Bitcoin’s worth has just lately skilled a drop from its all-time excessive (ATH), signaling a possible shift in market circumstances. This decline, whereas seemingly typical, could sign underlying considerations about future volatility.

Historic cues counsel {that a} volatility explosion could possibly be on the horizon, prompting key holders to show impartial.

Bitcoin is Going through The Calm Earlier than The Storm

The Bitcoin DVOL index, which tracks the volatility of the asset, is at traditionally low ranges. Solely 2.6% of days have skilled decrease values, indicating excessive complacency out there. This implies that traders should not hedging in opposition to potential downturns, which might result in vital worth actions if unexpected occasions set off volatility.

DVOL measures anticipated worth fluctuations over the approaching month, and the present low ranges point out a relaxed outlook from merchants. Nevertheless, this calm could possibly be fleeting, as volatility shocks usually observe intervals of complacency. If an sudden market occasion happens, Bitcoin might see fast worth swings, probably catching traders off guard.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

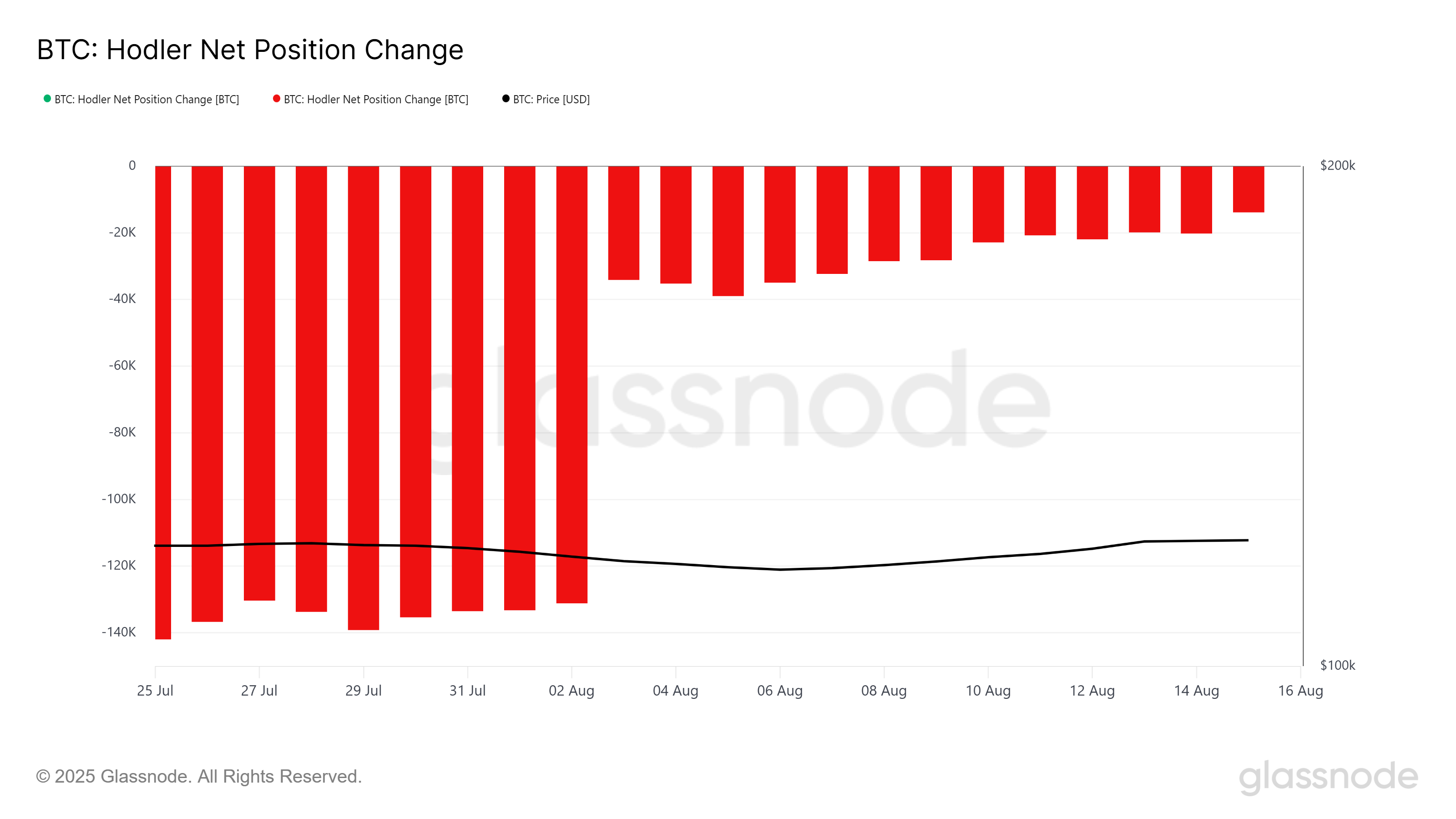

The general macro momentum of Bitcoin exhibits a marked shift in investor habits. The HODLer Web place change has slowed, signaling decreased exercise from long-term holders (LTHs). Though LTHs had begun accumulating at first of the month, this shopping for pattern paused, doubtless as a result of prevailing uncertainty out there.

Regardless of the dearth of latest shopping for exercise, the absence of promoting suggests a level of optimism amongst these holders. They look like ready for a clearer market route earlier than making their subsequent transfer. This implies that LTHs are cautious however anticipate that any volatility spike might finally result in a worth improve, protecting their positions intact for now.

BTC Value Can Maintain Its Help

Bitcoin’s worth had proven an upward pattern all through the month, however this momentum faltered within the final 24 hours, with BTC falling to $117,305. This decline occurred as the value slipped under the established uptrend line, signaling a shift in market sentiment.

If traders preserve their positions throughout the anticipated volatility surge, Bitcoin might stabilize above $117,000. This is able to open the door for a possible push towards $120,000, turning it into assist and permitting additional upside motion.

Nevertheless, if investor sentiment turns bearish and promoting will increase in response to volatility, Bitcoin might face a big drop. On this case, the value could fall by way of the $115,000 assist stage, probably reaching as little as $112,526. This is able to wipe out the features seen in August, invalidating the bullish outlook.

The submit Historic Bitcoin Indicator Indicators Large Volatility Spike – The place is BTC Value Headed? appeared first on BeInCrypto.