Decentralized Bodily Infrastructure Networks (DePIN) was probably the most talked-about sectors in crypto and skilled substantial progress in 2024. Nonetheless, as crypto metas like meme cash, NFTs, and others regain traction, DePIN has struggled to keep up its momentum.

This yr, it has fallen behind within the race for investor consideration. Nonetheless, Naman Kabra, CEO and co-founder of NodeOps, a DePIN protocol, emphasised that the sector isn’t lifeless; relatively, it is going to have an inevitable breakthrough in 2025.

Why Was DePIN Well-known?

Naman Kabra defined that DePIN’s preliminary progress was pushed by crypto’s promise of decentralizing important infrastructure. Tasks like Helium demonstrated how decentralized networks might effectively deploy bodily infrastructure, outpacing conventional telecom suppliers.

“This wasn’t price arbitrage however proof that decentralized coordination might outperform centralized planning in complicated infrastructure deployment. For these of us who understood Bitcoin’s distributed consensus breakthrough, seeing comparable rules utilized to bodily infrastructure felt like crypto’s pure evolution,” Kabra instructed BeInCrypto.

He added that DePIN supplied traders an answer to the factitious shortage and geographic monopolies managed by conventional suppliers. For builders, it offered the prospect to construct on infrastructure that might develop extra decentralized over time relatively than succumb to the lease extraction and platform danger posed by centralized companies.

Nonetheless, this yr the sector hasn’t had the perfect time. In response to Onchain Journal, the overall market capitalization of DePIN initiatives reached $25 billion in 2024. Nonetheless, since then, the market has skilled a noticeable decline in worth.

Regardless of this, Kabra famous this ‘slowdown’ is solely the sector maturing. He stated that this course of,

“Represents the sector’s transition from speculative pleasure to infrastructure actuality, a course of that at all times seems much less dynamic than token-driven narratives however creates extra sustainable worth.”

Kabra additionally drew parallels to Bitcoin’s evolution, from cypherpunk curiosity to institutional infrastructure.

“Early Bitcoin adoption was pushed by ideological conviction and speculative alternative. The primary main cycle introduced mainstream consideration but additionally unsustainable expectations. The crash and subsequent bear market winnowed out initiatives that couldn’t ship utility with out speculative assist. DePIN is following the same path,” he talked about.

Kabra burdened that the preliminary surge of curiosity offered essential consideration and capital to validate the technical viability of DePIN initiatives. Now, on this ‘obvious slowdown’ section, focus is shifting from speculative token progress to proving long-term utility. Thus, filtering out weaker initiatives finally strengthens the sector by highlighting what approaches ship actual worth.

Why DePIN’s ‘Boring’ Trajectory Is Its Largest Power in 2025

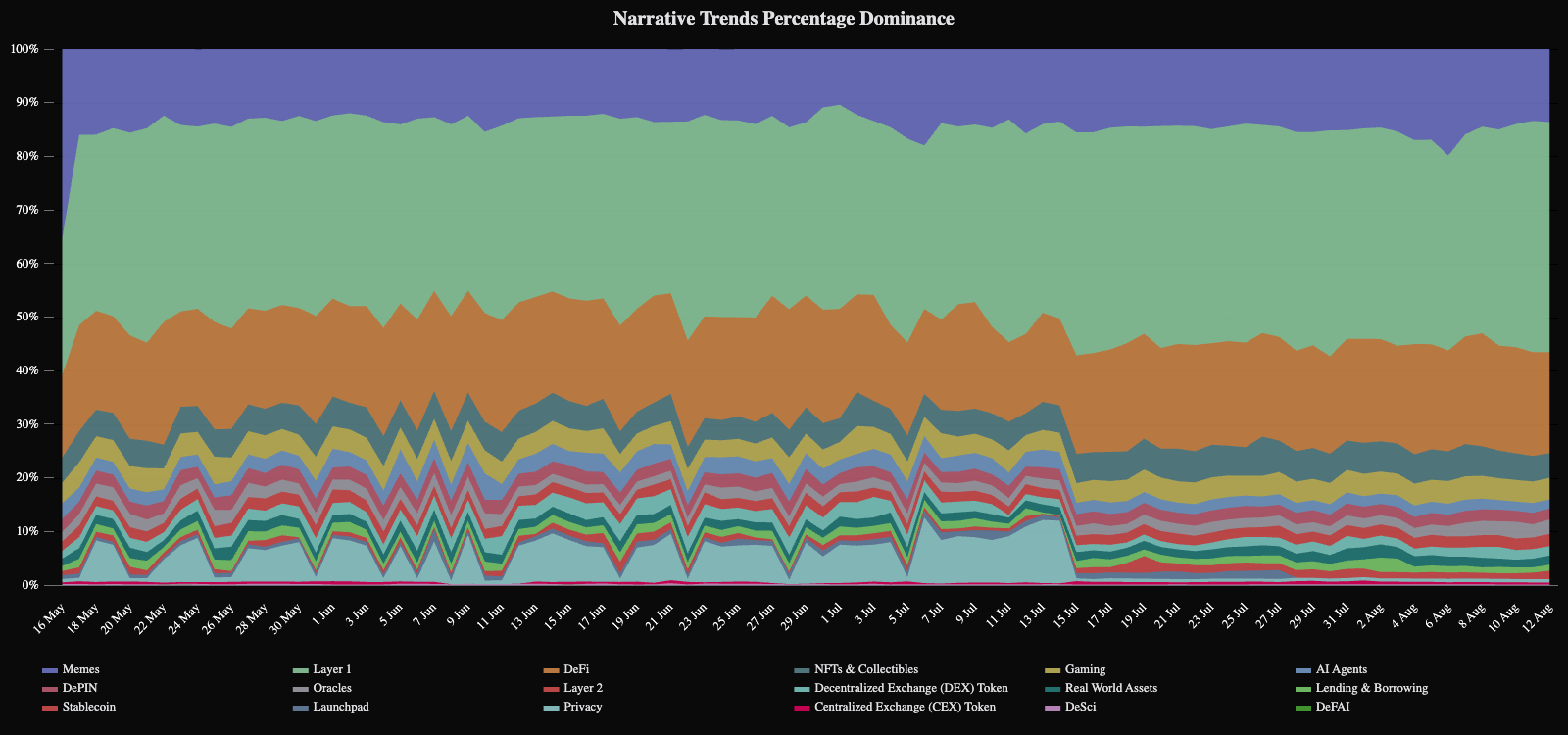

Whereas DePIN’s potential is powerful, its reputation isn’t. In response to knowledge from Sharpe AI, over the previous three months, layer1, DeFi, meme cash, and real-world belongings’ mindshare has grown, persevering with to dominate crypto discussions. In distinction, DePIN stays a bit far down on this checklist.

This raises the query: Is DePIN probably the most boring crypto narrative in 2025? In response to Kabra, this narrative that DePIN is ‘boring’ reveals a elementary misunderstanding of how transformative infrastructure operates.

“This notion truly alerts DePIN’s maturation past speculative pleasure into real utility. Essentially the most profitable applied sciences turn out to be invisible exactly as a result of they work so properly they fade into the background,” the chief stated

Kabra identified that applied sciences like TCP/IP protocols and Amazon Internet Providers, although essential to our digital lives, not often make headlines or development on social media. This invisibility paradox means that DePIN is transitioning in the direction of actual utility, transferring past speculative hype into one thing extra foundational and impactful.

“Infrastructure turns into fascinating solely when it fails, see for instance energy grids make headlines throughout blackouts, web suppliers development throughout outages. DePIN’s ‘boring’ trajectory signifies it’s attaining the final word infrastructure purpose: dependable invisibility. Whereas crypto focuses on meme cash and AI tokens, DePIN builders are developing the infrastructure foundations for Web3’s subsequent section,” he added.

The DePIN proponent additionally famous that the sector faces a mismatch with crypto’s consideration financial system. Within the crypto house, narrative velocity, short-term value fluctuations, and speculative pleasure typically overshadow the supply of actual utility and long-term worth.

DePIN operates on infrastructure timelines, measured in years of regular improvement, whereas crypto’s consideration spans are extra attuned to speedy narrative cycles measured in simply weeks.

This results in the undervaluation of the sector, which generates actual income from service supply, in comparison with tokens promising unproven breakthroughs.

“The irony is profound: whereas speculators chase AI tokens which will by no means ship on their guarantees, DePIN networks are fixing actual infrastructure issues that turn out to be extra priceless as AI adoption accelerates. The computing sources wanted for AI workloads don’t materialize from token hypothesis—they require the unglamorous work of coordinating distributed {hardware}, managing service high quality, and creating dependable infrastructure,” Kabra highlighted.

He said that the final word purpose for DePIN isn’t to win mindshare inside the crypto house however to turn out to be so integral to digital operations that its decentralized nature fades into the background as important infrastructure.

“DePIN might be as boring as water… till you’re thirsty. And for a lot of organizations going through AI-driven compute shortage and cloud oligopoly pricing, that thirst is approaching quickly,” Kabra commented.

Is DePIN Useless? Right here’s Why 2025 Marks Its Revival

In the meantime, Kabra emphasised that DePIN just isn’t going anyplace and can have a breakthrough this yr.

“Removed from being lifeless, 2025 marks DePIN’s inevitable breakthrough, not by speculative fervor, however by the quiet revolution of shared possession assembly real necessity,” he disclosed to BeInCrypto.

Kabra argued that DePIN represents a return to crypto’s core rules. It provides an answer past the false selection between institutional adoption and mainstream utility. Moreover, the house creates enterprise-grade and community-owned networks, addressing the rising shortage of infrastructure pushed by AI demand.

He added that as centralized suppliers concentrate on revenue, DePIN offers a decentralized different that’s turning into important. This shift mirrors historic patterns, just like the rise of different lending platforms after the 2008 monetary disaster.

“The selection gained’t be between decentralized and centralized infrastructure however between shared possession and digital feudalism. DePIN provides a path the place infrastructure serves customers relatively than extracting from them, the place community results profit members relatively than platform house owners,” Kabra declared.

Knowledgeable Sees Untapped Potential in DePIN

The NodeOps CEO outlined a number of key alternatives for innovation inside the DePIN house, emphasizing that it’s removed from reaching its peak.

“Quite than reaching peak innovation, DePIN is coming into its most vital improvement section. The infrastructure layer of any expertise stack usually follows a predictable evolution: preliminary proof of idea, speculative growth, market correction, and mature optimization,” Kabra claimed.

He defined that DePIN’s modular strategy allows horizontal innovation all through the infrastructure stack. The alternatives embody:

- AI-Native Infrastructure: DePIN can optimize infrastructure for AI workloads, providing dynamic useful resource allocation, specialised {hardware} for AI duties, and geographic distribution for edge computing. This addresses calls for that conventional infrastructure struggles to fulfill.

- Edge Computing Democratization: DePIN networks are well-suited for the distributed mannequin required by the rising variety of IoT gadgets. By coordinating sources throughout various places, relatively than counting on centralized knowledge facilities, DePIN can optimize for latency, price, and reliability.

- Income-Based mostly Tokenomics: Kabra highlighted the potential for DePIN initiatives to implement burn-and-mint mechanisms tied to infrastructure utilization. This might set up sustainable token demand based mostly on utility.

- Hybrid Financial Fashions: Innovation can be occurring in combining conventional enterprise fashions with cryptoeconomic coordination, which might increase DePIN’s enchantment past crypto-native customers.

- Evolving Financial Coordination Fashions: Lastly, he identified {that a} important innovation alternative lies in transferring past easy token-for-service fashions to extra refined financial mechanisms. Early DePIN initiatives confronted challenges with token utility design, creating synthetic demand by staking or governance participation that didn’t align with the precise infrastructure worth.

Kabra additionally recognized a number of promising, but underexplored, use instances for DePIN, providing new alternatives.

“Essentially the most promising unexplored territory lies on the DeFi-DePIN intersection, the place infrastructure turns into financialized by new primitives. We’re seeing early experiments in infrastructure bonds, compute futures, and bandwidth derivatives that allow customers hedge or speculate on community capability,” he revealed.

The knowledgeable drew consideration to a different important frontier: the transformation from “rented possession” to true possession. On this mannequin, end-user gadgets comparable to smartphones, laptops, or IoT gadgets turn out to be monetizable community nodes.

“This creates new financial fashions the place customers seize worth from their very own infrastructure utilization relatively than paying lease to platforms. These primitives allow infrastructure-backed lending, yield farming on community capability, and governance tokens tied to precise useful resource provision—essentially restructuring how we work together with and profit from digital infrastructure,” Kabra elaborated.

What Is Hindering DePIN’s Adoption?

Along with specializing in its use instances, Kabra acknowledged a number of challenges stopping DePIN from mass adoption.

- Technical Complexity: This arises from the hole between blockchain improvement and conventional IT expectations. Early initiatives required customers to handle crypto wallets and perceive tokenomics, creating friction.

- Consumer Engagement: These points stem from forcing customers to behave as token merchants, creating limitations for organizations that need infrastructure with out crypto issues.

- Coordination Challenges: It includes balancing provide and demand, with DePIN needing to bootstrap each side whereas sustaining decentralization.

He defined that the answer to enhancing person engagement lies in creating a number of interplay layers. On this system, crypto customers can interact straight with tokens, whereas mainstream customers entry infrastructure by conventional strategies.

To deal with coordination challenges, Kabra instructed,

“The breakthrough happens as networks attain important mass, the place market dynamics turn out to be self-sustaining. Early adopters present preliminary provide and demand, token incentives bridge the hole throughout progress phases, and eventual community results create natural coordination that doesn’t require fixed intervention.”

What Will Make DePIN Fascinating Once more?

Whereas Kabra advocated beforehand that DePIN doesn’t have to win mindshare, he nonetheless acknowledged the necessity to take steps to draw investor consideration once more.

“DePIN initiatives have to ignite curiosity relatively than disguise behind boring infrastructure narratives! The chance lies in making decentralized infrastructure irresistibly compelling—not simply functionally superior,” he remarked.

In response to him, to regain momentum in 2025 and past, DePIN initiatives can:

- Gamify Participation: Make infrastructure participating by providing interactive experiences like deploying nodes, incomes credit, or contributing bandwidth.

- Create Multi-Channel Experiences: Host occasions, workshops, and challenges that flip infrastructure into tangible, shareable moments.

- Type Strategic Partnerships: Collaborate with conventional infrastructure giants whereas demonstrating DePIN’s benefits, creating market pressure.

- Introduce Novel Entry Fashions: Use subscription, pay-per-use, or passive earnings fashions to make infrastructure personally compelling.

- Promote Shared Possession: Assist customers notice they co-own the web’s future, fostering a way of belonging and empowerment.

- Create a Motion: Place decentralized infrastructure as a motion, not only a service, to encourage pleasure and participation.

Thus, these methods could make DePIN extra participating, compelling, and enticing to customers and traders.

The submit Is DePIN Useless? Knowledgeable Reveals Why 2025 Will Be Its Breakthrough Yr appeared first on BeInCrypto.