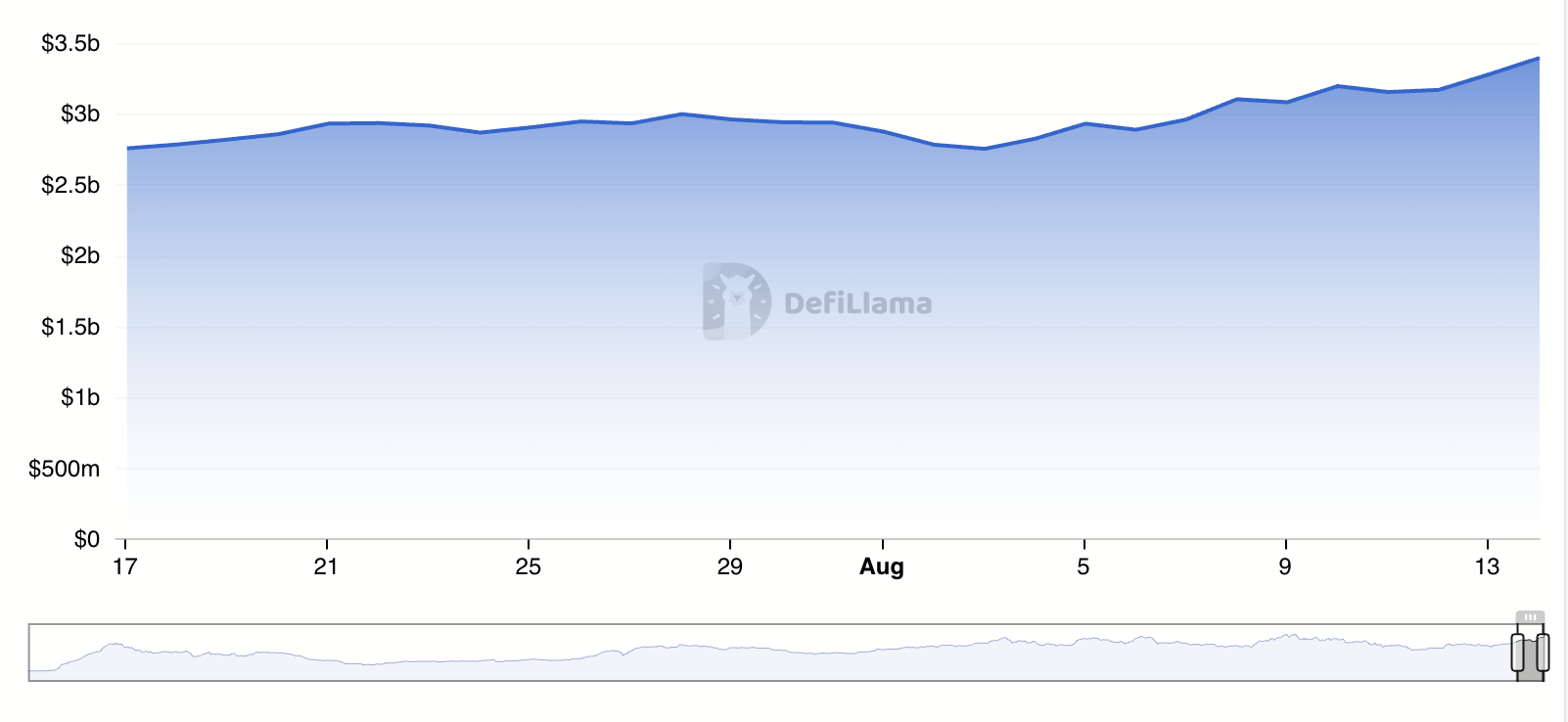

Arbitrum’s decentralized finance (DeFi) whole worth locked (TVL) has reached a year-to-date excessive of $3.39 billion.

The expansion comes as elevated exercise on the Ethereum community—fueled by rising buying and selling exercise—spills over to Layer-2 options (L2s) like Arbitrum.

Arbitrum Sees Report Liquidity Amid Ethereum Community Uptick

Based on DeFiLlama, Arbitrum’s TVL has reached a year-to-date excessive of $3.39 billion, climbing steadily over the previous 4 weeks.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

A rising TVL signifies higher liquidity and utilization on a community. It means that extra capital is being locked into good contracts for buying and selling, lending, or different decentralized finance actions.

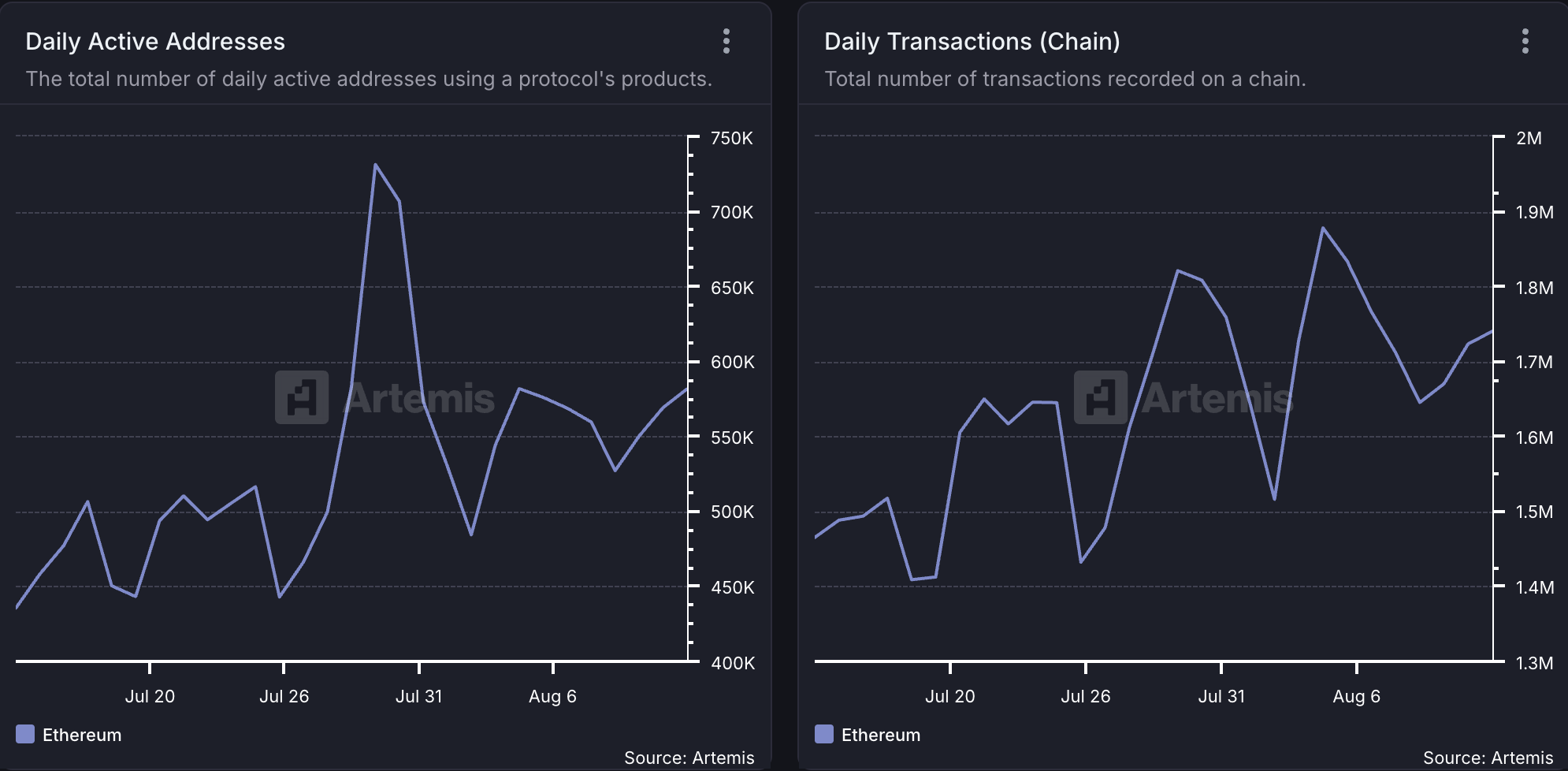

For Arbitrum, its rising consumer demand mirrors Ethereum’s current community exercise. Based on Artemis, Ethereum’s each day energetic deal with depend has surged 33% over the previous few weeks, with transaction quantity up 10%.

When Ethereum experiences an increase in consumer demand like this, a lot of the exercise spills into L2s. These networks present sooner transaction occasions and decrease charges, attracting customers who need to keep away from congestion on the primary Ethereum chain.

Because of this, L2s like Arbitrum usually see elevated liquidity and engagement every time Ethereum experiences heightened exercise.

ARB Rockets as Market Curiosity Heats Up

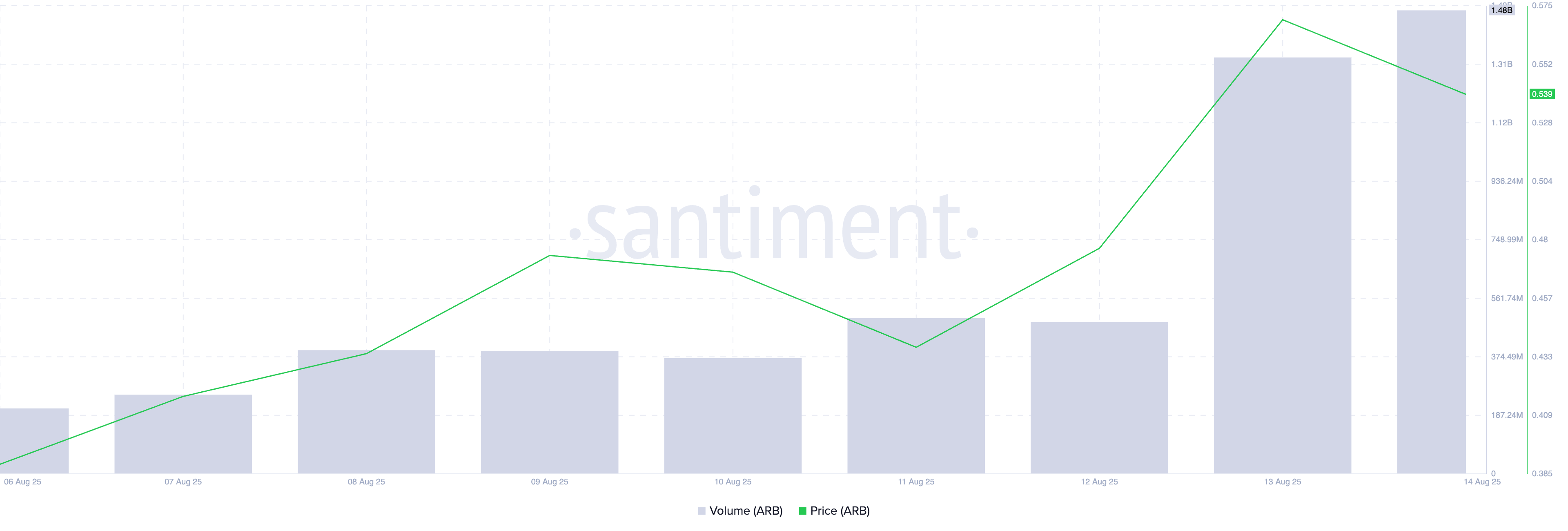

At press time, ARB trades at $0.54, climbing by 12% prior to now 24 hours. Throughout that interval, its buying and selling quantity is up by 155% and at present totals $1.48 billion.

When an asset’s worth and buying and selling quantity climb concurrently, it alerts robust market curiosity and bullish sentiment.

ARB’s rising worth reveals that demand outpaces provide, whereas its excessive buying and selling quantity confirms that the motion is backed by vital participation fairly than skinny liquidity. This pattern usually attracts extra merchants and traders, and will drive additional positive factors for ARB within the quick time period.

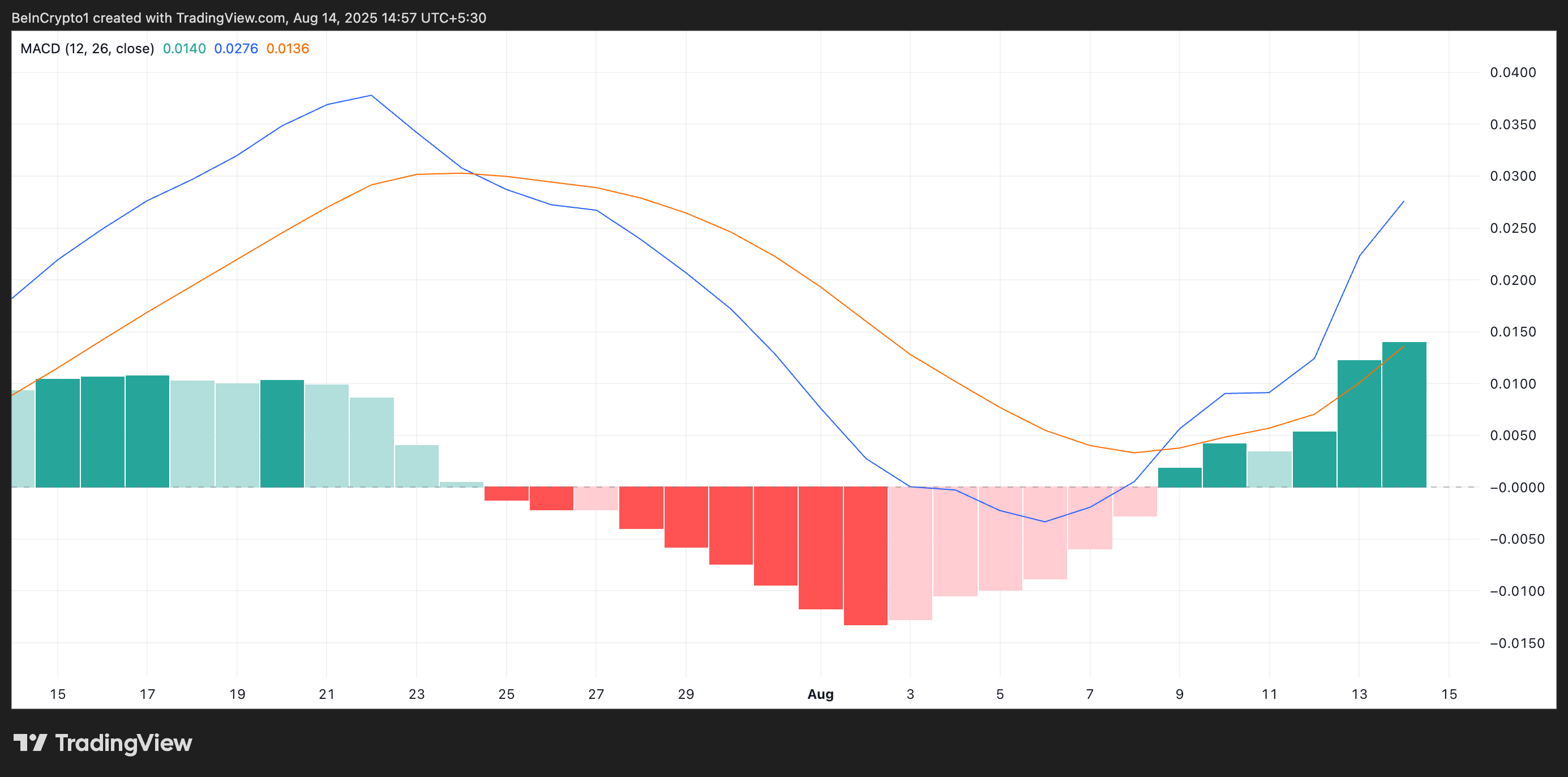

Additional, the bullish crossover of ARB’s Transferring Common Convergence Divergence (MACD) setup helps this bullish outlook. As of this writing, the token’s MACD line (blue) rests above its sign line (orange), confirming the buy-side strain.

Furthermore, the histogram bars that make up the MACD indicator have been regularly rising since August 6, with the inexperienced bars increasing in measurement. When this occurs, it means that the upward pattern is gaining power.

Can Bulls Push ARB Towards $0.74?

Sustained ARB accumulation might drive its worth towards $0.62. A profitable breach of this resistance degree might propel ARB’s worth towards $0.74, a excessive it final reached in January.

Nonetheless, if selloffs start, the altcoin’s worth dangers plunging to $0.45.

The publish Arbitrum TVL Hits YTD Excessive as Rising Ethereum Exercise Fuels Layer-2 Demand appeared first on BeInCrypto.