Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

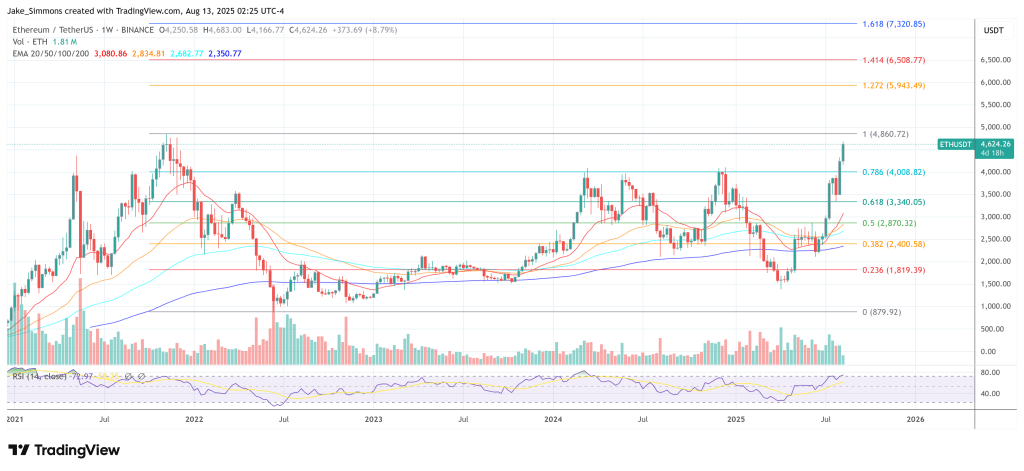

Ethereum’s chart is lighting up with what crypto analyst Kevin of Kev Capital calls a “once-in-a-decade” confluence of bullish indicators — patterns and indicators that he says haven’t appeared collectively within the asset’s historical past. In a video replace on August 12, Kevin revisited his Could forecast for “ETH season” and detailed why the rally is unfolding nearly precisely as projected, whereas warning that the ultimate technical barrier remains to be intact.

Ethereum Faces On Final Hurdle

Two months in the past, when sentiment towards Ethereum was at its most pessimistic in years, Kevin issued an alert based mostly on the ETH/USD, ETH dominance, and ETH/BTC month-to-month charts. “We have been most likely the primary folks flashing these warning indicators on ETH… it was so blatant and so apparent… one thing historic,” he mentioned. Since that decision, ETH has gained greater than 150%, with associated “beta performs” corresponding to Chainlink, Uniswap, and Ethereum Traditional seeing triple-digit proportion good points from their lows.

The catalyst, Kevin defined, started with a uncommon month-to-month demand candle at main assist — a formation that in previous cycles preceded huge rallies. That was backed by a number of momentum indicators turning from excessive oversold ranges.

Associated Studying

The month-to-month Inventory RSI confirmed what he described as an unprecedented “V-shaped turnaround,” the MACD histogram had been coiling tighter since late 2019, and whale cash stream was reversing from the bottom readings in Ethereum’s historical past. “You’re now simply seeing the month-to-month MACD cross on the apex of this sample… proper on the zero line,” he famous, framing it because the technical ignition level for a sustained breakout.

On ETH dominance, Kevin pointed to the identical multi-indicator alignment: oversold RSI and Inventory RSI, an imminent MACD cross, and value hitting the identical assist that underpinned the 2019–2020 cycle. In his view, that backside signaled the beginning of a sturdy part of ETH outperformance, one that will lead altcoins greater. The ETH/BTC chart, he argued, confirmed the timing: “The lead altcoin confirmed the way in which… the underside is clearly in.”

Nonetheless, Kevin harassed that Ethereum just isn’t but in open value discovery. The important thing resistance stays its earlier all-time excessive at roughly $4,850. “We’re not within the clear… don’t be shopping for into four-year main historic resistance ranges. That’s by no means sensible. That can get you damage,” he warned, noting that on the broader “Whole 2” market cap chart for all altcoins excluding Bitcoin, the $1.71–$1.72 trillion zone is the final main “line within the sand.” Till these ranges are damaged on excessive time frames, he sees the market in a high-risk, high-reward posture.

Associated Studying

Macro situations could tip the scales. With CME FedWatch now pricing in a 90%+ chance of a US rate of interest lower in September, and extra cuts projected for October and December, Kevin believes the combination of easing financial coverage and technical breakout constructions creates a “excellent recipe” for altcoin outperformance. Even so, he cautioned that macro shocks may derail momentum and that merchants ought to place with pullbacks in thoughts moderately than chasing into resistance.

For now, Kevin is content material to acknowledge a uncommon technical alignment that he believes has already made historical past. “The ETH dominance name, the ETH versus Bitcoin name that we made a number of months in the past has performed out superbly… I believe there can be pullbacks, however total, we’re on the again half of this bull market,” he mentioned. Whether or not that again half erupts into value discovery hinges on one quantity: $4,850. Till then, Ethereum’s once-in-a-decade bull sign stays charged — however not but absolutely unleashed.

At press time, ETH traded at $4,624.

Featured picture created with DALL.E, chart from TradingView.com