Be part of Our Telegram channel to remain updated on breaking information protection

Bitcoin surged previous $124k, setting a brand new all-time excessive (ATH) and briefly overtaking Google’s $2.488 trillion market capitalization to grow to be the world’s fifth-most useful asset.

BTC hit a document excessive of $124,457.12 previously 24 hours earlier than pulling again to commerce at $121,692 as of 12:28 a.m. EST. The crypto king is up extra 1.3% previously day and 5.8% previously final week amid buoyant market sentiment.

Traders are betting that lower-than-expected US CPI inflation this week and strain from President Donald Trump will carry rates of interest cuts subsequent month. Trump right this moment known as for a one foundation level lower, whereas Treasury Secretary Scott Bessent yesterday urged a 50 foundation level lower.

The surge additionally noticed Technique’s BTC holdings shut at a brand new ATH of $77.2 billion, stated govt chair, Michael Saylor, in a submit on X.

And in keeping with blockchain analytics agency Arkham Intelligence, the worth of Bitcoin held by Elon Musk’s SpaceX additionally has surpassed $1 billion. The corporate holds 8,285 Bitcoin.

Polymarket Bettors Goal $130K-$200K

Bitcoin’s ascent might not be over but, in keeping with bettors on the decentralized platform, Polymarket.

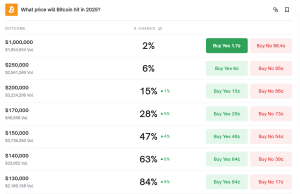

Over the previous 24 hours, a contract asking what value Bitcoin will hit noticed the percentages of $130K to $200K improve. Bets that BTC will surge to $130K earlier than the 12 months is over surged 8%, pushing the percentages to 84%.

The subsequent greatest improve was odds across the $140K goal being reached. Bettors upped the probabilities by 6% to 63%.

Odds for what value Bitcoin will hit in 2025 (Supply: Polymarket)

In the meantime, odds of $150K, $170K and $200K being reached earlier than the tip of the 12 months climbed 4%, 5%, and 1%, respectively. The $150K goal has the very best odds of the three, with bettors seeing a 47% probability that BTC might hit this value level.

Analysts additionally keep a bullish outlook for BTC, together with pseudonymous dealer and analyst Rekt Capital, who informed his over 556.4K X followers at the beginning of the week that Bitcoin convincingly breaking above $126K might result in a parabolic rally.

In that case, he believes the probabilities are that the BTC value “will go quite a bit increased and shortly.”

Mow Says Bitcoin And Altcoins Will Battle It Out After BTC’s All-Time Excessive

Following Bitcoin’s new ATH, Bitcoin pioneer and JAN3 CEO Samson Mow, who has greater than 352k followers on X, stated there are actually two attainable future paths.

Within the first one, he stated “We Godzilla or Omega up, suck all of the oxygen out of the room, and alts drop 30-40%.” The choice is “Alt mania peaks, triggering an enormous selloff because the Bagholder’s Dilemma loses equilibrium, BTC goes down briefly then up once more, as alts tank,” he added.

Two attainable paths for #Bitcoin now.

1⃣ We Godzilla or Omega up, suck all of the oxygen out of the room, and alts drop 30-40%.

2⃣ Alt mania peaks, triggering an enormous selloff because the Bagholder’s Dilemma loses equilibrium, BTC goes down briefly then up once more, as alts tank.

— Samson Mow (@Excellion) August 14, 2025

Mow, identified for his work on El Salvador’s Bitcoin technique and selling Bitcoin adoption by nations, predicted in an earlier submit right this moment that “there will likely be extra Bitcoin ATHs,” however warned {that a} pullback is probably going as a result of altcoins are at the moment “operating too scorching proper now.”

“As soon as the altcoin mania passes, Bitcoin will take off,” he stated. “That is simply the way it’s all the time been.”

Over the past month, the full capitalization for altcoins soared greater than 16%, knowledge from TradingView exhibits. The ETH/BTC ratio additionally soared over 20% throughout the identical interval, which suggests ETH is strengthening towards the main crypto.

Month-to-month chart for ETH/BTC (Supply: TradingView)

Mow commented on the surging ETH/BTC ratio as properly, saying that early Bitcoin buyers are simply utilizing the treasury narrative round ETH to pump its value increased. “As soon as they’ve gotten it excessive sufficient, they’ll dump their ETH” and rotate the positive factors again into BTC, he stated.

Bitcoin ETFs Proceed Influx Streak, However Lag Behind Ethereum Funds

Whereas Mow forecasts a possible rotation from ETH to BTC, US spot Ethereum ETFs (exchange-trade funds) proceed to outperform their Bitcoin counterparts.

The BTC funds have been capable of prolong their optimistic stream streak to six days after $86.9 million entered the ETFs’ reserves yesterday. BlackRock’s ETF recorded no new flows for the day, which is a change within the product’s dominant pattern seen in current weeks.

As an alternative, buyers poured capital into Constancy’s FBTC, Bitwise’s BITB, ARK Make investments’s ARKB, Invesco’s BTCO and Grayscale’s BTC.

Over the previous week, the Bitcoin ETFs have recorded greater than $1.103 billion inflows, in keeping with Farside Investor knowledge.

Institutional buyers, nevertheless, appeared to have most popular spot Ethereum ETFs over the BTC funds. In simply the final 3 days, inflows for the ETH merchandise topped $2.2 billion. Yesterday, BlackRock’s fund pulled in additional than $500 million by itself as properly.

That’s after the US ETH ETFs began the week off on a powerful notice, and recorded web day by day inflows above $1 billion. Following yesterday’s inflows, the ETH merchandise are additionally on a 7-day streak.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection