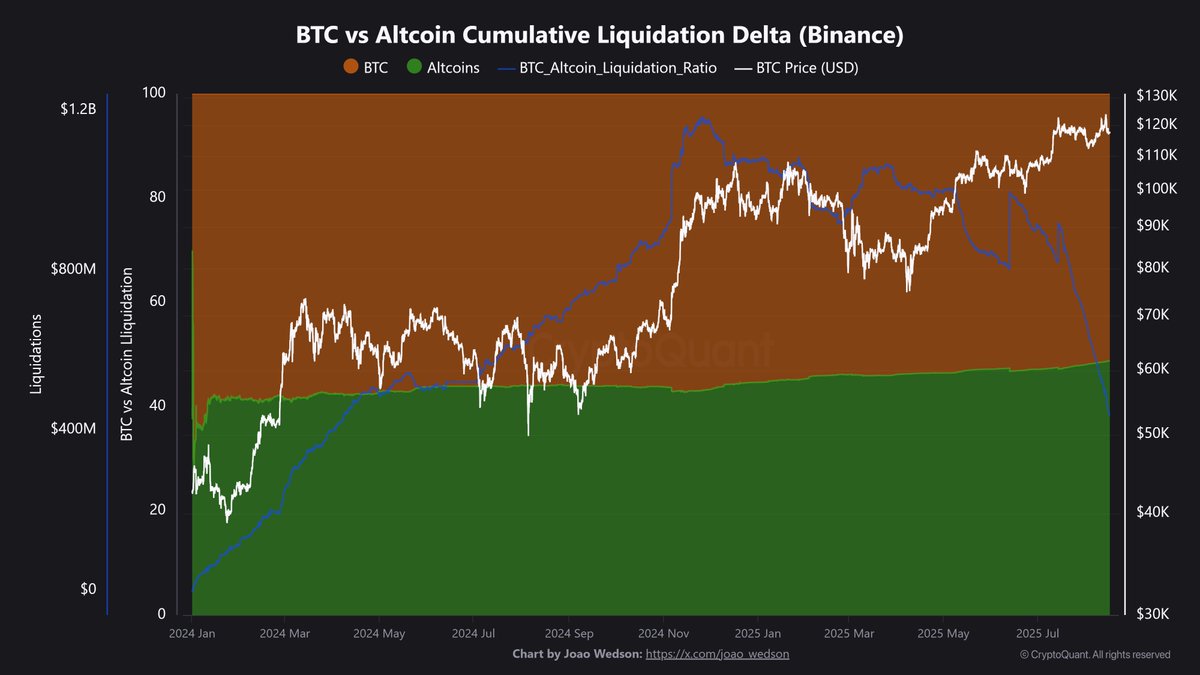

Altcoins have formally surpassed Bitcoin in cumulative liquidations on Binance, signaling a dramatic shift in speculative curiosity throughout crypto markets.

In accordance with market strategist Joao Wedson, information from 2025 exhibits merchants are taking over extra threat in altcoins than in Bitcoin – a reversal of the 2024 pattern.

From Bitcoin-led to Altcoin-driven

In 2024, Bitcoin dominated liquidations, with positions far outpacing all altcoins mixed. However since January 2025, the tables have turned. Cumulative altcoin liquidations started rising steeply, steadily eroding Bitcoin’s lead. By July, the stability flipped as altcoins recorded a surge in each lengthy and quick liquidations, pushing the BTC vs. Altcoin Cumulative Liquidation Delta on Binance to new lows.

Wedson emphasised that July marked the inflection level, with altcoins not simply catching up however overtaking Bitcoin in liquidation exercise for the primary time.

An indication of dealer urge for food

This surge displays a deeper shift in sentiment. Merchants at the moment are speculating extra aggressively on altcoins than on Bitcoin, chasing greater volatility and potential upside. Binance, given its liquidity depth and big person base, offers a transparent vantage level for monitoring this sentiment shift.

“The extra merchants get liquidated, the clearer the message — demand and buying and selling exercise for altcoins are accelerating, surpassing BTC in speculative curiosity,” Wedson famous.

Implications for the following cycle

Traditionally, heightened altcoin liquidation exercise has coincided with the early phases of altcoin seasons. These are durations when capital rotates out of Bitcoin and into altcoins, usually resulting in explosive value rallies in smaller-cap tokens.

The present spike in altcoin liquidations could due to this fact be a sign that the market is getting into one other speculative rotation part. With Bitcoin dominance holding above 59% however starting to flatten, analysts recommend that altcoin volatility might develop into the defining driver of the following quarter.