Gifto faces backlash following its current transfer to mint and dump GFT tokens into the market. On November 26, Binance introduced that it will delist the GFT/USDT buying and selling pair on December 10, 2024.

The delisting, a part of Binance’s broader resolution to take away eight altcoin spot buying and selling pairs, has already despatched shockwaves by the market.

Gifto’s Controversial GFT Token Dump

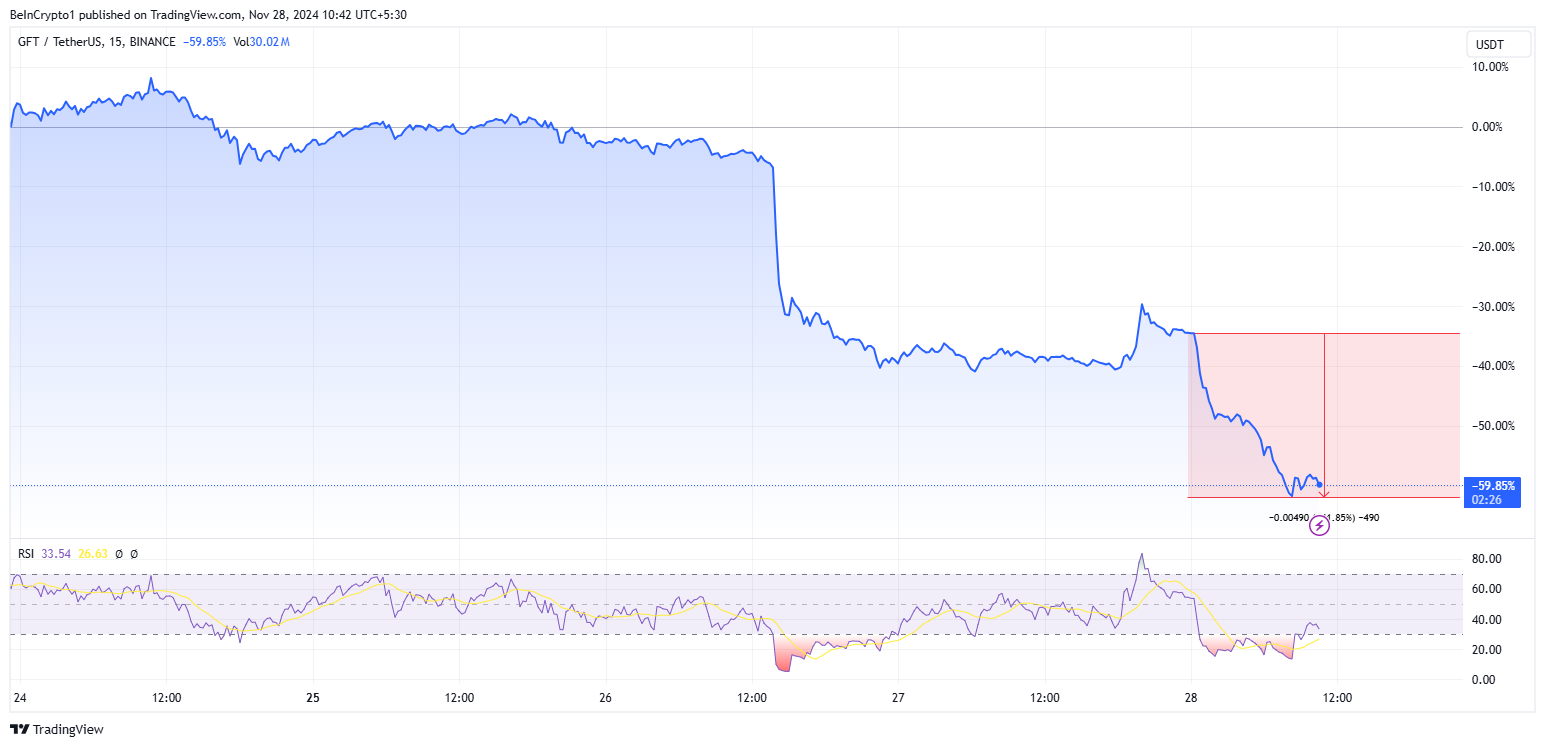

The rapid aftermath of the Binance’s delisting announcement on Tuesday was swift and extreme. In what may solely be ascribed to a pointy decline in investor confidence, the GFT token’s worth dropped by roughly 25%. Expectedly, delistings from main exchanges like Binance usually set off panic promoting as liquidity and accessibility to the asset lower.

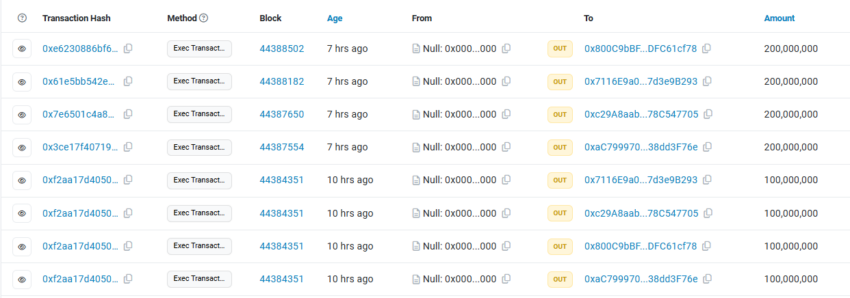

Including gas to the hearth, on Thursday, Web3 knowledge evaluation instrument Lookonchain implicated Gifto in a big token dump. Based on the blockchain analytics agency, the Gifto staff minted 1.2 billion GFT tokens, valued at roughly $8.6 million, inside an eight-hour window. These tokens had been then deposited into exchanges, coinciding with an alarming 40% drop in GFT’s market worth.

“On Nov 26, Binance introduced it will delist GFT on Dec 10, 2024. The Gifto staff minted 1.2 billion GFT ($8.6 million) prior to now 8 hours and deposited it into exchanges. Gifto could have dumped these tokens onto the market, and the worth of GFT has dropped by ~40%,” Lookonchain revealed.

The timing of this mint-and-dump operation has raised eyebrows. Many within the crypto neighborhood understand it as an opportunistic exit technique, additional eroding belief within the token. One person on X (previously Twitter) criticized Gifto’s actions.

“Getting delisted and dumping tokens on holders… basic web2 transfer. That is why we’d like decentralized initiatives that may’t pull the sort of exit bs. Keep on with actual DeFi,” the person famous.

Broader Implications of Binance Delistings

Binance’s resolution to delist GFT and 7 different altcoins displays a rising pattern within the cryptocurrency house. Exchanges repeatedly consider and take away underperforming or problematic tokens. The property set to be delisted alongside Gifto embody IRISnet (IRIS), SelfKey (KEY), OAX (OAX), and Ren (REN).

Delistings usually have profound penalties for affected tokens. Past rapid worth declines, they face decreased liquidity, diminished market confidence, and boundaries to entry for potential buyers. In some circumstances, the token’s long-term viability comes into query because it loses the visibility and buying and selling quantity that exchanges like Binance present.

For Gifto, the mixture of the delisting and the controversial token dump has created an ideal storm. It leaves its neighborhood in disarray. Retail buyers, usually the final to react, discover themselves at a drawback as costs plummet and enormous token holders offload their positions.

The unfolding Gifto saga highlights important vulnerabilities within the crypto ecosystem. Centralized management over token minting and allocation can result in occasions like this. When belief is undermined, retail buyers bear the brunt of poor decision-making.

This episode additionally serves as a cautionary story in regards to the dangers of holding tokens overly depending on centralized exchanges. With the rise of decentralized finance (DeFi) and decentralized exchanges (DEXs), there may be rising momentum towards extra clear and resilient alternate options. For now, GFT holders face an unsure future, with December 10 looming as a important date.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.