Pantera Capital has pulled off one of the correct Bitcoin forecasts in latest reminiscence.

Again in 2022, the funding agency projected that Bitcoin would attain $117,482 on August 11, 2025, a determine that turned out to be simply 1% shy of the particular value of $118,700 on that day.

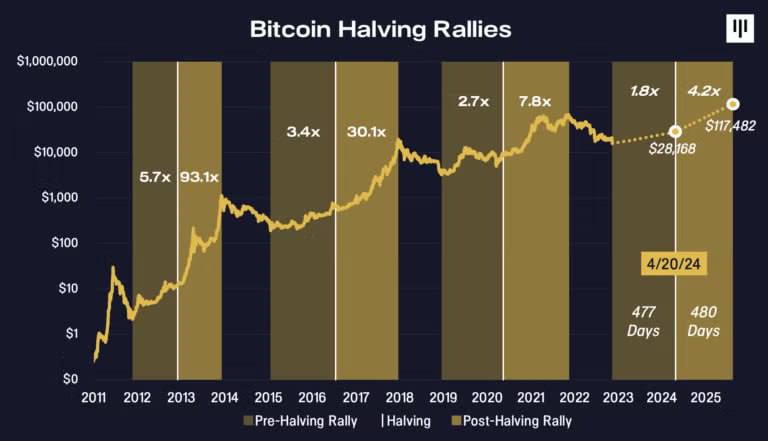

What makes the prediction much more outstanding is that it wasn’t primarily based on random hypothesis. Pantera used historic halving cycle patterns to construct its mannequin, monitoring how Bitcoin tends to behave earlier than and after every block reward discount. These patterns not solely guided the worth estimate but in addition accurately pinpointed the timing of this cycle’s peak, which has now unfolded proper on schedule.

The halving framework has lengthy been a key reference level for Bitcoin merchants, as earlier cycles have proven dramatic rallies within the months and years following a provide minimize. In response to Pantera’s chart, Bitcoin’s earlier post-halving surges delivered positive aspects starting from 2.7x to over 90x, with every cycle displaying its personal distinctive rhythm whereas nonetheless becoming the broader development.

This newest cycle has already seen Bitcoin climb from round $28,000 on the April 2024 halving to over $118,000 in simply 477 days. If the historic trajectory continues, the months forward might carry heightened volatility as merchants reassess positions within the wake of the expected peak.

For Pantera, the accuracy of this forecast is a significant credibility increase, underscoring the worth of long-term, data-driven evaluation in a market usually dominated by short-term noise. And for the broader crypto group, it’s one other reminder that whereas historical past could not repeat completely, it usually rhymes — particularly with regards to Bitcoin’s halving cycles.