Be part of Our Telegram channel to remain updated on breaking information protection

Japan-based Bitcoin treasury agency Metaplanet has introduced one other $93 million BTC purchase because the crypto market chief trades within the $115K vary after a 24-hour pullback.

The Bitcoin worth slid 2% up to now 24 hours commerce at $115,593.74 as of 12:50 a.m. EST, knowledge from CoinMarketCap reveals. The lower nudged BTC’s weekly efficiency deeper into the pink zone, with the crypto now down round 5% up to now seven days.

Bitcoin worth chart (Supply: CoinMarketCap)

Bitcoin maxi and Technique Government Chairman Michael Saylor has additionally hinted that his agency will announce one other BTC buy later right this moment.

Metaplanet And Technique Proceed Bitcoin Accumulation

Metaplanet CEO Simon Gerovich took to X right this moment to announce his firm’s newest Bitcoin purchase of 775 BTC.

Metaplanet has acquired 775 BTC for ~$93 million at ~$120,006 per bitcoin and has achieved BTC Yield of 480.2% YTD 2025. As of 8/18/2025, we maintain 18,888 $BTC acquired for ~$1.94 billion at ~$102,653 per bitcoin. $MTPLF pic.twitter.com/9r1law8jyH

— Simon Gerovich (@gerovich) August 18, 2025

In response to Gerovich, the BTC was acquired at a mean buy worth of $120,006 per Bitcoin. The agency now holds a complete of 18,888 BTC that was acquired for $1.94 billion at $102,653 per Bitcoin, the CEO added. The corporate has additionally achieved a year-to-date (YTD) acquire of 480.2% with its BTC holdings.

Technique might quickly announce a Bitcoin purchase later right this moment as properly.

That’s after Saylor posted a screenshot of the Saylor Tracker chart on X yesterday. Up to now, posts like these have at all times been adopted by an announcement of one other Bitcoin purchase.

Inadequate Orange pic.twitter.com/QcRT0RTzEg

— Michael Saylor (@saylor) August 17, 2025

If Technique does announce one other BTC purchase right this moment, it will likely be the second consecutive week that the agency has bought the crypto. The newest acquisition was introduced on Aug. 11, and noticed the corporate purchase 155 BTC for $18 million at a mean worth of $116,401.

Each Metaplanet and Technique are among the many largest company Bitcoin holders globally.

Technique, which began its aggressive accumulation of the crypto market chief again in 2020, is at the moment the most important Bitcoin holder with its holdings of 628,946 BTC, in keeping with knowledge from Bitcointreasuries.

That ranks is way above the subsequent greatest Bitcoin holder, MARA holdings, with its BTC stockpile standing at 50,639 cash.

Saylor Tracker knowledge reveals that Technique is sitting on an unrealized revenue of over $26.62 billion, which is round a 57% acquire on its BTC place. General, the corporate’s holdings equate to over $72.73 billion at present costs.

Technique Bitcoin holdings (Supply: Saylor Tracker)

In the meantime, Metaplanet, with its current buy, is the seventh largest BTC treasury firm globally. Additionally it is the largest company Bitcoin holder in Asia.

With the most recent buy, the agency is now inside putting distance of overtaking Riot Platforms, who has 19,239 BTC on its stability sheet, because the sixth largest Bitcoin holder on the earth.

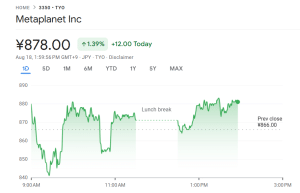

Metaplanet’s inventory worth jumped over 1% following the most recent BTC purchase.

Metaplanet worth chart (Supply: Google Finance)

The acquire within the early hours of right this moment’s buying and selling session marked a slight reversal from the longer-term destructive development the corporate’s inventory worth has been in.

Within the final week, Metaplanet shares slid over 15%, pushing the inventory’s loss within the final month to greater than 34% as properly.

That’s even after the corporate posted sturdy earnings through the second quarter in its newest quarterly report final week, with whole income reaching 1.2 billion yen ($8.4 million) – a 41% quarter-on-quarter acquire.

Metaplanet additionally posted a internet revenue of 11.1 billion yen ($75.1 million), in comparison with a 5 billion yen (34.2 million) loss within the first quarter. The corporate additionally expects this stellar efficiency to proceed.

“We proceed to venture full-year income of three.4 billion yen and working revenue of two.5 billion yen, supported by recurring cash-secured-put premiums and operational efficiency,” Metaplanet stated in its report.

Regardless of the drop in share worth over the previous month, the corporate’s shares stay over 44% up on the the 6-month timeframe with a YTD acquire exceeding 144%.

Metaplanet To Take On Japan’s Bond Market With Bitcoin-Backed Yield Curve

Metaplanet’s Bitcoin buy announcement right this moment follows the corporate’s Bitcoin-backed yield curve and a most popular share program the agency unveiled final week.

The goal behind these initiatives is to make BTC a reputable type of collateral in Japan’s capital markets, whereas concurrently difficult the dominance of conventional mounted earnings merchandise.

With the Bitcoin-backed yield curve, the corporate would create a pricing framework for BTC-collateralized credit score. This might then open the door for institutional buyers to realize publicity to Bitcoin whereas additionally locking in predictable yields.

In the meantime, the “Metaplanet Prefs” program will see the corporate situation BTC-backed devices throughout a number of credit score profiles and timelines in an effort to additional weaponize the agency’s Bitcoin treasury.

Metaplanet’s head of Bitcoin technique Dylan LeClair stated in an X publish that the initiatives are the subsequent step within the firm’s mission to “digitally rework Japan’s capital markets” and put together for “hyperbitcoinization.”

Metaplanet Releases Q2 Earnings:

– Publicizes ‘Metaplanet Prefs’ to scale Bitcoin treasury operations

– Publicizes intent to construct a Bitcoin-Backed Yield Curve in Japanese Mounted Earnings capital market.Full 84 Web page Presentation connected under pic.twitter.com/j4uBbld7C5

— Dylan LeClair (@DylanLeClair_) August 13, 2025

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection