Altcoins are displaying recent indicators of life, and VeChain (VET) could also be among the many subsequent to rally, based on dealer Michaël van de Poppe.

In a current evaluation, he argued {that a} mixture of technical setup and elementary development locations VET in a powerful place for a breakout.

Elementary drivers

Regardless of broader market downturns over the previous 12 months, VeChain has continued to strengthen its ecosystem. The challenge lately launched Stargate Staking, providing early individuals yields of as much as 9% APY. Partnerships, together with one with Dana White, are serving to to broaden visibility, whereas the approval of a MiCAR license is opening doorways to onboarding conventional Web2 purchasers. VeChain has additionally shifted its tokenomics to scale back inflation, a transfer anticipated to assist long-term value appreciation.

Technical setup

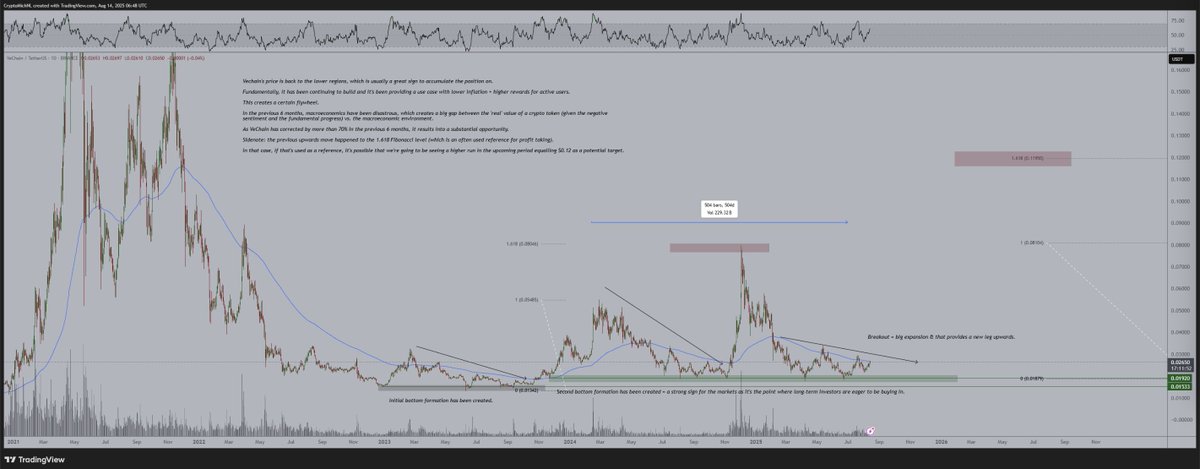

From a technical perspective, van de Poppe highlighted that VET is mirroring earlier consolidation patterns seen in 2023 and 2024. The asset has traded between $0.02 and $0.03 following a crash from its December 2024 excessive close to $0.075. He famous that VET is as soon as once more testing the 200-day EMA, and a profitable flip may mark the transition from downtrend to uptrend. Based mostly on Fibonacci extensions, he tasks a possible run towards $0.12 within the subsequent leg greater.

Lengthy-term outlook

Van de Poppe emphasised that market cycles usually undervalue tasks relative to their elementary progress, creating alternatives for traders. With the mixture of staking incentives, diminished provide inflation, and bullish technical indicators, he expects VeChain’s subsequent rally to surpass its earlier highs.

“Issues are wanting vivid for VeChain,” van de Poppe concluded, including that the challenge’s mixture of fundamentals and technical momentum makes it one to observe within the present altcoin cycle.