XLM has been one of many extra carefully watched altcoins in latest weeks. Over the previous three months, the XLM value has delivered good points of almost 50%. However the momentum has pale; final month noticed a 7% drop, the previous week has shaved off one other 7.5%, and the previous 24 hours alone introduced a 5.4% decline, in step with broader market weak spot.

With sellers urgent more durable, merchants are actually questioning the sturdiness of XLM’s breakout. On-chain and technical metrics current a blended image: most indicators level to weak spot, however one knowledge set hints {that a} explicit group of holders may be quietly constructing positions.

Spot and Derivatives Present Weak spot

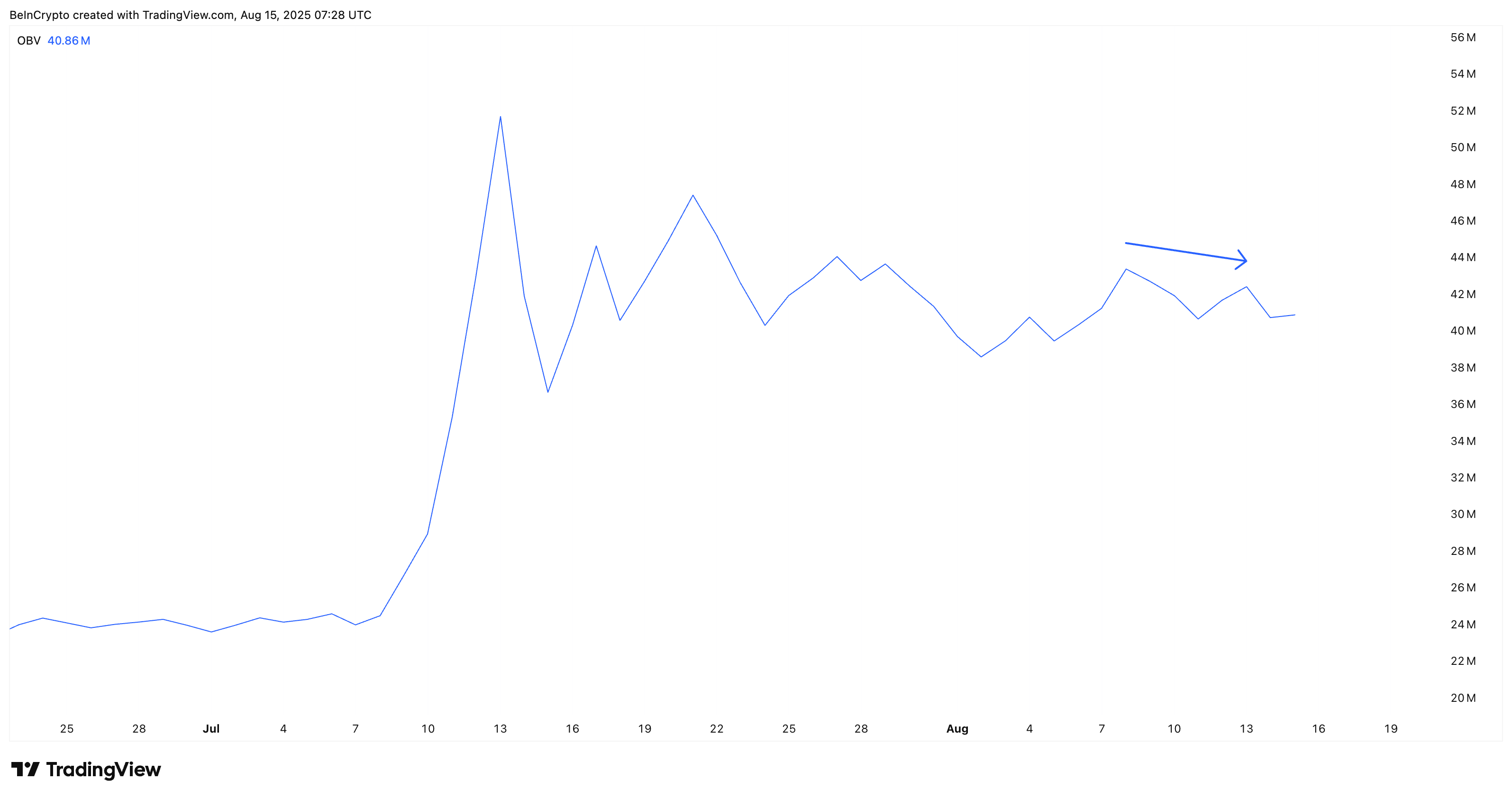

The primary pink flag is in market participation. Whereas the XLM value made a better excessive on the worth chart (between August 8 and August 13), On-Steadiness Quantity (OBV) printed a decrease excessive. This means that spot shopping for curiosity isn’t following the identical momentum. This divergence signifies that rallies have been met with lighter shopping for stress, limiting sustainability.

In derivatives, the story is analogous. Stellar’s Futures open curiosity has been on a gentle slide, falling from round $420 million in mid-July to roughly $260 million at press time.

This drop exhibits leveraged merchants are stepping again, decreasing the type of speculative gasoline that usually helps maintain breakouts. With each spot demand and leveraged publicity fading, the market’s speedy posture leans cautious.

Futures Open Curiosity (perpetual) is the overall worth of all energetic perpetual futures contracts that haven’t been closed or settled, exhibiting how a lot capital is dedicated to the market at a given time.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter right here.

Lengthy-Time period Holders Lighten Up, Quick-Time period Palms Step In

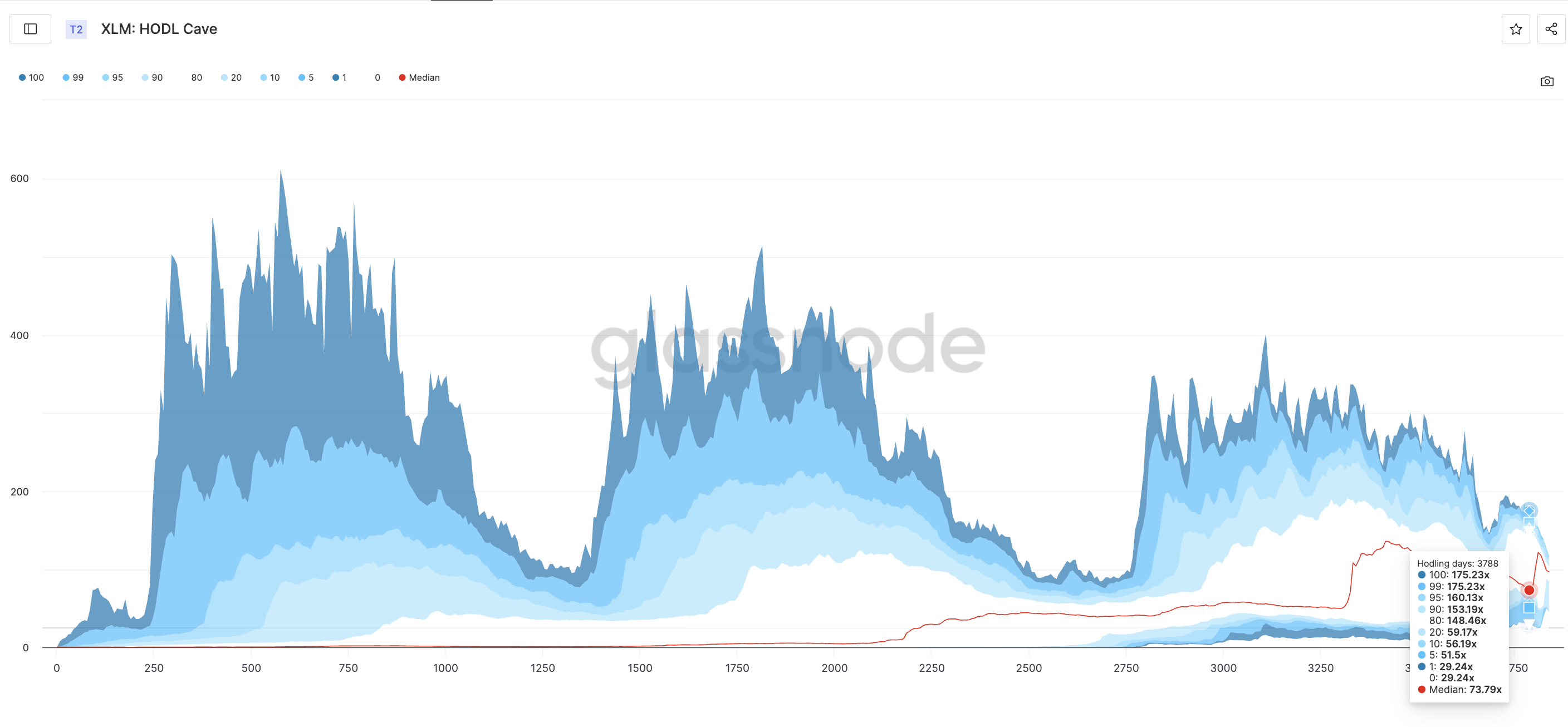

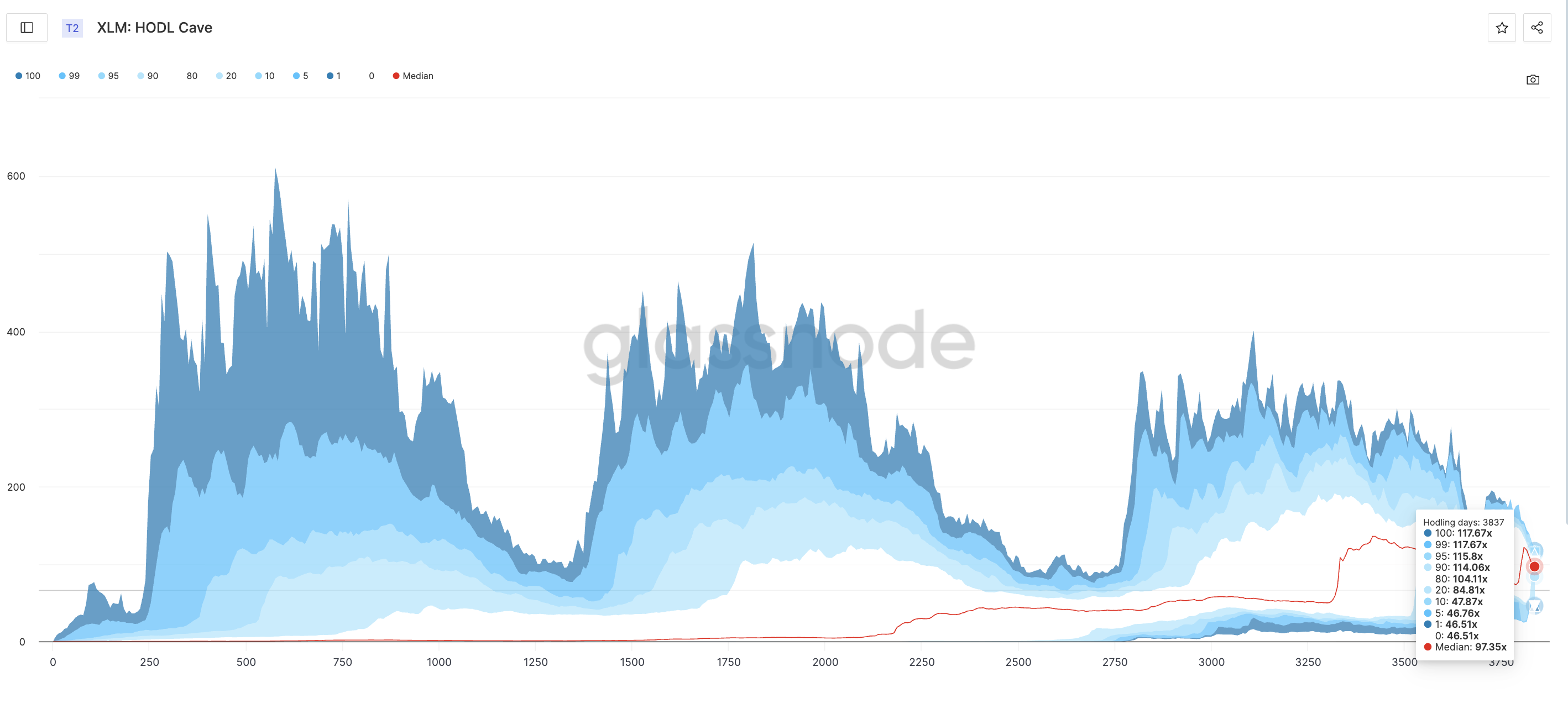

The HODL Cave metric maps the distribution of historic returns for XLM holders throughout totally different percentiles on the present time limit (day 3,837).

For instance, a a hundredth percentile worth of 117.67x signifies that in all historic holding durations for that period, the best-performing one delivered a minimum of 117.67x good points.

Between holding day 3,788 and three,837, XLM’s median historic return (fiftieth percentile) climbed from 73.79x to 97.35x — an indication that the everyday return throughout all holding durations has improved. However this improve hides a rotation:

- The best percentile bands — 100, 99, 95, 90, and even 80 — have fallen sharply. This indicators that the easiest historic returns for long-term holders are actually decrease, per profit-taking from older cash.

- The bottom percentile bands — 0, 1, 10, 20 — have risen strongly (e.g., twentieth percentile from 59.17x to 84.81x). This means that even the weakest historic returns for shorter holding durations are bettering.

This sample suggests older, high-return cash are being offered into the market, however newer consumers are stepping in and reaching stronger short-term revenue multiples. In different phrases, long-term holders are distributing, whereas recent entrants are selectively accumulating throughout weak spot.

When paired with spot and futures knowledge, the image remains to be blended. Spot volumes and OBV stay delicate, whereas futures positioning has failed to point out sustained build-up. Each these metrics present that momentum consumers aren’t but again in drive. Nevertheless, the advance in decrease percentile bands inside the HODL Cave signifies that a minimum of a part of the market is quietly positioning.

Key XLM Value Ranges Present Rangebound Motion

The XLM value at the moment trades close to $0.42, which is inside two key zones. Shedding $0.40 (key assist) might set off a slide towards $0.38 and $0.36. On the upside, reclaiming $0.46 (key resistance) would deliver $0.48 into view, and a push by way of that stage might arrange a retest of the $0.52 native excessive.

Nevertheless, for the previous few buying and selling classes, the XLM value has been transferring inside this support-resistance zone, hinting at indecision.

For now, the charts say the bottom is delicate. However the HODL Cave metric hints that quick and mid-term consumers could also be quietly positioning for the following leg. All the bullish development fades if the XLM value loses $0.36, as that might open doorways to new swing lows.

The publish XLM Value Faces Deeper Pullback, However One Cohort Might Be Silently Shopping for the Dip appeared first on BeInCrypto.