Bitcoin (BTC) fell to $114,386 earlier at this time, triggering almost $300 million in liquidations over the previous 24 hours as investor confidence within the asset stays shaky. Nonetheless, rising spot buying and selling volumes provide a glimmer of hope that BTC might now be getting into an accumulation section.

Is Bitcoin In The Accumulation Section?

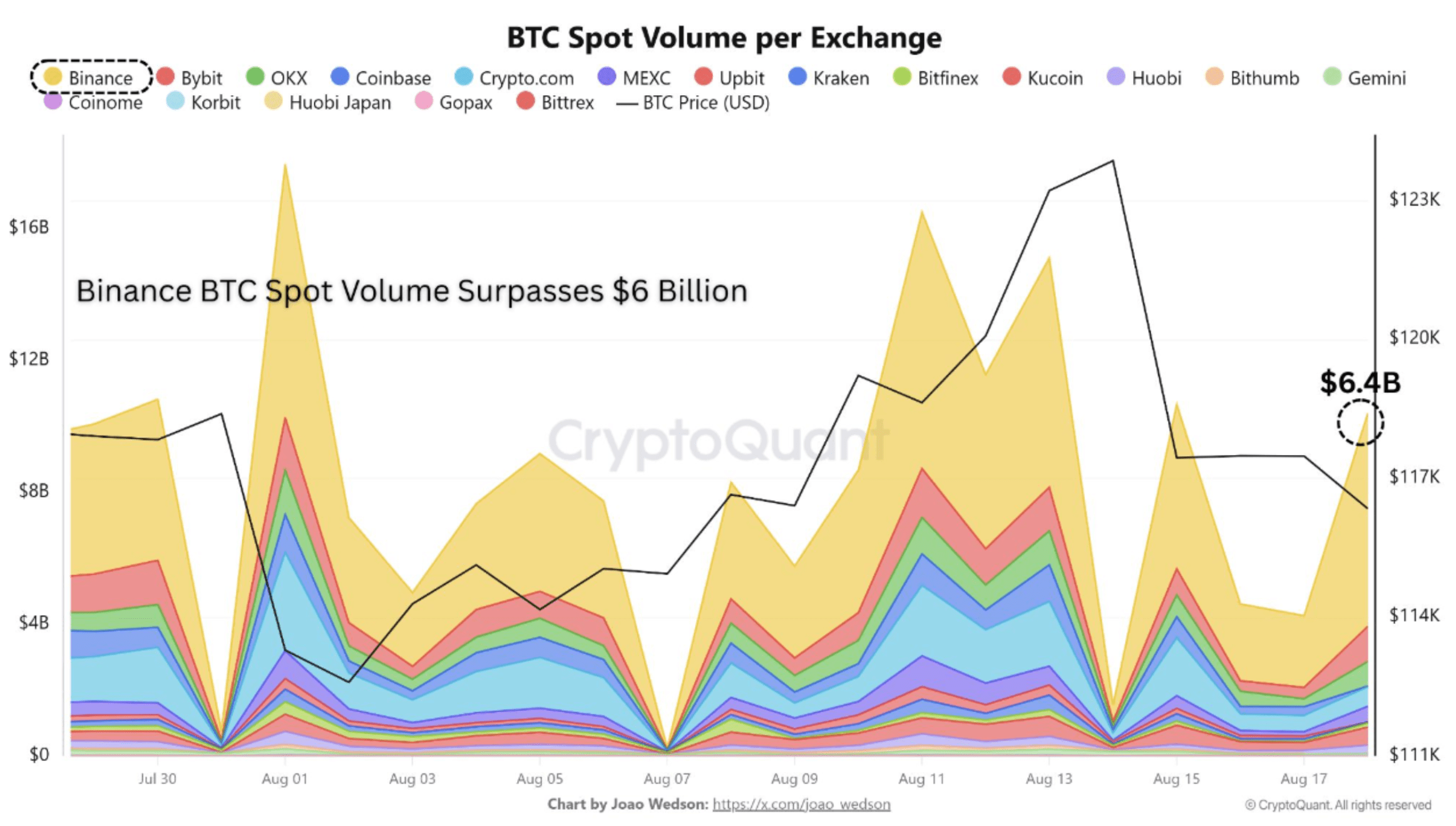

In response to a CryptoQuant Quicktake publish by contributor Amr Taha, Binance’s BTC spot buying and selling quantity surpassed $6 billion on August 18 – some of the vital spikes this month.

Taha famous that such sudden spikes usually sign elevated participation from institutional buyers and huge merchants, together with some retail exercise seeking to capitalize on heightened volatility.

It’s value noting that the surge in Binance spot quantity coincided with BTC’s drop beneath $115,000 – a motion that may function a number one indicator of a possible reversal in value momentum.

Historic information means that sturdy spot shopping for throughout value dips usually displays merchants stepping in to build up BTC at discounted costs. This dynamic can ease promoting stress and lay the inspiration for a rebound if demand persists.

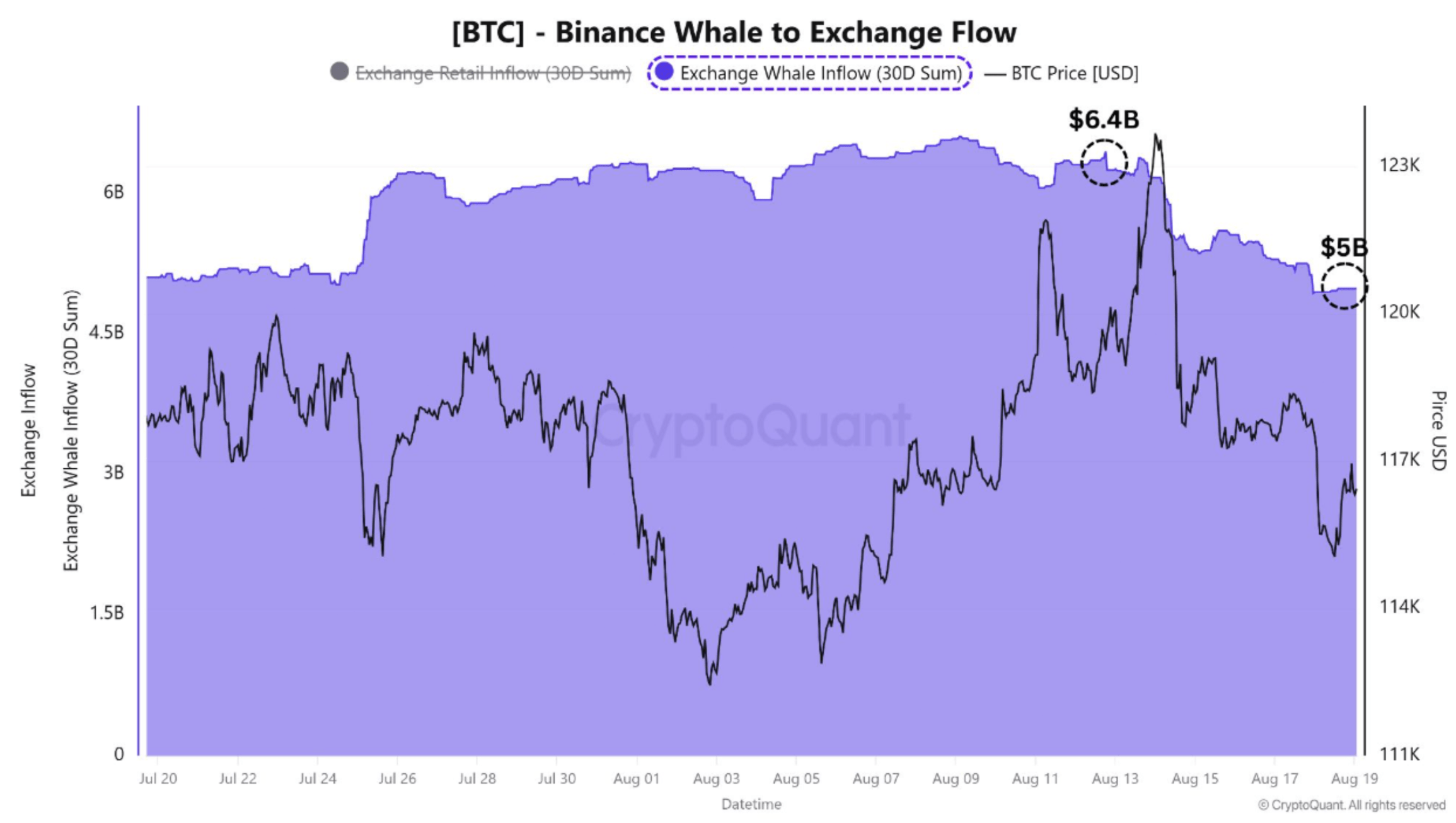

Taha additionally highlighted that the rise in Binance spot quantity occurred alongside a decline within the Binance Whale-to-Alternate Movement, which fell from $6.4 billion to $5 billion – a $1.4 billion drop in whale transfers to Binance over the previous week.

This discount in whale deposits suggests fewer massive holders are sending BTC to exchanges for potential promoting, a development typically thought of bullish. Taha concluded:

Bringing these components collectively – a surge in Binance spot quantity, rising demand throughout a value dip, and a decline in whale deposits – the market is displaying early indicators of stabilization. If accumulation continues at present ranges, Bitcoin has a strong likelihood to recuperate and retest greater resistance ranges within the close to time period.

From a technical perspective, crypto analyst Titan of Crypto famous that BTC remains to be following its weekly trendline. If the development holds, BTC may goal $130,000 within the coming weeks.

Warning Indicators For September

Whereas Taha suggests BTC might presently be in an accumulation section with the potential for a development reversal within the coming months, different analysts stay cautious. Crypto analyst Josh Olszewics warned that BTC should survive a “brutal September” earlier than any significant rebound can happen in This autumn 2025.

Equally, CryptoQuant contributor BorisVest cautioned that the following 1–2 weeks might convey heightened promoting stress for the highest cryptocurrency by market capitalization. At press time, BTC trades at $115,489, down 0.1% over the previous 24 hours.