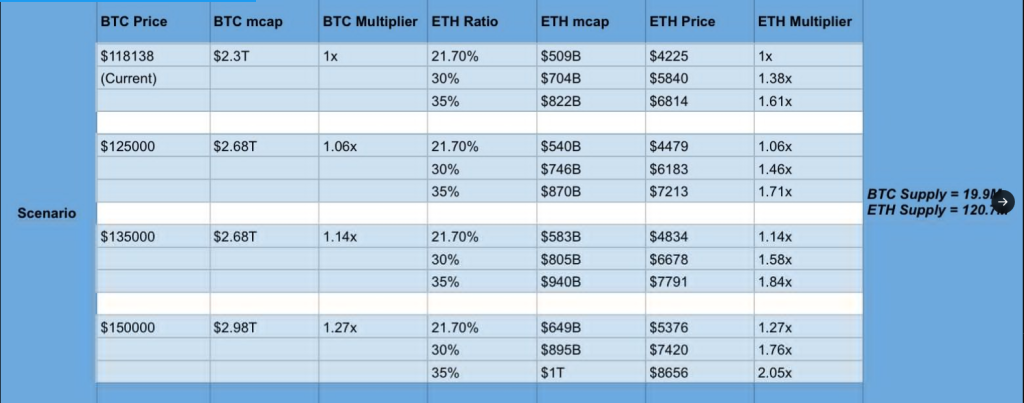

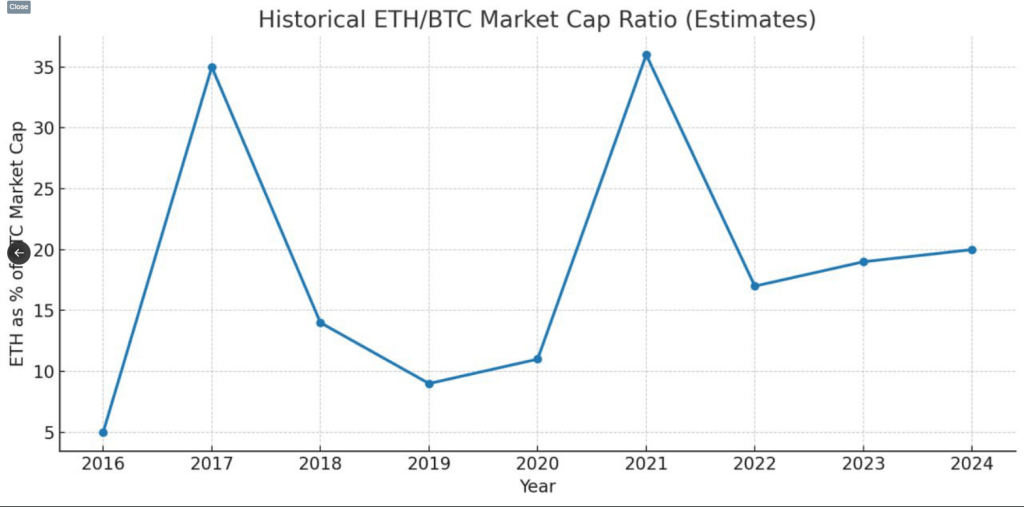

A math-based state of affairs is getting consideration in markets this week. In response to specialists, Ether’s market worth has traditionally moved to about 30–35% of Bitcoin’s market cap throughout main bull runs.

Associated Studying

If Bitcoin climbs to $150,000 from its present value of $119,250, that ratio would put Ether close to $8,656 on the prime finish of the mannequin.

On the time of writing, Ether was up 8% in a 24-hour value transfer, hitting $4,630 for brand spanking new weekly excessive. Bitcoin was up a p.c, and slowly closing in the important thing $120,000 area, knowledge from Coingecko exhibits,

In response to an evaluation by dealer Yashasedu a decrease vary of ratios — between near 22% and 30% — would put Ether between $5,370 and $7,400 if Bitcoin does attain $150,000.

Market Cap Math And The Upside Case

In response to the dealer’s logic, the calculation is straightforward: choose a BTC value, multiply by BTC provide for market cap, then apply a selected ETH/BTC market-cap ratio and divide by ETH provide to get an ETH value.

In main bull runs, $ETH sometimes hits 30-35% of Bitcoin’s mcap.

2017: ~35%

2021: ~36%We’re seeing related setup now👇

> TVL on @ethereum crossed $90B after 2022

> Establishments purchase billions of {dollars} value of $ETH

> Billions of {dollars} of ETF influx

> Shares transitioning… pic.twitter.com/xuaCOAfw9P— YashasEdu (@YashasEdu) August 10, 2025

Yashasedu notes that in 2021 Ether climbed to about 36% of Bitcoin’s market cap, which is why the 30–35% vary is getting cited now.

Stories have disclosed that institutional flows and rising ETF demand for Ether are a part of the explanation some merchants anticipate the sample to repeat.

Flows, Treasury Buys, And TVL

Primarily based on experiences, spot Ether ETFs recorded a single-day influx of $1 billion lately — the most important day thus far — and TVL on Ethereum has topped $90 billion, figures that supporters level to as proof demand is rising.

A number of well-known market voices have put out increased Bitcoin targets that feed into these eventualities. Tom Lee, Arthur Hayes, and Joe Burnett have forecasted Bitcoin may attain as excessive as $250,000 by the top of 2025.

MN Buying and selling Capital founder Michaël van de Poppe has stated that we’ll possible see a brand new ATH for ETH after which some consolidation. These calls are opinions, and merchants use them to construct eventualities relatively than certainties.

Associated Studying

Quick-Time period Indicators And Technical Forecasts

In the meantime, technical indicators present present sentiment as Bullish, and the Concern & Greed Index sits at 73 (Greed). In response to one value prediction, Ethereum is predicted to rise about 10% to achieve $5,125 by September 12, 2025.

Ether recorded 20 out of 30 inexperienced days lately, a 67% run of constructive days, and about 8.33% value volatility during the last 30 days. These numbers feed each the bullish story and the case for warning.

Featured picture from Meta, chart from TradingView