%, indicating an increase within the variety of cash altering arms.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

When an asset’s value falls whereas buying and selling quantity climbs, it indicators heightened promoting strain. This sample means that extra buyers are offloading their positions relatively than shopping for. Therefore, the development indicators that the APT market is experiencing stronger downward momentum with rising vendor dominance.

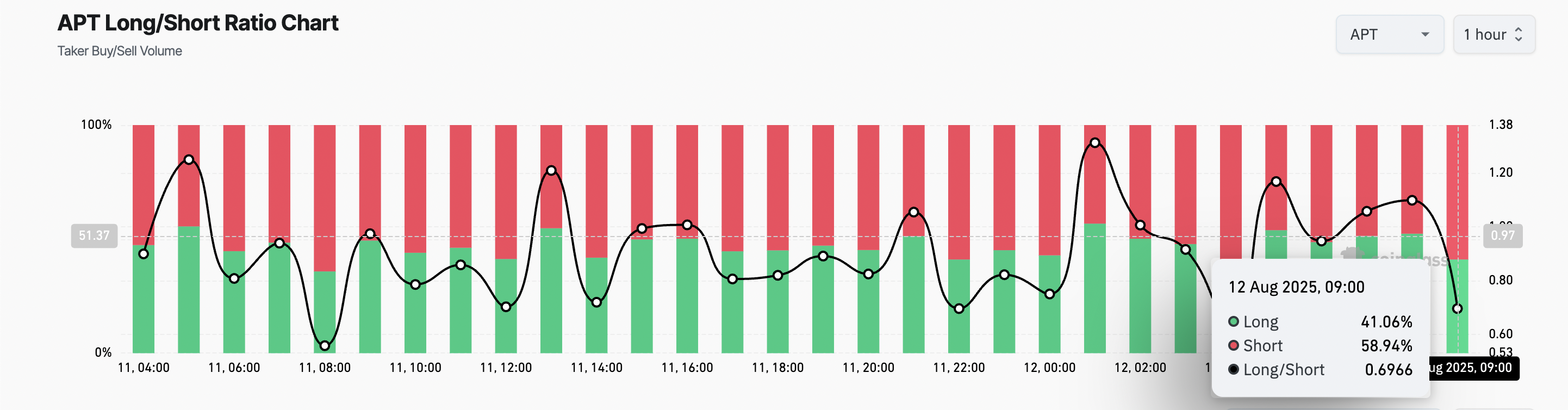

As well as, the coin’s falling lengthy/brief ratio helps this bearish outlook. Noticed on an hourly chart, this sits at 0.69 at press time.

The lengthy/brief metric measures the proportion of lengthy bets to brief ones in an asset’s futures market. A ratio above one indicators extra lengthy positions than brief ones. This means a bullish sentiment, as most merchants anticipate the asset’s worth to rise.

However, an extended/brief ratio beneath 1 signifies that extra merchants are betting on the asset’s value to say no than these anticipating it to rise.

APT’s lengthy/brief ratio signifies rising demand for brief positions, as merchants place themselves to capitalize on the rising downward strain.

Can Aptos Maintain the Line?

On the day by day chart, APT presently trades at its 20-day Exponential Transferring Common (EMA). This places the altcoin at vital threat, the place the course it takes subsequent may set the tone for its near-term value motion.

The 20-day EMA measures an asset’s common value over the previous 20 buying and selling days, giving weight to latest costs. When an asset climbs above it, it indicators strengthening momentum and a possible uptrend, indicating that consumers are gaining management.

Conversely, falling beneath this stage suggests weakening momentum and a attainable shift towards bearish sentiment, with sellers taking the lead.

If APT’s value breaks decisively beneath the 20-day EMA, it might affirm that the bears have regained full market management. Such a transfer may set off additional promoting strain, pushing APT’s value down beneath $4.52.

Conversely, if the 20-day EMA holds agency as a assist flooring, it may present the muse for a value rebound. Consumers stepping in at this stage might drive APT’s value above $5.01.

The put up Why Aptos May See Extra Draw back After Unlocking $51 Million in APT appeared first on BeInCrypto.