- Avalanche’s value pulled again from $25+ to round $23.6, however on-chain information reveals power with every day transactions leaping from 500K to over 1.3M in only a month.

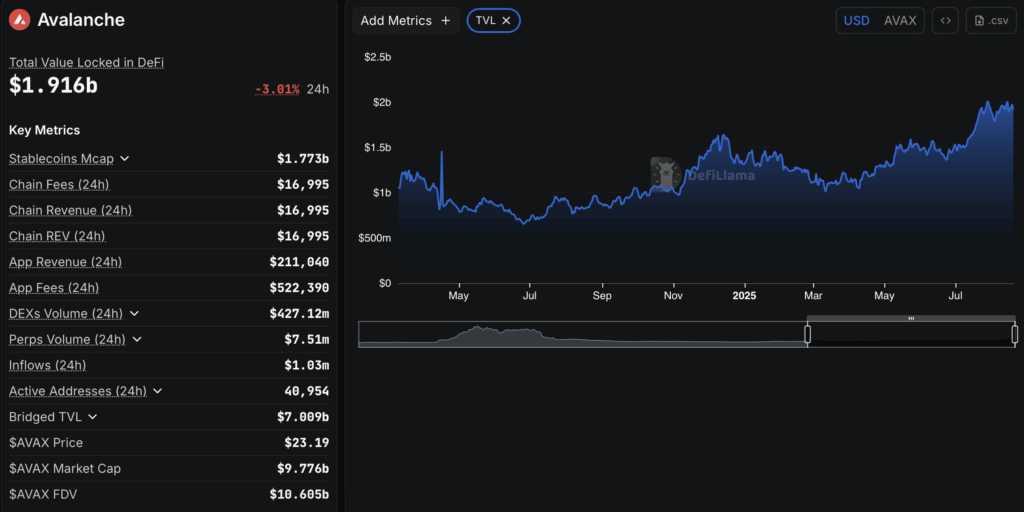

- Stablecoin progress, DeFi traction, and rising TVL spotlight sturdy fundamentals, at the same time as market-wide corrections weigh on AVAX’s short-term momentum.

- Avalanche is pushing deeper into real-world asset tokenization, with $250M in RWAs coming onchain through Grove, Visa settlement offers, and even tokenized whisky bottles from Bowmore.

Avalanche has had an odd week. On one hand, the token slipped from highs above $25, dragged down by a market-wide pullback that left most cash within the crimson. However, its community exercise is surging, flashing a a lot more healthy image beneath the floor.

Worth Below Strain, Market Cools Off

AVAX touched $25.64 on August 18 earlier than retracing to round $23.61, marking a 5% every day drop. The transfer was a part of a broader sell-off—Bitcoin slid beneath $115k whereas Ethereum dipped near $4,200. Briefly, the standard profit-taking wave hit. For Avalanche although, it was extra of a technical cool-down than a collapse, particularly given the information exhibiting sturdy fundamentals constructing beneath.

Transactions Surge Previous 1.3M Day by day

In response to recent numbers from analytics platform Nansen, Avalanche’s every day transactions greater than doubled up to now month. From half 1,000,000 a day to over 1.3 million, most of this spike got here in simply the final two weeks. That form of acceleration factors to rising utility, not simply speculative churn. Stablecoin progress and DeFi traction have been main drivers, serving to Avalanche keep relevance at the same time as costs wobble.

DeFi, Tokenization, and Actual-World Property

DeFiLlama information reveals whole worth locked (TVL) on Avalanche has been steadily recovering from the lows of April 2024. However the true buzz is round real-world asset tokenization. In July, Grove introduced $250 million in RWAs could be coming onchain through Avalanche, adopted by a world stablecoin settlement take care of Visa. Extra lately, Bowmore, certainly one of Scotland’s oldest distilleries, rolled out tokenized whisky bottles on the community—a mixture of custom and cutting-edge tech that highlights Avalanche’s increasing position.

The Larger Image

Worth momentum has cooled, certain, however community fundamentals are urgent ahead. Analysts recommend that if the present tempo of person exercise continues, AVAX may very well be establishing for one more breakout as soon as broader market sentiment steadies. For now, Avalanche appears to be like like a type of tasks quietly stacking long-term wins, even when the charts don’t scream it but.