Ripple’s XRP has shed roughly 10% of its worth prior to now week as sell-offs intensify throughout the broader crypto market.

Whereas the token’s rally to an all-time excessive of $3.66 throughout July’s market growth left many holders in revenue, rising volatility is starting to check investor sentiment. What does this imply for token holders?

XRP Merchants Cling to Beneficial properties Regardless of Losses

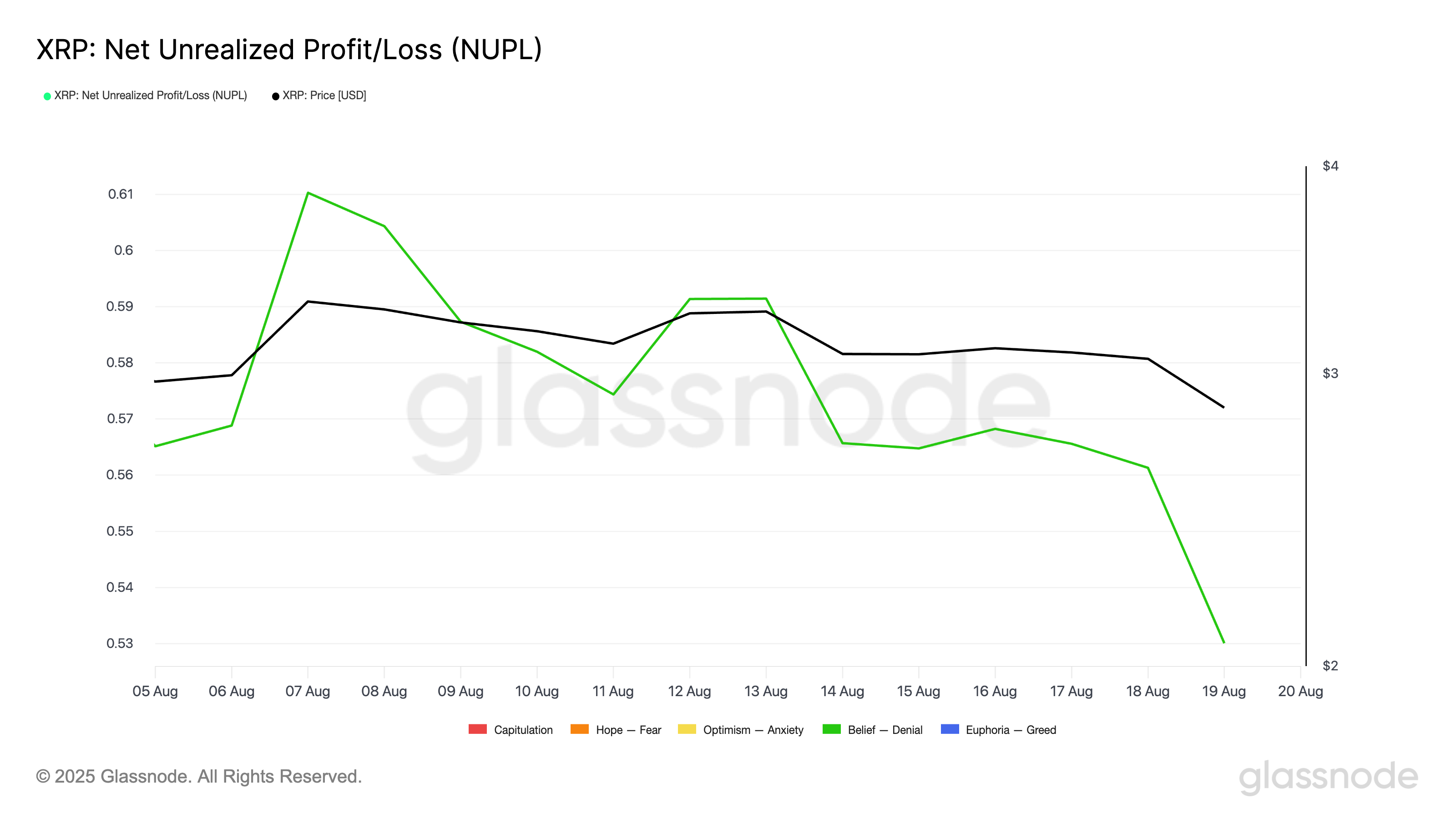

In response to Glassnode, readings from XRP’s Web Unrealized Revenue/Loss (NUPL) metric present that the market is at present within the perception–denial zone, the place buyers maintain on to positive factors regardless of mounting losses.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

The NUPL metric measures the distinction between unrealized income (when holders are nonetheless within the inexperienced) and unrealized losses (when positions are underwater).

Per the on-chain information supplier, the assumption–denial zone displays a transitional section in market sentiment. Within the perception stage, buyers are assured, most positions are worthwhile, and optimism dominates. Within the denial stage, costs start to slide, however holders refuse to acknowledge the downturn, hoping for a rebound.

With XRP’s NUPL on this zone and the token having dropped 11% over the previous week, holders’ confidence is beginning to waver. However, many proceed to cling to hope, denying the potential of a deeper downturn.

XRP Futures Reveal Bullish Bias Regardless of Value Stress

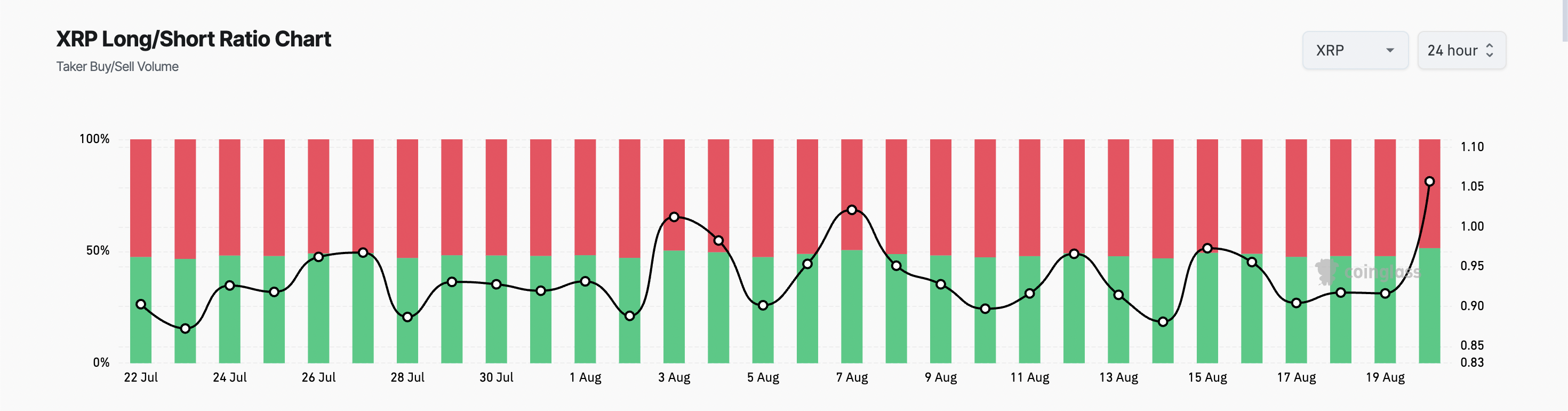

XRP’s rising lengthy/quick ratio highlights the optimism amongst futures market individuals, who proceed to guess on a value rebound regardless of latest losses.

In response to CoinGlass, the ratio at present sits at a 30-day excessive of 1.05, exhibiting that extra merchants take lengthy positions than quick ones.

The lengthy/quick ratio tracks the steadiness between merchants betting on value will increase (longs) versus these betting on declines (shorts). When the ratio is above 1, it signifies that lengthy positions dominate, signaling bullish sentiment; conversely, a ratio beneath 1 means that quick positions are heavier, pointing to bearish expectations.

XRP’s elevated ratio exhibits that merchants stay looking forward to a rebound, at the same time as market volatility and promoting strain proceed to rise.

XRP at a Tipping Level

At press time, XRP trades at $2.887. If bullish bets climb and market sentiment step by step flips optimistic, the token may attain $3.222.

Alternatively, if selloffs persist and bearish strain will increase, XRP may proceed its decline and fall towards $2.637.

The submit XRP Value Drops 11% as Holders Seem Caught Between Hope and Actuality appeared first on BeInCrypto.