Be part of Our Telegram channel to remain updated on breaking information protection

Ethereum surged 8% to shut in on its all-time excessive as US spot ETF inflows and file futures exercise fueled a broad crypto market rally.

The surge comes amid lower-than-expected US inflation knowledge yesterday, which boosted risk-on sentiment and raised expectations for future rate of interest cuts.

Treasury Secretary Scott Bessent known as for a 50 foundation level charge lower subsequent month and President Donald Trump ramped up strain on Federal Reserve Chair Jerome Powell, saying he could sue him over development work on the Fed constructing.

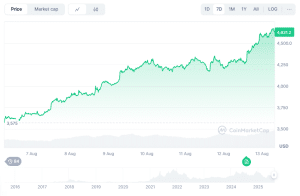

Ethereum is buying and selling at $4,695 as of 5:03 a.m. EST, its highest degree since November 2021, after surging greater than 29% over the previous week. It’s now inside 4% of its ATH of $4,891.70 that it set on Nov. 16, 2021.

ETH worth chart (Supply: CoinMarketCap)

Ethereum ETFs Prolong Inflows Streak After Report $1 Billion Day

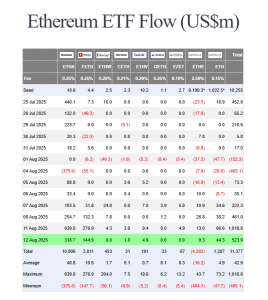

Fueling the ETH rally is the robust inflows into spot US Ethereum ETFs over the past week.

US spot Ethereum ETFs notched file inflows yesterday, with traders pouring greater than $1 billion into the funds, marking the most important single-day web addition since their launch final July.

Over the previous 48 hours, the ETFs have attracted greater than $1.5 billion in complete, extending the constructive web circulate streak to six days, in response to Farside Investor knowledge.

US Spot Ethereum ETF inflows (Supply: Farside Buyers)

Of the over $1.5 billion that entered the funds prior to now 48 hours, BlackRock’s ETHA product attracted essentially the most capital. Throughout the two-day interval, greater than $900 million entered the ETH ETF’s reserves.

In second place is Constancy’s FETH, which managed to drag in additional than $410 million throughout the identical interval.

Ethereum Open Curiosity Tops $60B As ETH Closes On ATH

Heightened curiosity round ETH shouldn’t be solely evident with US spot Ethereum ETFs, as open curiosity within the futures marketplace for the altcoin soars to past $60 billion, setting a brand new all-time excessive (ATH).

Within the final 24 hours, open curiosity for ETH futures edged up a fraction of a proportion to face at greater than $64.34 billion, in response to CoinGlass. The final file was set on July 28, when the determine hit $58 billion.

The present open curiosity additionally represented over twice the worth it stood at simply weeks in the past, in late June.

Retail Merchants In “Disbelief” Of ETH Rally As Whales Swoop In

ETH’s latest efficiency comes regardless of a wave of concern, uncertainty and doubt (FUD) on social platforms.

Crypto sentiment monitoring platform Santiment famous in an Aug. 12 X put up that “merchants have proven FUD and disbelief” as ETH’s worth continues climbing greater.

🫢 Ethereum is now inside 6.4% of its $4,891 all-time excessive from November 16, 2021. There have been constant sell-offs from retail merchants as crypto’s #2 market cap has made this historic rally.

Costs traditionally transfer the wrong way of retail merchants’ expectations.… pic.twitter.com/241va9Jc5L

— Santiment (@santimentfeed) August 12, 2025

The platform added that costs normally transfer in the wrong way of retail merchants’ expectations, and highlighted such cases in June 16 and July 30 of this 12 months. On each days, there was “excessive greed” out there, which in the end led to cost corrections, Santiment wrote.

“With key stakeholders accumulating unfastened cash that small $ETH merchants are keen to half with proper now, costs are exhibiting little or no sentiment resistance from breaking by means of and making historical past within the close to future,” Santiment wrote of their X put up.

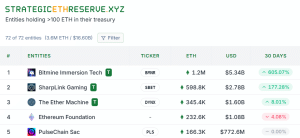

A lot of the whale exercise comes from the rising variety of public firms which can be including ETH to their stability sheets. Presently, these company consumers maintain 5.19% of ETH’s complete provide of their reserves, in response to StrategicETHReserve knowledge.

High 5 greatest company ETH treasuries (Supply: StrategicETHReserve)

The biggest holders are Bitmine Immersion Applied sciences and SharpLink Gaming who maintain $1.2 million ETH and 598.9K ETH, respectively.

ETH Could Be Due For A Correction, Analysts Warn

Analysts have lately warned that ETH could also be due for a correction quickly after the stellar efficiency over the previous month.

Amongst them is famend crypto dealer and analyst Ali Martinez, who instructed his over 149.4K X followers in a put up earlier at present that the TD Sequential has flashed a promote sign for Ethereum on the day by day chart.

TD Sequential flashed a promote on Ethereum $ETH day by day. Shedding $4,150 may drop it to $3,980 or $3,860. pic.twitter.com/OiSxY1OB8p

— Ali (@ali_charts) August 13, 2025

He subsequently warned that ETH dropping beneath the $4,150 mark may result in a plunge to $3,980, and even $3,860 in an excessive case.

That warning follows an earlier put up by Martinez during which he predicted that ETH may soar “straight in direction of $5,241” if it clears the $4,300 mark, which it has.

MN Fund CIO Michael van de Poppe additionally instructed his over 801.9K X followers in an Aug. 12 put up that it could be finest for traders and merchants which can be totally allotted to ETH to lower their publicity barely after the latest rally.

One small thought:

What goes up vertically normally has harsh corrections.

That is why, if I’d have had a full allocation into $ETH, I’d take some chips of the desk.

Use these to purchase the dip once more.

Corrections are normally a painful one.

— Michaël van de Poppe (@CryptoMichNL) August 12, 2025

“What goes up vertically normally has harsh corrections,” he wrote.

Van de Poppe’s warning additionally follows a previous prediction that ETH will soar greater. Earlier on the identical day, he in contrast the latest transfer by the altcoin to how BTC reacted to the launch of spot Bitcoin ETFs final 12 months.

He subsequently forecast that ETH will soar to a brand new all-time excessive earlier than consolidating. “There’s far more to come back for this cycle,” he added.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection