Be a part of Our Telegram channel to remain updated on breaking information protection

Bitcoin hit a brand new all-time excessive (ATH) above $124k on Wednesday, extending its month-long rally, whereas Cardano jumped 17% to a five-month peak on information of an ADA ETF submitting by Grayscale.

Bitcoin climbed to $124,128, pushed by expectations of Federal Reserve charge cuts, institutional shopping for, and pro-crypto insurance policies from the Trump administration. BTC has since fallen to $120,509 at 8:34 a.m. EST, kind of flat on the day.

Cardano was additionally within the highlight after a 17% bounce powered by information that fund supervisor Grayscale submitted an software on August 12 to register a spot Cardano ETF in Delaware, utilizing a method much like its Bitcoin ETF. ADA is at present up 4.1% to commerce at $0.9193.

The BTC and ADA worth pumps got here because the crypto market general climbed 1.5% to achieve a market capitalization of $4.21 trillion.

This surge within the Bitcoin worth is trickling right down to different altcoins, with Gitcoin (GTC), Wiki Cat (WKC), and Skale (SKL) main the highest gainers record on CoinGecko, with pumps of virtually 50% every.

BTC Soars As Fed Price-Lower Hopes Inject Market Optimism

Bitcoin funding is being buoyed by expectations of rate of interest cuts subsequent month after lower-than-expected US CPI inflation this week. President Donald Trump has referred to as for a 1 proportion level minimize minimize and Treasury Secretary Scott Bessent earlier urged a 50 foundation level minimize.

The BTC rally additionally comes as Federal Reserve charge minimize expectations climb to over 90% for September. Decrease rates of interest sometimes increase danger belongings like cryptocurrencies because the decrease price of borrowing boosts liquidity.

Since his return to the White Home, BTC has risen 32%, boosted by a collection of pro-crypto insurance policies. Simply final week, Trump signed an govt order that opens crypto to to $8.7 trillion of belongings held by 401(okay) pension plans.

Trump: “I imagine we must be 3 or 4 factors decrease. In order that’s over $1 trillion we pay yearly in curiosity. And it is actually only a paper calculation. You signal a doc and also you save nearly a trillion {dollars}.” pic.twitter.com/QWodkI7WAb

— Aaron Rupar (@atrupar) August 13, 2025

In the meantime, BTC is selecting up curiosity from main establishments, as they proceed including to their hoard.

This week, Japanese Bitcoin treasury agency Metaplanet acquired an extra 518 BTC for roughly $61.4 million, as the corporate continues to build up the world’s prime cryptocurrency.

Metaplanet has acquired 518 BTC for ~$61.4 million at ~$118,519 per bitcoin and has achieved BTC Yield of 468.1% YTD 2025. As of 8/12/2025, we maintain 18,113 $BTC acquired for ~$1.85 billion at ~$101,911 per bitcoin. $MTPLF pic.twitter.com/Gm2bYBgYF0

— Simon Gerovich (@gerovich) August 12, 2025

Metaplanet’s Tuesday buy follows its announcement of plans to lift as much as $3.7 billion to help its BTC acquisition technique.

Michael Saylor’s Technique stays the most important company investor in Bitcoin with a hoard of over $628,946 BTC, in line with Bitcointreasuries.internet.

Bitcoin Might Goal New ATH At $130K

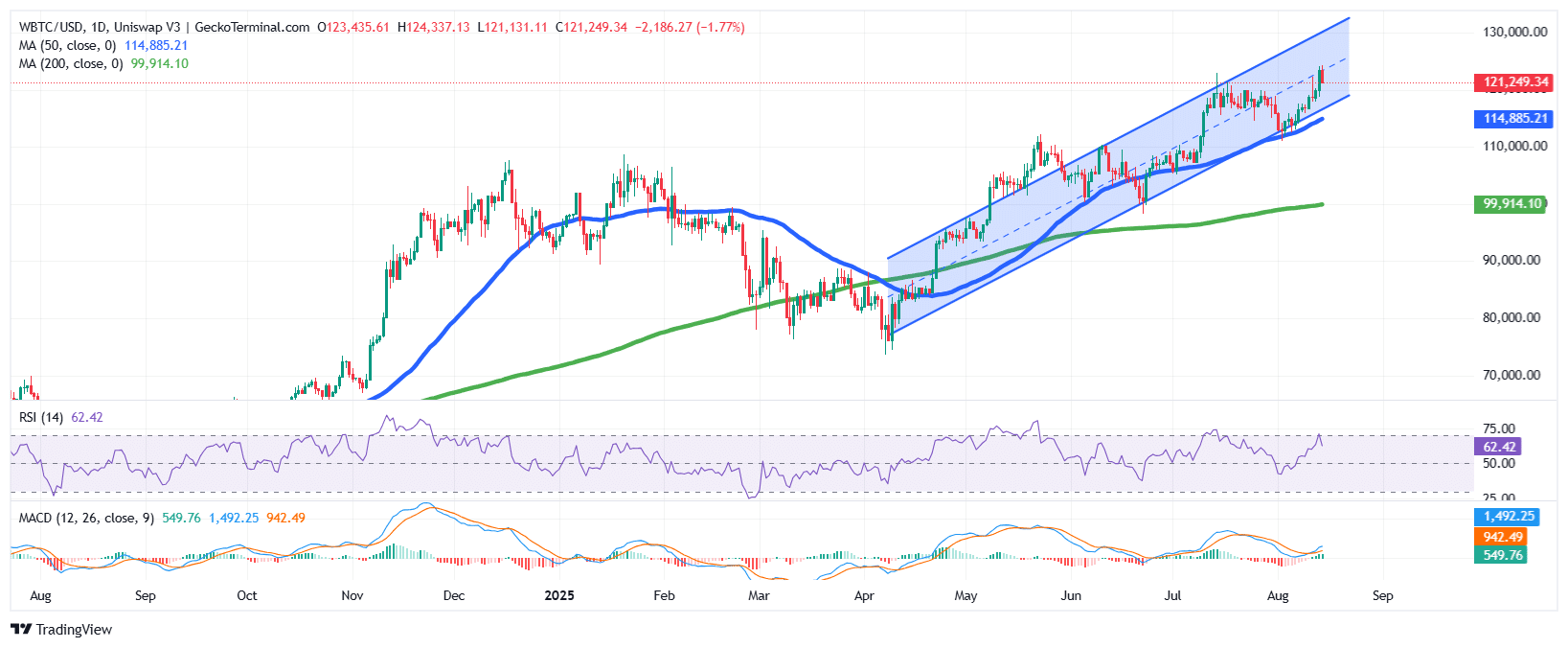

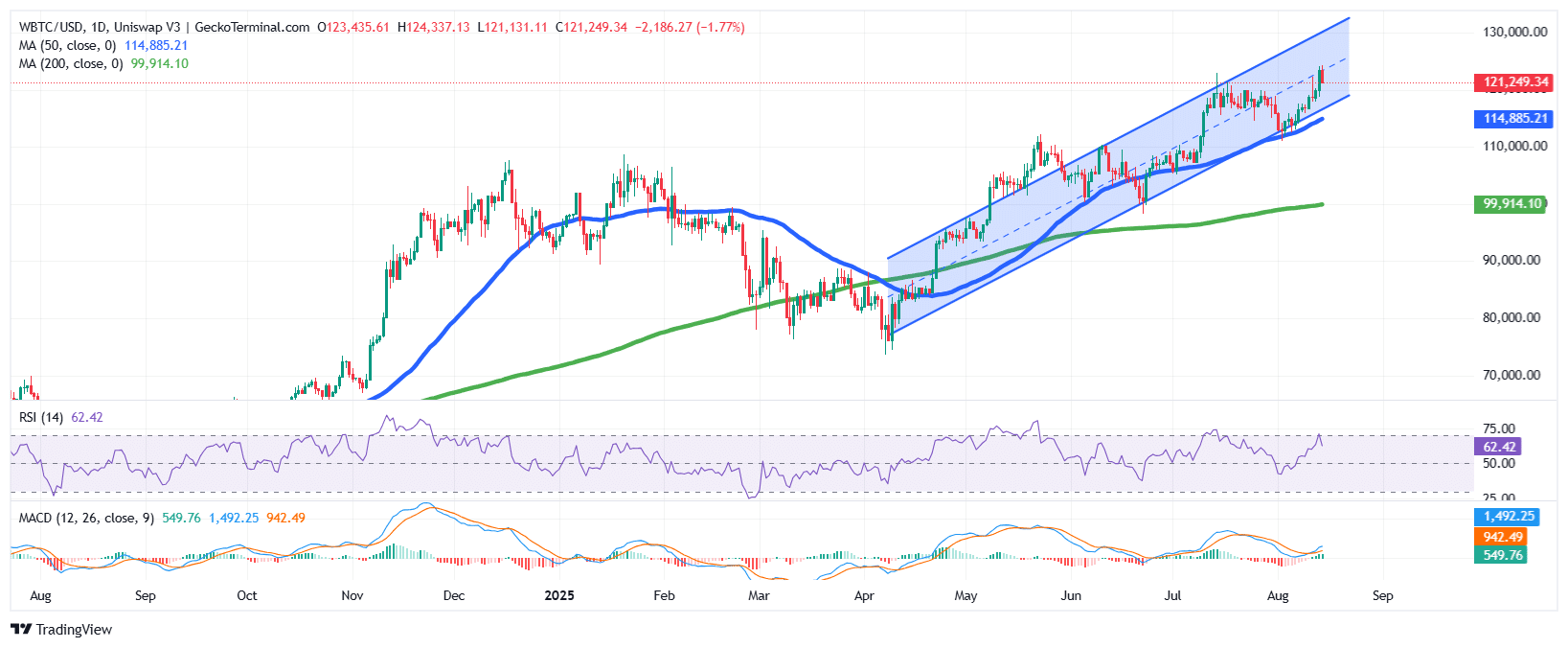

BTC worth continues to respect the rising channel sample, because it maintains highs and better lows since April 2025.

It’s at present testing the $122,000–$124,000 resistance space after rebounding from mid-channel help close to $115,000, as GeckoTerminal knowledge exhibits.

The 50-day Easy Shifting Common (SMA) at $114,885 is offering sturdy dynamic help, with the 200-day SMA far beneath at $99,914, which cements the general outlook.

The Relative Power Index (RSI) is at 62.42, displaying sturdy bullish momentum with out being overbought, which alerts that traders nonetheless have an area to push the worth up earlier than being overextended.

Moreover, the Shifting Common Convergence Divergence (MACD) can also be displaying indicators of a bullish rally, with the blue MACD line crossing above the orange sign line.

If the worth of Bitcoin breaks above $125,000, the asset might goal a brand new ATH at $130,000.

Nonetheless, failure to interrupt resistance might see a pullback to $115,000 or, in a deeper correction, towards $110,000 help.

Cardano’s ADA Jumps 17% On ETF Submitting

Because the Bitcoin worth hit its newest new ATH, Cardano’s ADA surged 17% to the touch $1 for the primary time in months.

The submitting has triggered a series of hypothesis about potential regulatory greenlights and broader adoption of ADA throughout the conventional monetary markets.

In line with decentralized prediction market Polymarket, merchants now see an 80% probability that the US SEC (Securities and Trade Fee) will greenlight a Cardano ETF this yr.

One other catalyst could possibly be after the Cardano group accredited a $71 million (96 million ADA) funding plan to advance key upgrades. The upgrades embrace the Hydra scaling resolution and the Ouroboros Leios consensus mechanism.

These key upgrades to the Cardano ecosystem goal to enhance transaction pace, finality, and scalability points. After this improve, ADA might change into extra engaging to each builders and institutional traders, a bullish case for the worth of Cardano token, which is up 36% within the final month.

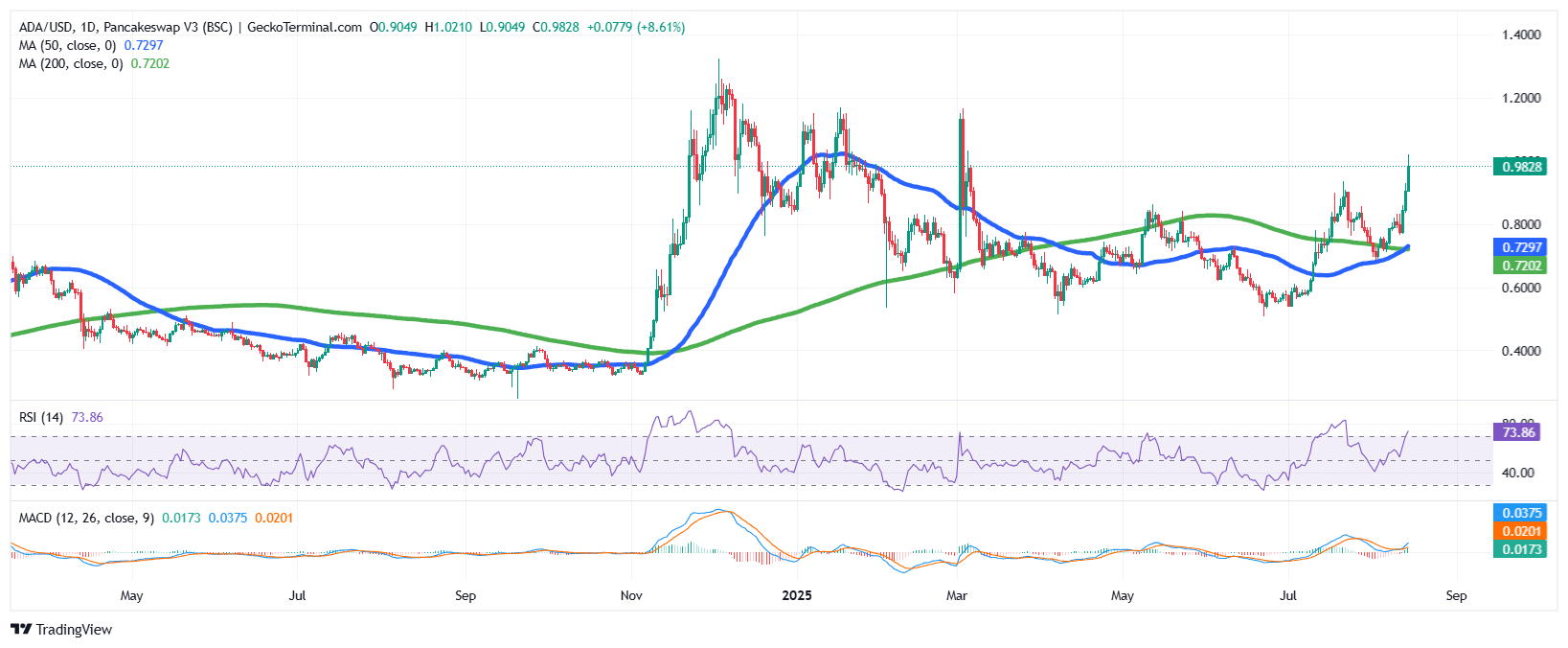

The ADA/USD chart evaluation on the each day timeframe exhibits that the 50-day SMA has crossed above the 200-day SMA, forming a golden cross at $0.7244, which might act as a bullish issue.

Furthermore, the RSI exhibits indicators of a continued surge, signaling sturdy shopping for stress previous the 70-overbought zone.

The MACD line has additionally turned constructive, with the blue MACD line crossing above the orange sign line.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection