Though the week closed with a modest web outflow throughout all funds, BlackRock continued to strengthen its Ethereum place.

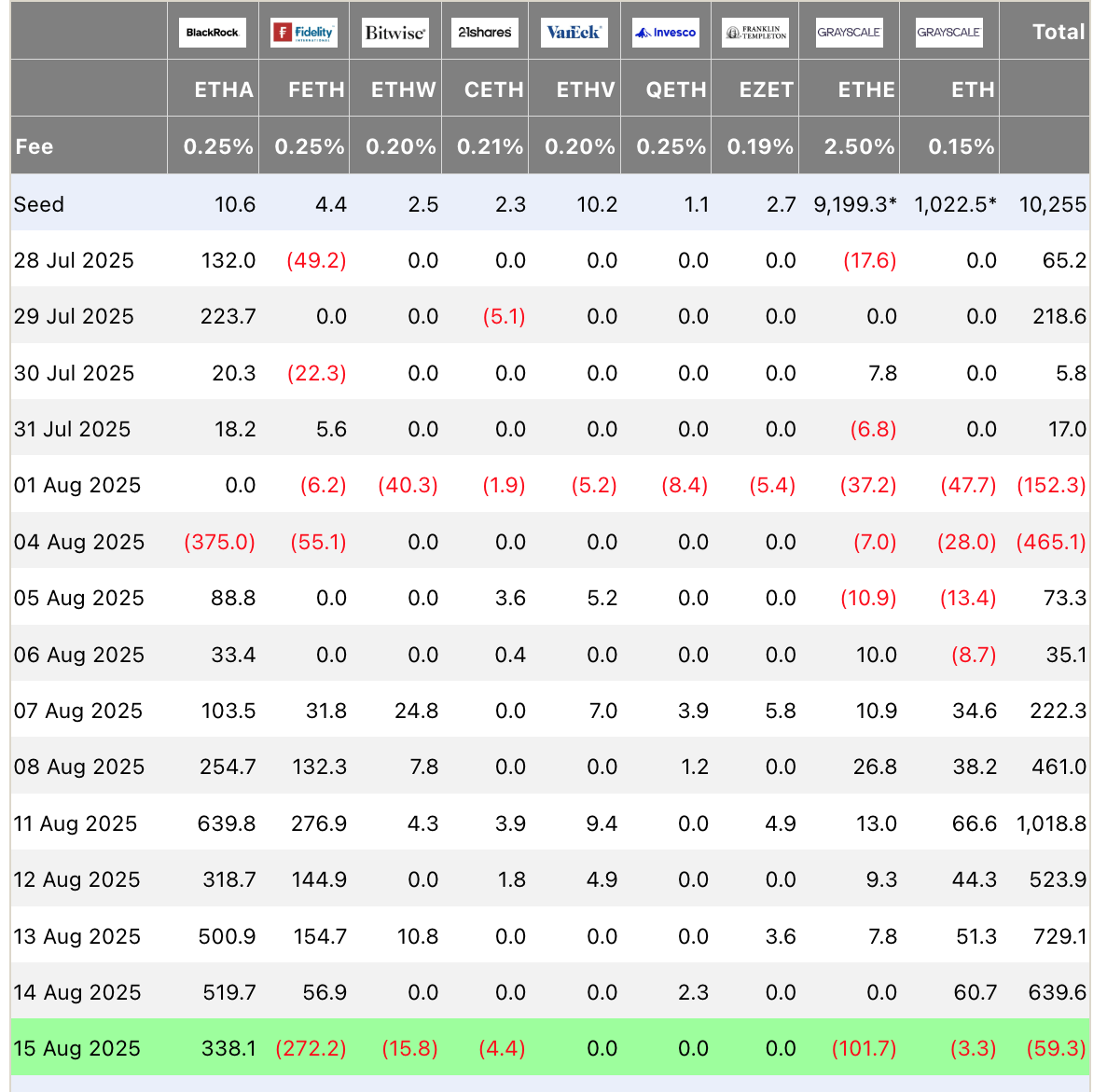

In response to information from Farside Buyers, BlackRock’s iShares Ethereum ETF has been main the cost, with a $519 million influx on August 14. Whereas the week ended with a slight web outflow of $59 million throughout all funds, BlackRock continued its accumulation, including one other $338 million on August 15.

By the tip of July, the asset supervisor had already collected $11.4 billion value of Ethereum in only a matter of weeks, underscoring its conviction in ETH regardless of prevailing volatility within the broader crypto market.

Ethereum ETFs are experiencing unprecedented demand, with inflows and buying and selling exercise reaching record-breaking ranges. This week alone, web inflows totaled $2.85 billion, whereas buying and selling quantity surged previous $17 billion.

Monday marked a milestone for the asset, as spot Ethereum ETFs recorded their largest single-day web inflows ever, amounting to $1.01 billion. Over the primary two weeks of August, inflows exceeded $3 billion, making it the second-best month on document for Ethereum ETFs. BlackRock’s iShares Ethereum ETF has led this surge, attracting $519 million in new inflows on August 14 alone.

Ethereum itself has remained firmly within the highlight, supported by robust institutional demand and regulatory developments.

On Thursday, the world’s second-largest cryptocurrency by market capitalization climbed 0.7% to hover above $4,700 per token, edging nearer to its all-time excessive of $4,891.70 set in 2021.

The Securities and Alternate Fee’s current “Undertaking Crypto” initiative, which goals to modernize the company and set up clear digital asset laws, has additionally fueled optimism round ETH’s long-term adoption.

Market sentiment briefly wavered earlier this week after a serious Ethereum ICO-era whale executed a brand new spherical of profit-taking, triggering issues about elevated promote stress.

Nevertheless, these fears have since eased as demand from ETFs and company patrons seems to be absorbing the promoting exercise. Regardless of this bullish backdrop, some merchants stay involved that Ethereum has but to interrupt decisively above its 2021 peak, with the value nonetheless about 3% shy of the $5,000 psychological milestone.

Including to the momentum, Commonplace Chartered has considerably raised its Ethereum value targets, citing rising institutional participation and disclosed plans for company reserve accumulation.

The financial institution now tasks ETH to achieve $7,500 by the tip of 2025, up from its prior forecast of $4,000. Its long-term outlook has additionally been revised upward, with a brand new 2028 year-end goal of $25,000 in comparison with $7,500 beforehand.

Company accumulation plans might show to be a serious catalyst, with mixed targets throughout a number of firms totaling $30.4 billion in ETH. Bitmine is anticipated to guide these efforts with an allocation of $22 billion, representing almost 5% of the whole ETH provide.