Since clinching a brand new all-time excessive of $122,920 on Monday, Bitcoin’s value has trended sideways, reflecting the slowdown in market momentum.

The muted value motion comes as many merchants take earnings after the current surge, whereas on-chain indicators level to fading urge for food from US-based buyers.

BTC Value Pauses Rally as US Buyers Step Again

On-chain knowledge reveals a marked dip in buying and selling exercise amongst US members over the previous week. This will increase the chance of an prolonged consolidation part, or perhaps a short-term correction.

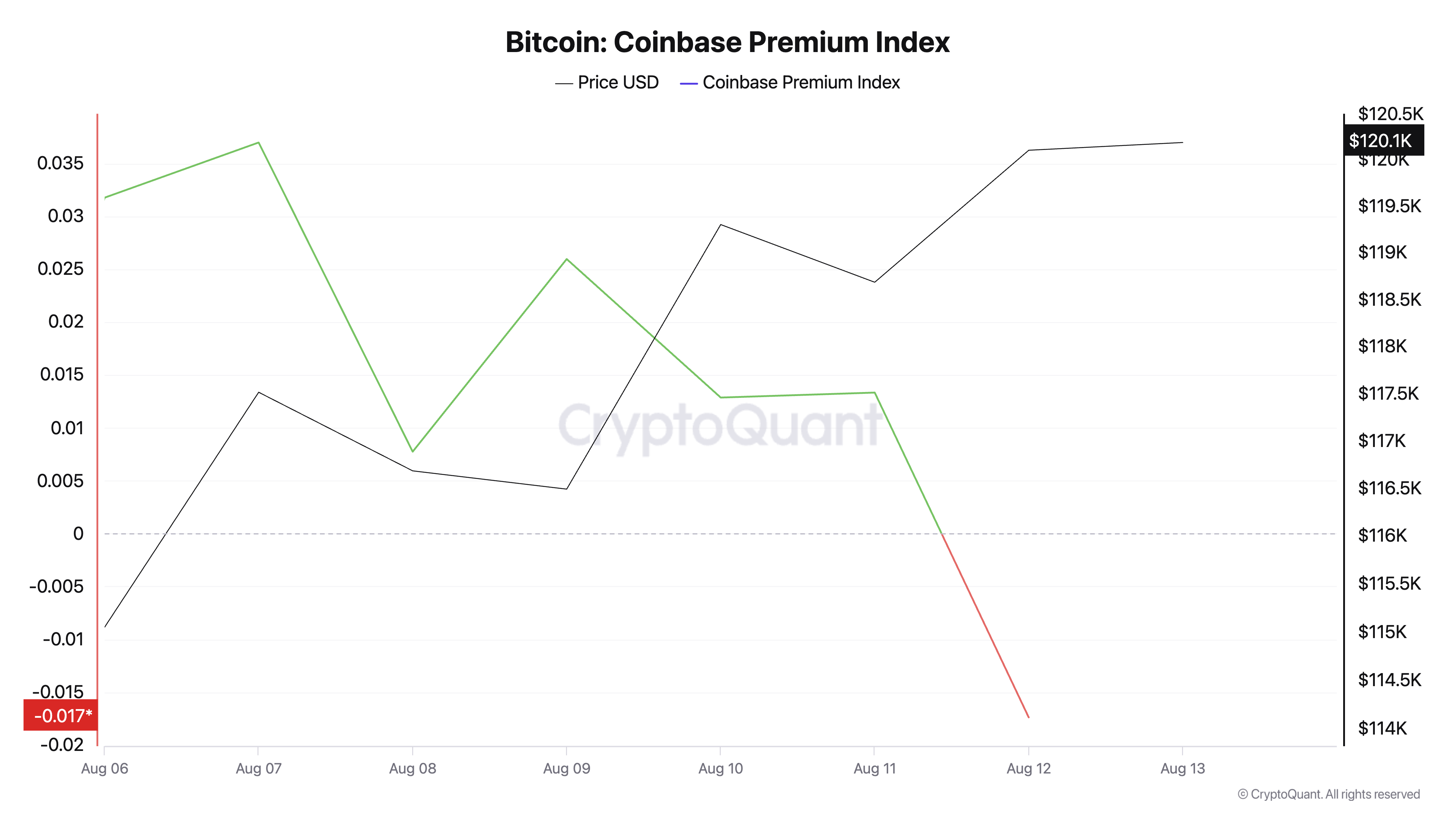

In line with knowledge from CryptoQuant, BTC’s Coinbase Premium Index (CPI) has fallen steadily over the previous week, signaling a decline in shopping for curiosity from US-based buyers.

Per the information supplier, this closed at a seven-day low of -0.017 yesterday.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

This metric measures the distinction between BTC costs on Coinbase and Binance, serving as a dependable gauge of US investor sentiment.

When CPI rises, BTC trades at a premium on Coinbase in comparison with worldwide exchanges, signaling stronger shopping for strain from US-based buyers.

Conversely, when it falls or turns destructive, it signifies that demand on Coinbase is trailing behind world markets, as a result of profit-taking or fading curiosity amongst US patrons. That is at present in play, as lowered demand from US buyers could also be a contributory issue to the coin’s sideways motion after it reached its file excessive two days in the past.

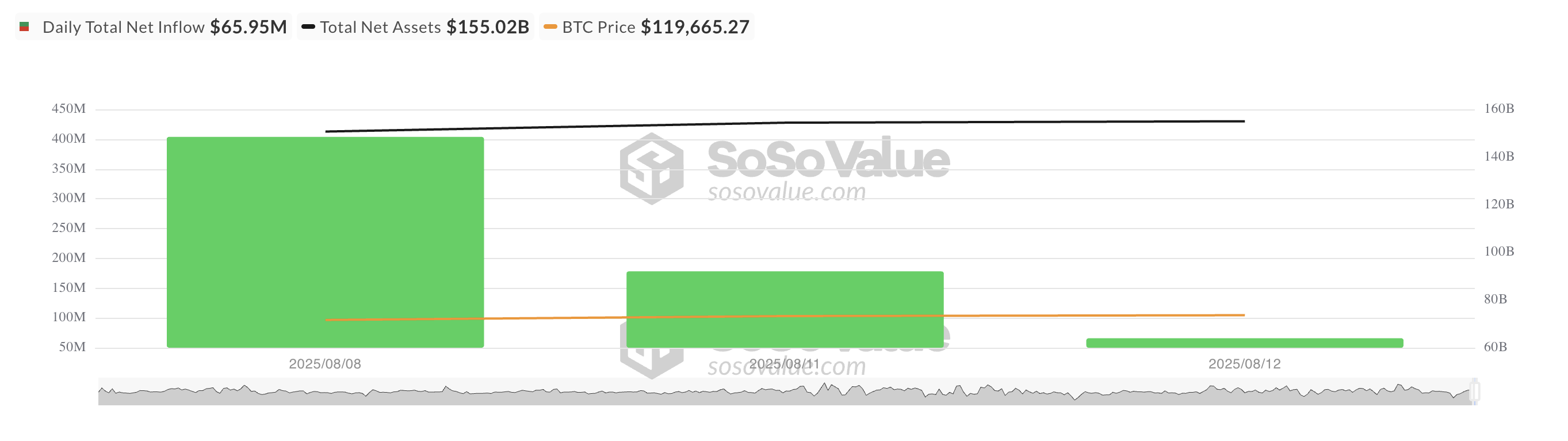

Additional, this cooling sentiment has additionally been mirrored within the decline in spot inflows into BTC-backed exchange-traded funds (ETFs) for the reason that begin of the week.

Per SosoValue knowledge, whereas BTC-backed funds have maintained optimistic internet inflows since Monday, the quantity of those inflows has been steadily dropping.

This factors to a modest, but noticeable pullback in institutional participation.

$118,000 Flooring or $122,000 Ceiling?

These tendencies recommend that the wave of aggressive shopping for seen throughout BTC’s current rally could also be shedding momentum. If this continues, BTC might lengthen its decline and fall to $118,851.

Nonetheless, if sentiment improves amongst US-based buyers and so they enhance coin accumulation, BTC’s value might resume its uptrend and revisit its all-time excessive.

The put up Bitcoin Faces Cooling Demand as US Patrons Pull Again appeared first on BeInCrypto.