- The professionals and cons of treasuries

- Ethereum ETFs hit information

Ethereum co-founder Vitalik Buterin lately shared his perspective on the function of treasury firms within the ecosystem, highlighting each their potential advantages and dangers.

In an interview with the Bankless podcast, Buterin jokingly referred to the U.S. authorities as his favourite “treasury firm,” noting his appreciation for the occasions when authorities confiscated stolen Ethereum.

The professionals and cons of treasuries

Ethereum treasuries contain firms allocating a part of their company reserves to Ether (ETH), giving buyers oblique publicity to the cryptocurrency.

Buterin acknowledged the advantages of this follow, saying treasury corporations present another car for folks to entry ETH. “Having completely different automobiles for folks to have entry to ETH… can also be good,” he defined, including that larger choices finally strengthen Ethereum’s ecosystem.

On the identical time, Buterin cautioned towards the dangers of over-leverage. “For those who woke me up three years from now and informed me that the Treasury has led to the downfall of ETH, then… my guess for why would principally be that one way or the other they flip into an over-leveraged recreation,” he warned.

Regardless of the priority, he expressed confidence in Ethereum’s group and institutional contributors, describing them as “accountable folks” unlikely to permit treasuries to destabilize the community.

Ethereum ETFs hit information

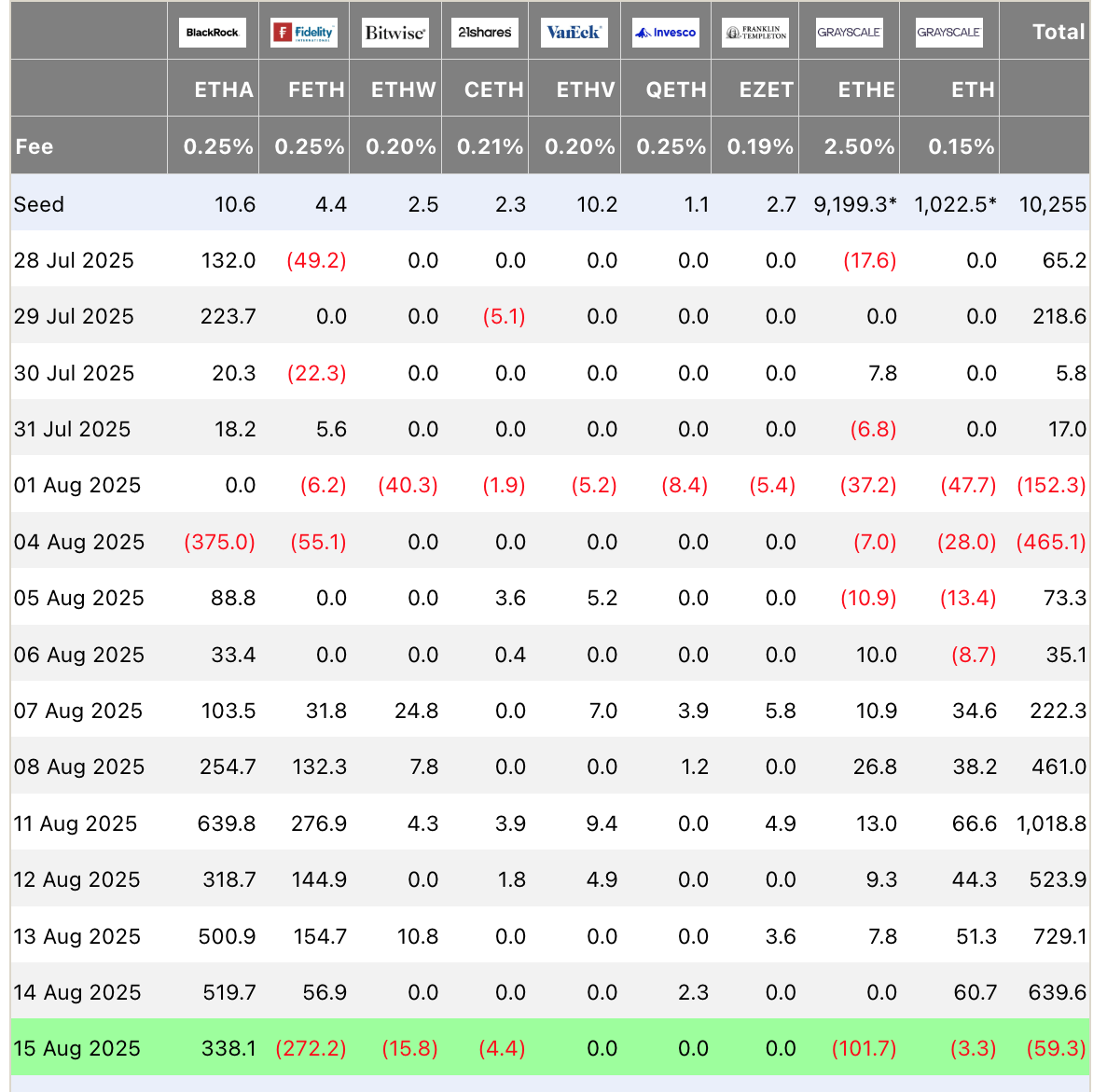

In the meantime, Ethereum ETFs are seeing unprecedented demand. This week alone, internet inflows hit a document $2.85 billion, with buying and selling quantity surging previous $17 billion.

On Monday, spot Ethereum ETFs recorded their largest single-day internet inflows ever, totaling $1.01 billion. Over the primary two weeks of August, they’ve seen greater than $3 billion in inflows, making this their second-best month on document.

BlackRock’s iShares Ethereum ETF has been main the cost, with a $519 million influx on August 14. Whereas the week ended with a slight internet outflow of $59 million throughout all funds, BlackRock continued its accumulation, including one other $338 million on August 15.

On the finish of July, the asset supervisor had already amassed $11.4 billion price of Ethereum inside just some weeks, demonstrating its sturdy conviction in ETH regardless of market volatility.