Notcoin value has corrected almost 14% previously week and 28% during the last three months. It has failed to affix the broader market rally, and its value motion now sits simply 19.4% above its all-time low.

Heavy promoting close to these ranges is never a bullish sign, however a better look reveals two metrics that might nonetheless affect the result, in the event that they align in Notcoin’s favor.

Trade Inflows Present Panic Promoting Regardless of Whale Buys

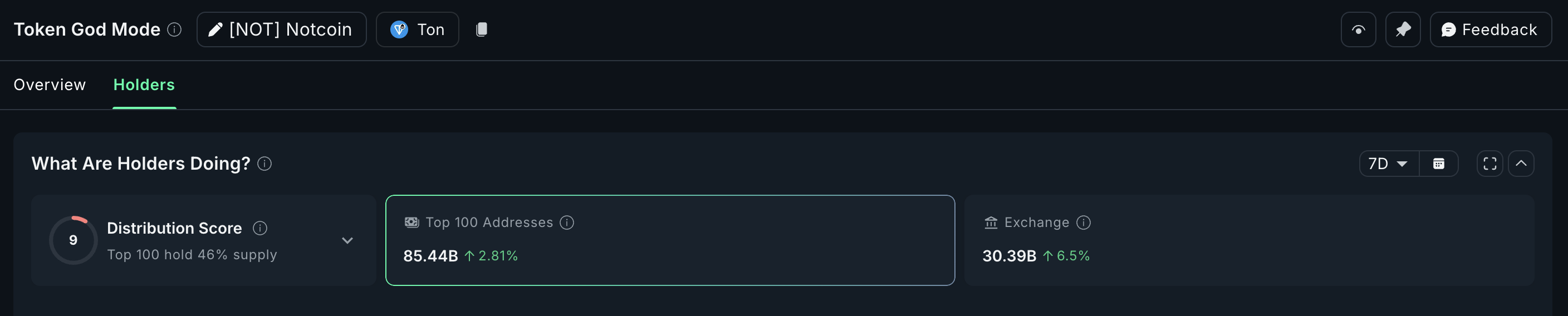

Over the previous seven days, trade inflows have risen 6.5%, pushing complete trade balances to 30.39 billion NOT. It is a clear signal of retail-driven promoting stress, particularly with the Notcoin value hovering near an all-time low.

Curiously, the highest 100 addresses have been web patrons throughout this era. If these massive holders maintain accumulating whereas trade inflows sluggish and finally flip to outflows, market sentiment might start to shift.

However for now, promoting stress close to the lows stays the dominant pressure, leaving bulls on the defensive. On the day by day timeframe, bearish energy can also be rising, signaling that sellers are nonetheless dictating momentum.

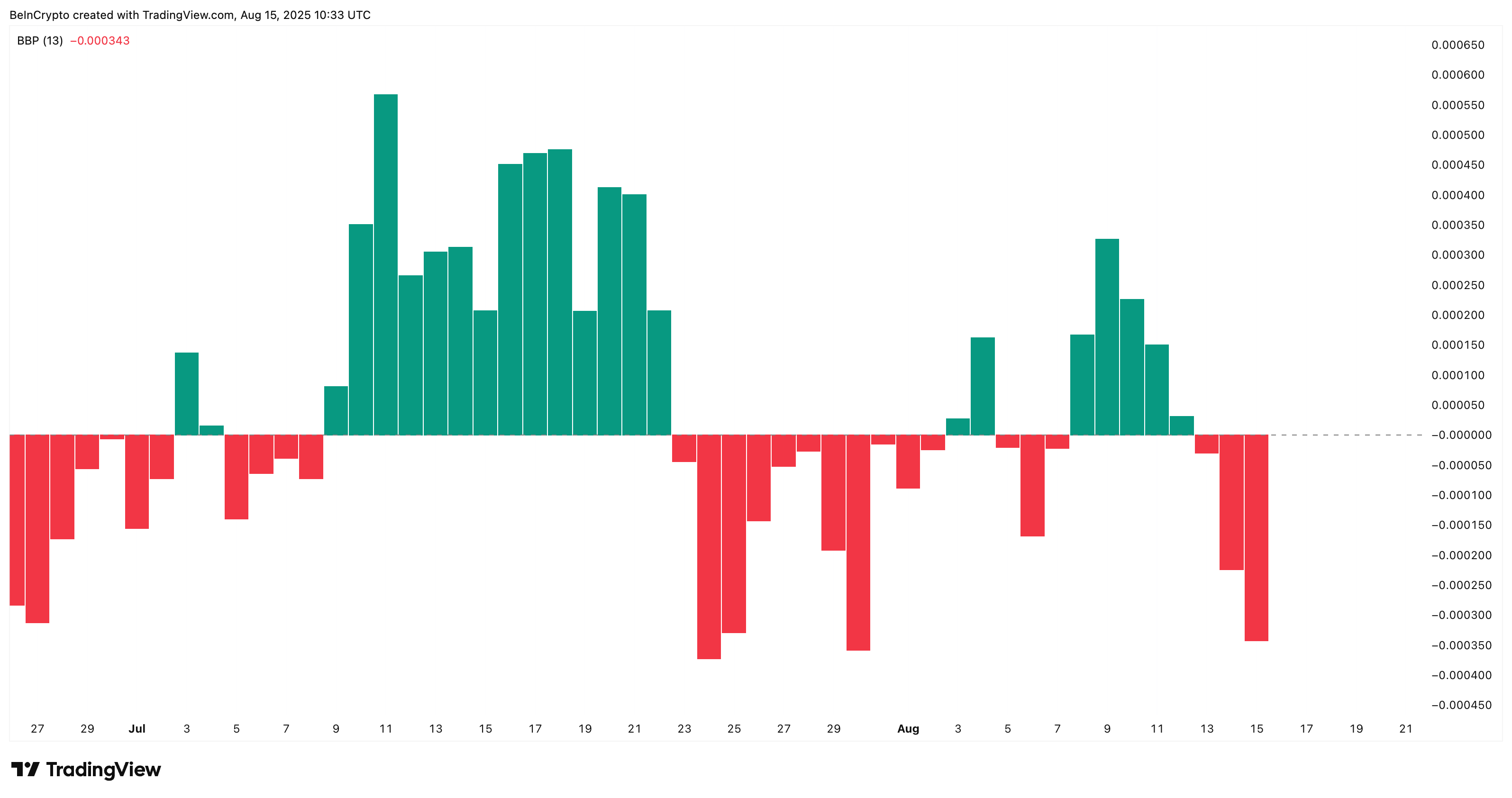

The Bull-Bear Energy Indicator is a technical evaluation instrument used to measure shopping for and promoting stress out there.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

Dying Crossover Threat Looms

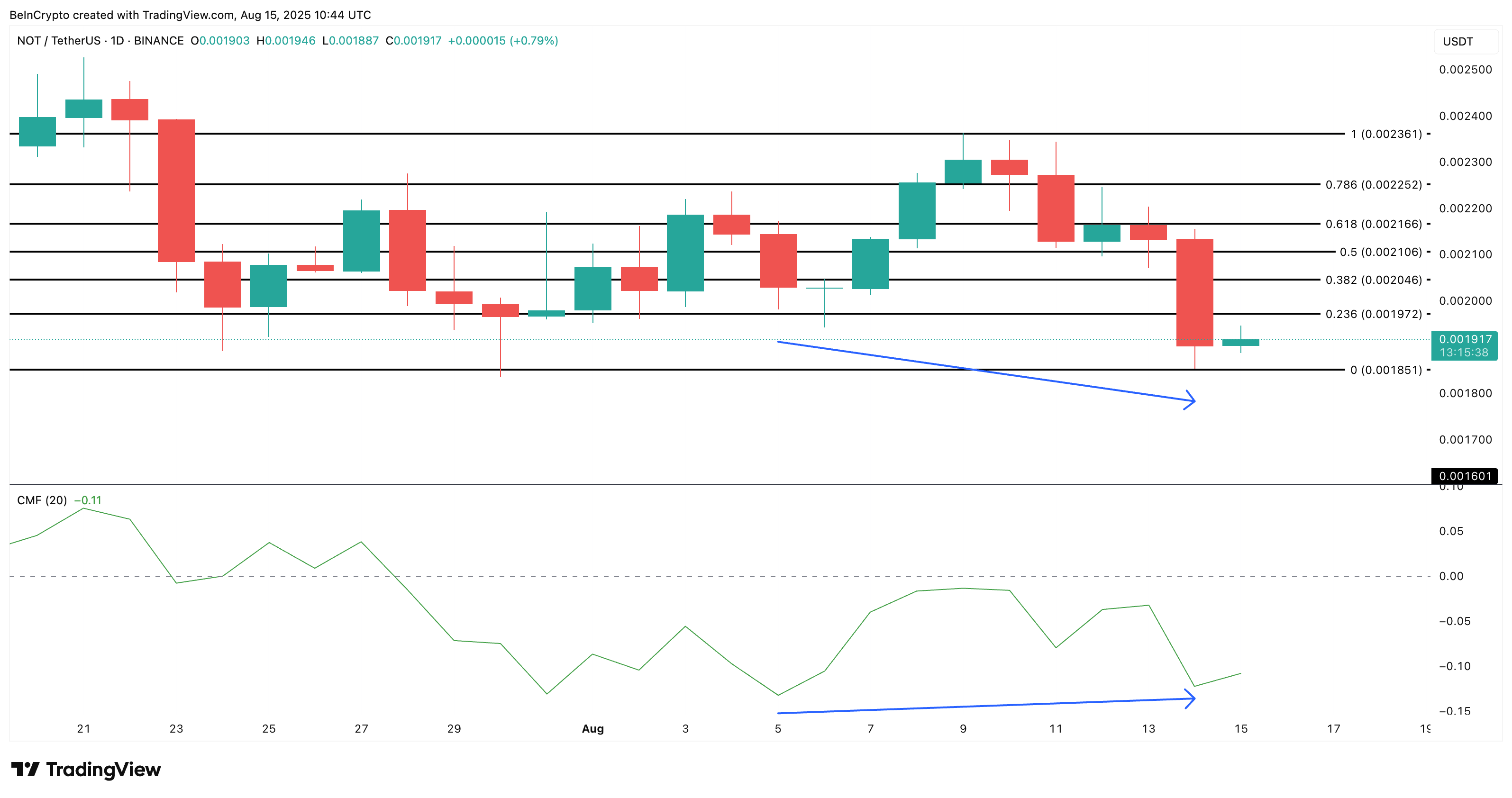

Notcoin’s technical setup is flashing a significant crimson flag. On the 4-hour chart, a number of dying crossovers have shaped in latest classes, every marking sharp value drops. The following one is looming — the 100-period EMA or Exponential Transferring Common (sky blue line) is closing in on a cross under the 200-period EMA (deep blue line).

If this crossover confirms whereas trade inflows stay excessive, it might speed up the trail towards retesting $0.0018 or setting a contemporary all-time low. This chart construction echoes the identical bearish momentum seen earlier than earlier declines, reinforcing the short-term threat.

An Exponential Transferring Common (EMA) tracks value developments however offers extra weight to latest information. A crossover occurs when a short-period EMA crosses a long-period EMA. It indicators a attainable development change.

One Bullish Divergence Left Standing On The Notcoin Value Chart

The one constructive signal on the chart comes from the Chaikin Cash Stream (CMF). Whereas value made a decrease low between August 5 and August 14, CMF printed a better low — an early signal that promoting stress could also be easing.

Nonetheless, CMF stays in detrimental territory, that means the market remains to be below web promoting stress. For this divergence to matter, CMF would want to interrupt above zero, backed by a visual enhance in high 100 deal with accumulation and a swap to web trade outflows.

The Chaikin Cash Stream (CMF) measures shopping for and promoting stress utilizing value and quantity. A CMF above zero exhibits shopping for energy, whereas under zero exhibits promoting stress.

If that alignment occurs, a bounce towards $0.0019–$0.0020 turns into attainable. However till then, a break under $0.0018 stays the extra seemingly final result, maintaining the chance of a brand new all-time low very a lot alive. And if that occurs, the Notcoin value may find yourself re-testing the all-time low of $0.0016 or head decrease.

The publish Notcoin Bears in Management — Two Metrics Recommend It’s “NOT” In Free Fall But appeared first on BeInCrypto.