Uniswap (UNI) value has surged roughly 15% within the final 24 hours, fueled by robust bullish momentum. The RSI has climbed to 67, indicating UNI is approaching overbought territory however nonetheless has room for additional features earlier than a possible correction.

If the uptrend continues, UNI might take a look at resistance at $13.3 and $14.8, with a possible push to $17, however a reversal might see it retest helps at $12 or drop to $8.59.

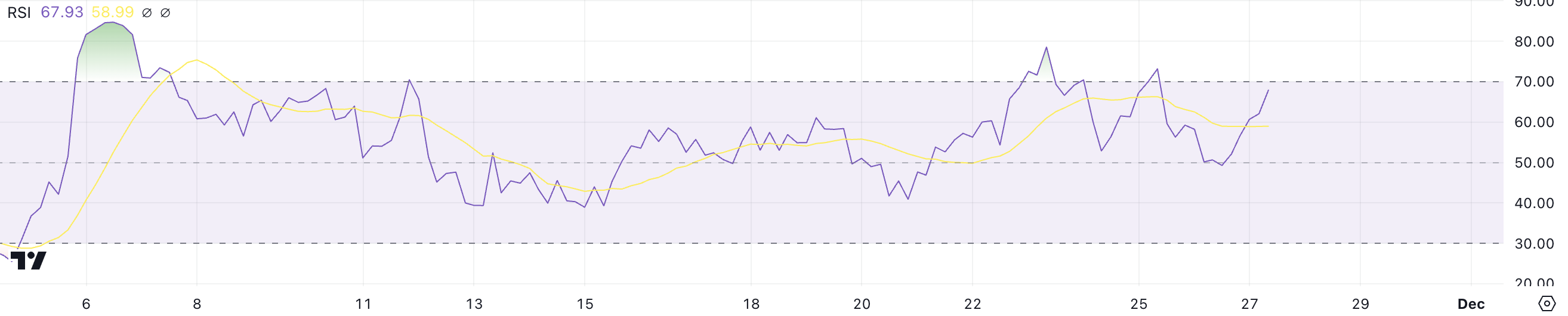

UNI RSI Isn’t Overbought But

Uniswap RSI surged from 50 to 67 in simply in the future, reflecting a robust improve in bullish momentum. The RSI, or Relative Power Index, measures the pace and magnitude of value actions on a scale of 0 to 100.

Values above 70 point out overbought situations and a possible for a correction, whereas values under 30 recommend oversold situations and doable restoration. The present RSI of 67 suggests UNI is approaching overbought territory however nonetheless has room for additional features.

Given the current momentum, UNI value might proceed climbing till the RSI surpasses 70, signaling stronger bullish sentiment within the quick time period.

Traditionally, cash usually expertise corrections after getting into overbought zones. Nonetheless, with the RSI not but there, the surge might have extra room to run, because it occurred originally of November.

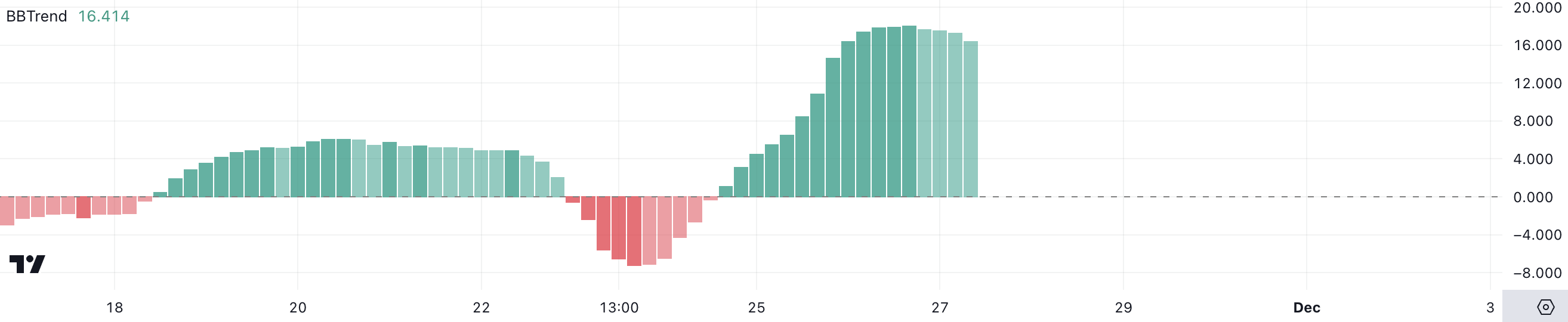

Uniswap BBTrend Is Very Constructive

UNI BBTrend is at present at 16.5, remaining optimistic since November 24 after briefly turning adverse between November 23 and November 24. The BBTrend, or Bollinger Bands Pattern, measures the energy and route of value actions relative to the Bollinger Bands.

Constructive values point out upward momentum, whereas adverse values mirror downward strain. The optimistic BBTrend indicators that Uniswap is at present in a bullish section.

Though UNI’s BBTrend remains to be excessive at 16.5, it has declined barely from 18 yesterday, suggesting a slight weakening of bullish momentum.

This drop signifies that whereas the uptrend is undamaged, the energy of the present rally will not be as robust as earlier than. If the BBTrend continues to say no, it might sign an upcoming consolidation or correction in UNI’s value.

UNI Value Prediction: Can It Attain $17 In November?

If Uniswap value robust uptrend continues, the value is prone to take a look at resistances at $13.3 and $14.8 within the close to time period. Breaking by these ranges might push UNI value as excessive as $17, marking its highest value since March and representing a possible 36% achieve.

Nonetheless, if the uptrend reverses, UNI value might face a retest of key helps at $12 and $10.4. Ought to these ranges fail to carry, the value may drop additional to $8.59, marking a considerable 31% correction.

Disclaimer

According to the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.