In short

- Treasury Secretary Scott Bessent urged the Fed to contemplate a 50bps minimize in September after weak job revisions and tender inflation knowledge.

- July inflation got here in at 2.7% year-over-year, barely above expectations however reinforcing hopes for looser coverage.

- Crypto markets rallied, with Ethereum hitting multi-year highs as merchants priced in deeper price cuts.

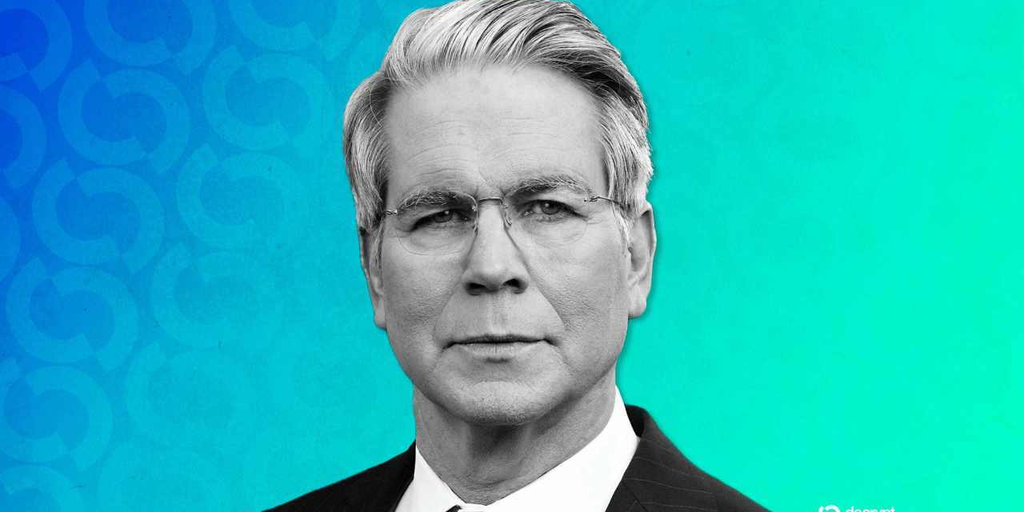

U.S. Treasury Secretary Scott Bessent mentioned Tuesday a 50-basis-point price minimize in September ought to be on the desk following “improbable” inflation knowledge, launched this week.

Bessent mentioned the U.S. Federal Reserve ought to think about chopping by half a degree after the Bureau of Labor Statistics revised its employment figures for Might and June downward by a mixed complete of 258,000 jobs.

President Donald Trump abruptly dismissed BLS Commissioner Erika McEntarfer, shortly after the bureau launched its preliminary figures on August 1, accusing it of manipulating jobs knowledge to undercut his administration.

“If we had the unique numbers, we may have been chopping in June and July,” Bessent advised Fox Enterprise in an interview on Tuesday. “I feel the actual factor now to consider is: Ought to we get a 50-basis-point price minimize in September?” he mentioned.

Decrease charges cut back borrowing prices, encourage spending and funding, and push buyers towards higher-yielding danger property, usually lifting markets, together with crypto.

“A 50 foundation level minimize would affirm danger on for the remainder of the 12 months,” Ryan McMillin, chief funding officer at crypto fund supervisor Merkle Tree Capital, advised Decrypt.

Hypothesis over deeper cuts comes as figures from the BLS confirmed July headline inflation rose 2.7% year-over-year, exceeding economists’ expectations by 10 foundation factors.

Crypto was fast to reply, with some blue-chip digital property rising to their highest level in weeks, and Ethereum extending good points made earlier within the month to succeed in its highest level in years.

Whereas odds for a 25-basis-point price minimize at the moment are “locked in” for subsequent month, in accordance with McMillin, the Fed nonetheless must take care of one other spherical of jobs and inflation knowledge.

The prospect of a price minimize has bolstered previous rallies fueled by ETF inflows, however commerce developments, macro uncertainty, and seasonal tendencies may shift the market’s course.

Choices exercise exhibits crypto buyers stay cautiously optimistic, with put shopping for nonetheless a dominant theme.

Positioning from merchants hints at draw back safety in opposition to the third quarter, which has usually displayed a median return of 0.96% over the previous 12 years, Decrypt was beforehand advised.

Day by day Debrief Publication

Begin daily with the highest information tales proper now, plus unique options, a podcast, movies and extra.