Main cryptocurrency Bitcoin has witnessed heightened volatility this week, marked by sharp value swings and contemporary file highs. Simply yesterday, the coin surged to a brand new all-time excessive of $123,731 earlier than retreating. Now buying and selling at $119,937, the asset has pulled again by roughly 4% from its peak.

Nonetheless, regardless of these fluctuations, on-chain knowledge has revealed a holding sample amongst Bitcoin’s short-term holders (STHs). This might assist drive one other upward thrust for the coin within the quick time period.

Quick-Time period Holders Might Be Gas for Bitcoin’s Subsequent Rally

BTC STHs (buyers who’ve held their cash for 155 days or much less) have lowered their selloffs and regularly fallen into an accumulation sample even because the market’s volatility climbs.

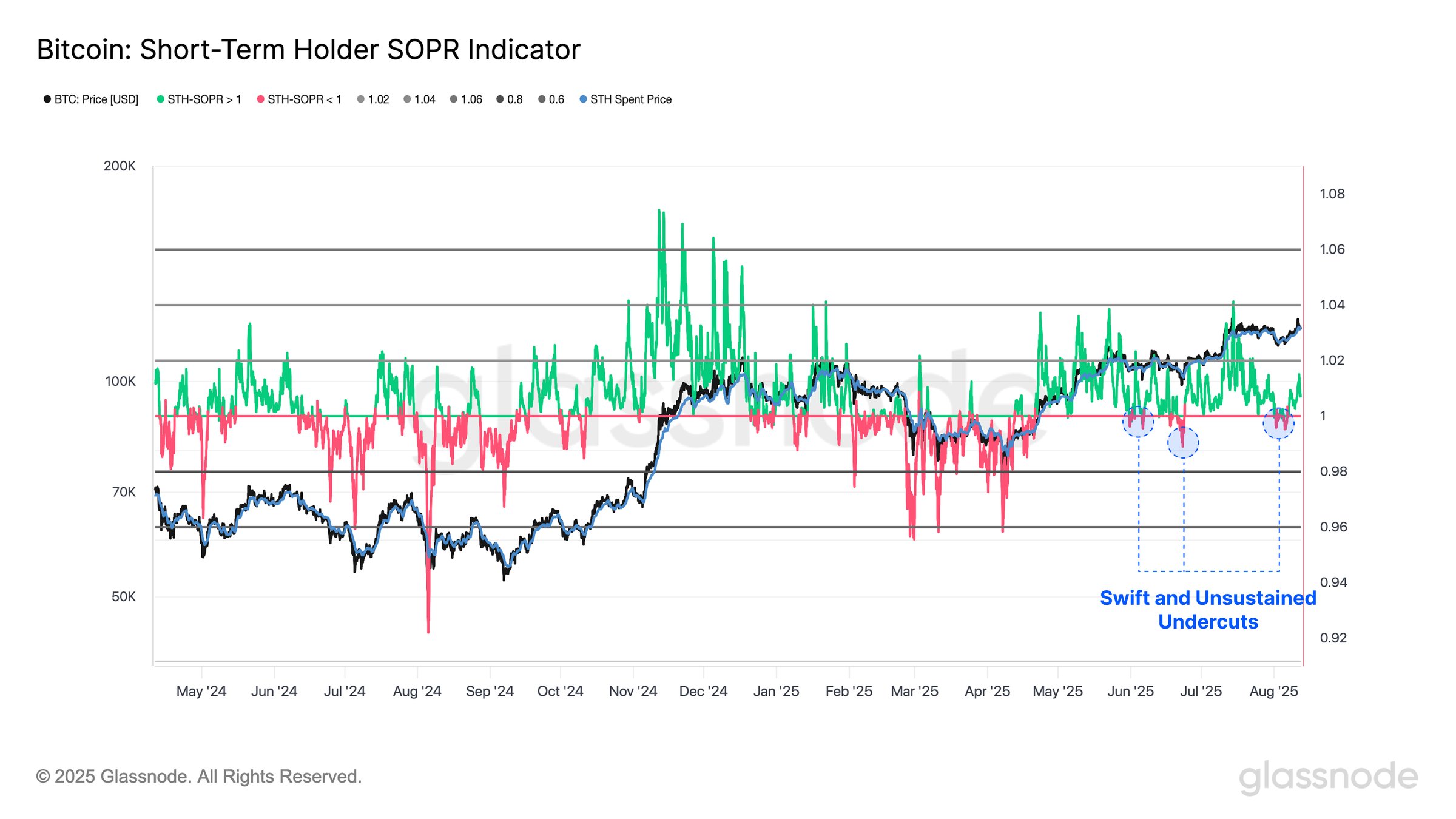

That is mirrored by the coin’s STH Spent Output Revenue Ratio (STH-SOPR) metric, which briefly dipped under the impartial line however has rebounded, per Glassnode.

The STH-SOPR metric measures whether or not cash moved by STHs are being bought at a revenue or a loss. When it stays above the impartial one stage, STHs promote at a revenue, signaling robust market sentiment. Alternatively, when it drops under one, these buyers are distributing their cash at a loss.

The motion of BTC’s STH-SOPR above the impartial line is noteworthy as a result of STHs are among the many most influential contributors in BTC’s value actions. With their value bases typically near the present market value, STHs are normally the primary to react to swings. They worsen selloffs throughout downturns or enhance rallies once they maintain or accumulate.

Subsequently, their resolution to revert to a holding sample, regardless of sharp value fluctuations, displays a level of conviction that may assist stabilize the market.

Bitcoin’s Aggressive Patrons Soak up Promote Strain

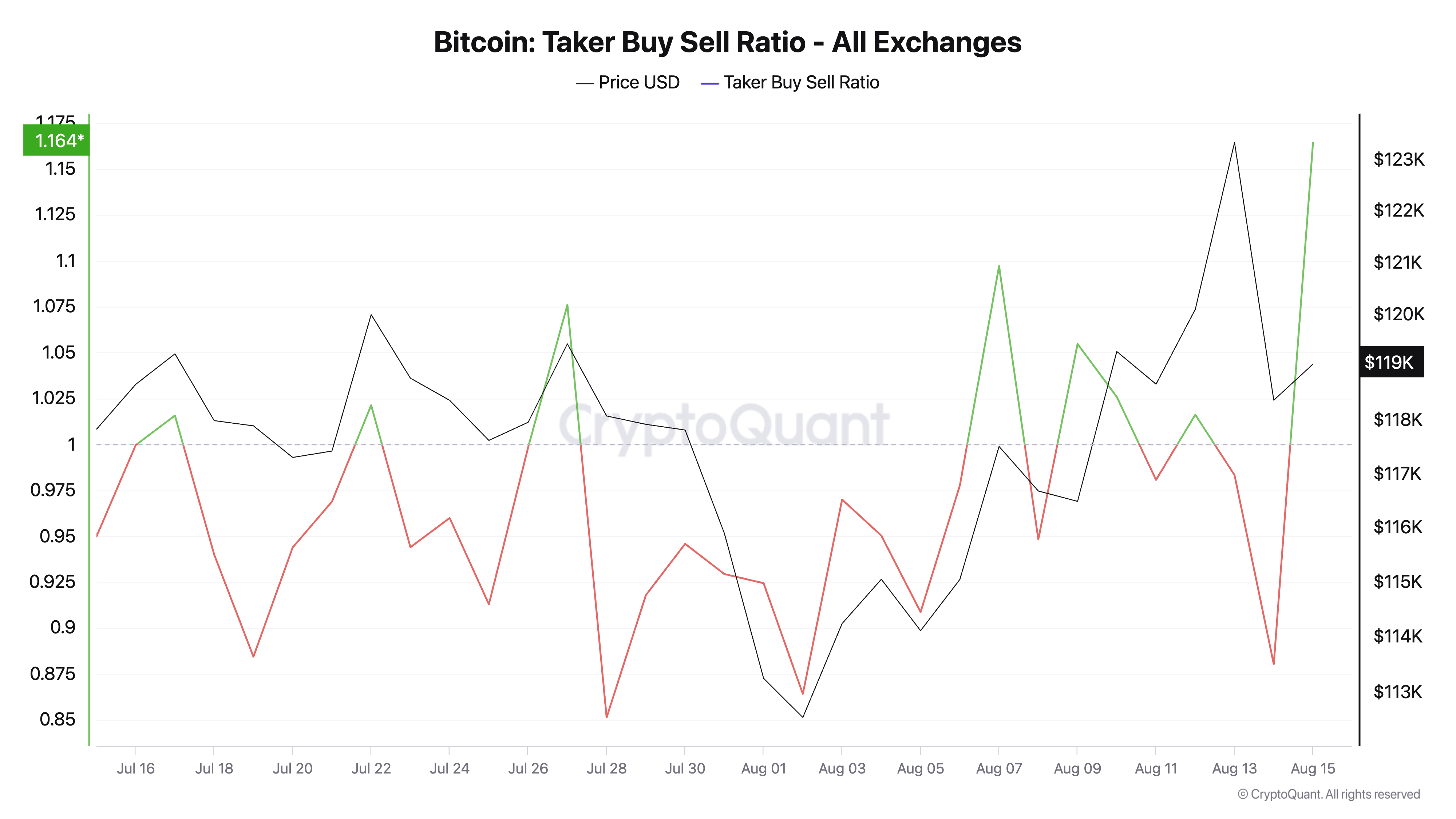

Bitcoin’s taker-buy/promote ratio has climbed to a month-to-month excessive of 1.16, confirming the bullish tilt in sentiment amongst derivatives merchants.

The ratio measures the stability between market purchase orders and promote orders on futures and perpetual contracts. A worth above one signifies that extra trades are executed on the ask value (market buys) than on the bid value (market sells), signaling stronger purchaser aggression.

BTC’s present taker-buy/promote ratio means patrons in its derivatives market are actively absorbing sell-side liquidity. This reveals rising demand and highlights strengthening conviction, which may drive a rebound.

$122,000 Breakout or Drop to $115,000?

If these tendencies persist, the king coin BTC might be again on monitor to retest the $122,000 stage within the close to time period. A breach of the resistance at $122,190 may set off a rebound towards its all-time excessive of $123,731.

Nonetheless, if volatility strengthens and bullish conviction weakens, sell-side stress may improve, inflicting a value drop to $115,892.

The submit Bitcoin’s New Buyers Maintain the Line as Bulls Eye Return to $122,000 appeared first on BeInCrypto.