Ethereum faces $3.9B validator exits as bulls defend $3.9K help, whereas establishments increase ETH holdings.

Ethereum is coming into a decisive buying and selling part as validator exits and institutional inflows form its near-term worth path.

Nilesh Rohilla, a worldwide market researcher, posted on X that validator exits surged from 1,920 ETH a month in the past to 893,599 ETH, value over $3.5 billion. The dimensions of withdrawals has raised considerations amongst market individuals, but worth charts counsel bulls stay centered on defending the $3.9K help zone.

🚨 #Ethereum Validator Exits Explode in 30 Days!

From simply 1,920 ETH within the exit queue a month in the past…

to a record-breaking 893,599 $ETH ($3.5B+) right now.What’s driving this historic surge — and will stakers fear? Let’s break it down 🧵👇 pic.twitter.com/AZkVTH9xbf

— Nilesh Rohilla (@nilesh_rohilla) August 19, 2025

Ethereum Validator Exodus Reaches Document Ranges

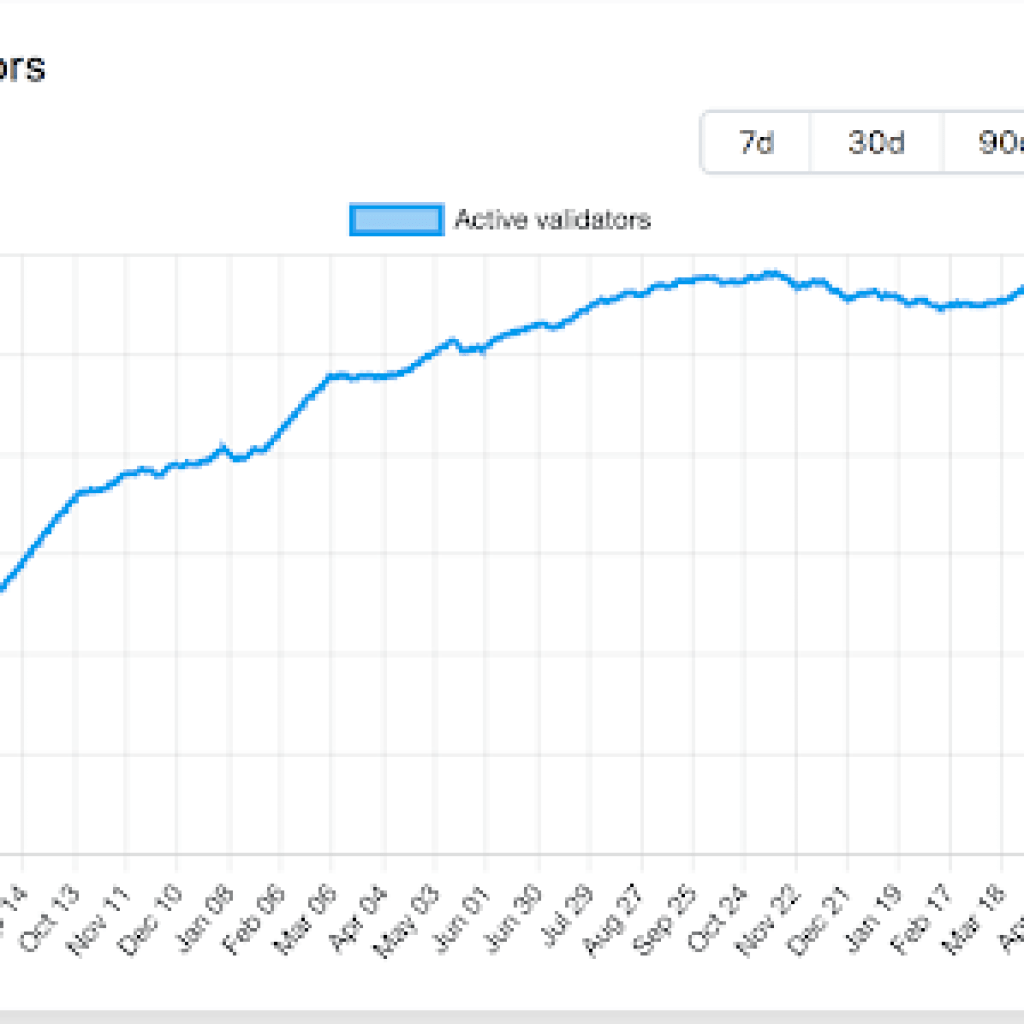

The Ethereum validator exit queue has expanded to an unprecedented degree, with almost 900,000 ETH awaiting withdrawal. The quantity is much larger than seen in earlier months and alerts a rising pattern of validators leaving the community.

Whereas the explanations fluctuate, market watchers level to each profit-taking and regulatory uncertainty as contributing elements. The exits coincide with broader volatility within the cryptocurrency market, the place merchants stay cautious about liquidity actions.

Regardless of the surge in withdrawals, Ethereum’s proof-of-stake community stays practical. Validators proceed to earn rewards, and staking swimming pools are nonetheless energetic, at the same time as some giant entities modify their publicity.

Key Liquidity Zones Round $3.9K and $4.4K

Ether is buying and selling close to $4,195 after reaching its highest weekly shut in over 4 years. Analysts counsel the $3,900 to $4,400 vary is crucial, with robust liquidity zones on each side.

Market information reveals bids stacked under $4,000, forming a cluster of potential help ranges. Kiyotaka, a buying and selling platform, described this space as a “large cluster of resting bids stacked all the way in which all the way down to $3.9K.”

On the upside, the $4,400 degree represents fast resistance, created by worth imbalances from latest strikes. A sustained breakout above this degree may open the trail towards $4,583, organising a attainable rally towards new highs.

Institutional Demand Stays Sturdy Regardless of Exits

On the identical time that validator exits develop, institutional inflows into Ether stay strong. U.S.-listed spot Ether ETFs recorded internet inflows of almost 649,000 ETH final week, the most important weekly complete on document.

SharpLink Gaming, a sports activities betting platform, disclosed that it bought 143,593 ETH value $667 million at near-record costs. In accordance with its SEC submitting, the corporate now holds 740,760 ETH valued at about $3.2 billion, with most deployed in staking.

NEW: SharpLink acquired 143,593 ETH at ~$4,648, bringing complete holdings to 740,760 ETH

Key highlights for the week ending Aug 17, 2025:

→ Raised $537M via ATM and direct choices

→ Added 143,593 ETH at ~$4,648 avg. worth

→ Staking rewards: 1,388 ETH since June 2 launch… pic.twitter.com/GSe6XzSAwW— SharpLink (SBET) (@SharpLinkGaming) August 19, 2025

BitMine additionally expanded its holdings, shopping for 373,000 ETH and boosting its complete to 1.52 million ETH. Board chair Thomas Lee famous that this buy makes BitMine one of many largest Ether treasuries worldwide, second solely to Technique’s Bitcoin holdings.