Bitcoin rose as excessive as $124,533 on Aug. 14 earlier than taking a success following July’s hotter-than-expected wholesale inflation information.

The July shopper worth index was broadly consistent with market expectations, although the core studying that excludes meals and power edged increased to three.1%, barely over Wall Avenue estimates. Nevertheless, the July producer worth index, which measures wholesale gadgets, confirmed a shock sturdy 0.9% month-to-month acquire, probably the most in practically three years.

Across the time of writing, BTC was buying and selling down 0.77% within the final 24 hours to $117,741, following Friday’s drop to a low of $116,859.

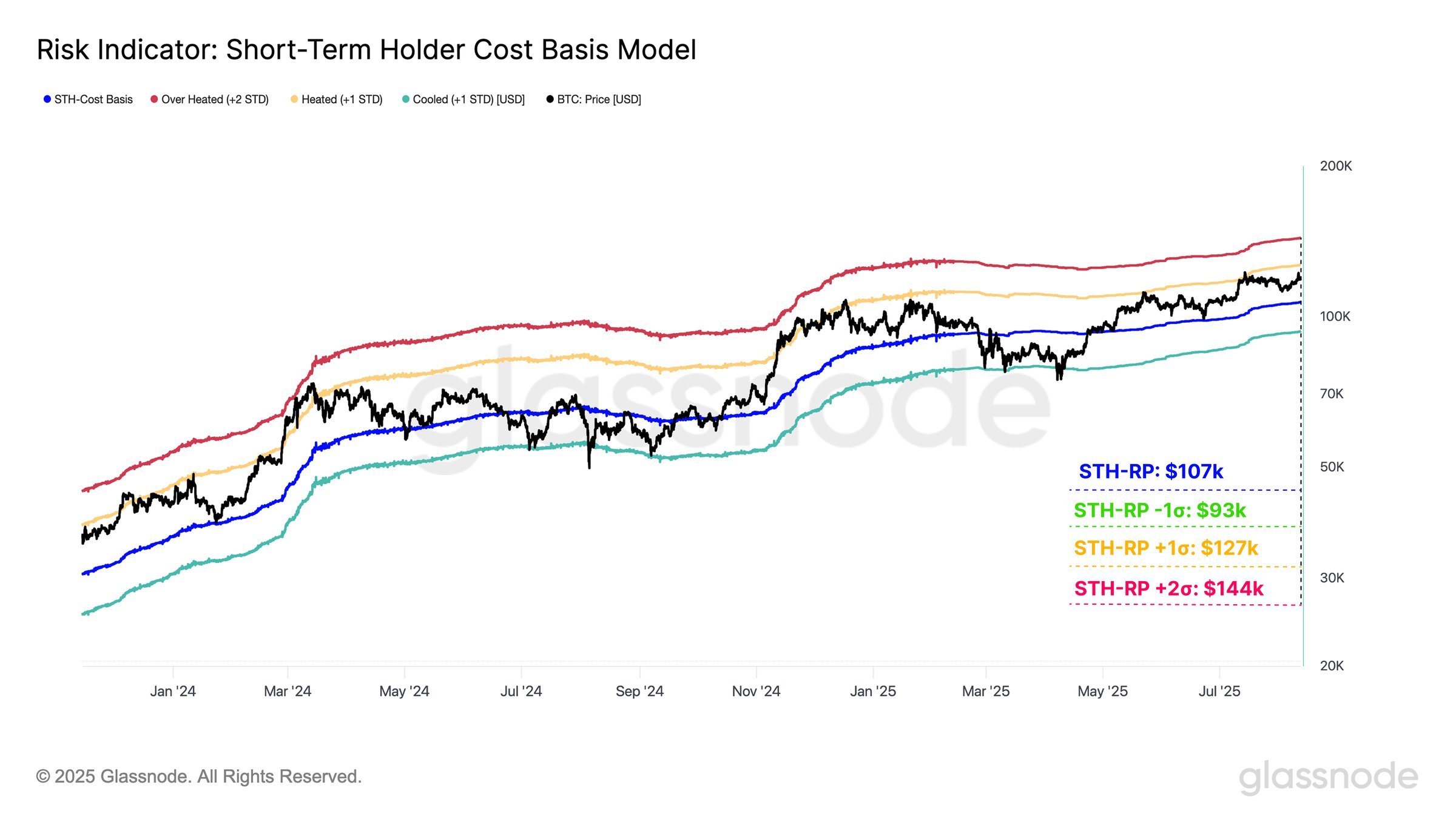

On what comes subsequent, BTC’s common entry worth for newer buyers and its normal deviation bands can assist to determine overheated zones.

In line with Glassnode information, the short-term holder realized worth (STH RP) for Bitcoin (BTC) presently sits at $107,000, which represents the common on-chain acquisition worth of Bitcoin (BTC).

The STH RP +1σ degree is at $127,000, and it’s a main key resistance for Bitcoin to surmount, with a breakout opening the trail to $144,000, which coincides with the short-term holder realized worth +2σ, a degree the place prior market tops noticed elevated promoting strain. Brief-term holder realized worth normal deviation bands +1σ and +2σ coincide with heated and overheated zones, respectively.

Bitcoin has not but reached these ranges, suggesting that the present rally may nonetheless have room to run.

Fed alerts carefully watched

Federal Reserve President Austan Goolsbee spoke on Friday about blended inflation numbers, with the continued instability displaying doubts for decreased charges.

The Fed’s annual assembly of the world’s central bankers in Jackson Gap, Wyoming, from Aug. 21-23, has traditionally been used for the Fed to sign coverage shifts and can be watched carefully by buyers subsequent week.

Markets anticipate the FOMC to vote to lower the benchmark federal funds charge by 1 / 4 proportion level in September, from 4.25% to 4.50%. Nevertheless, there are issues about what occurs subsequent, with 55% odds of one other lower in October and solely a 43% likelihood of a 3rd transfer in December.