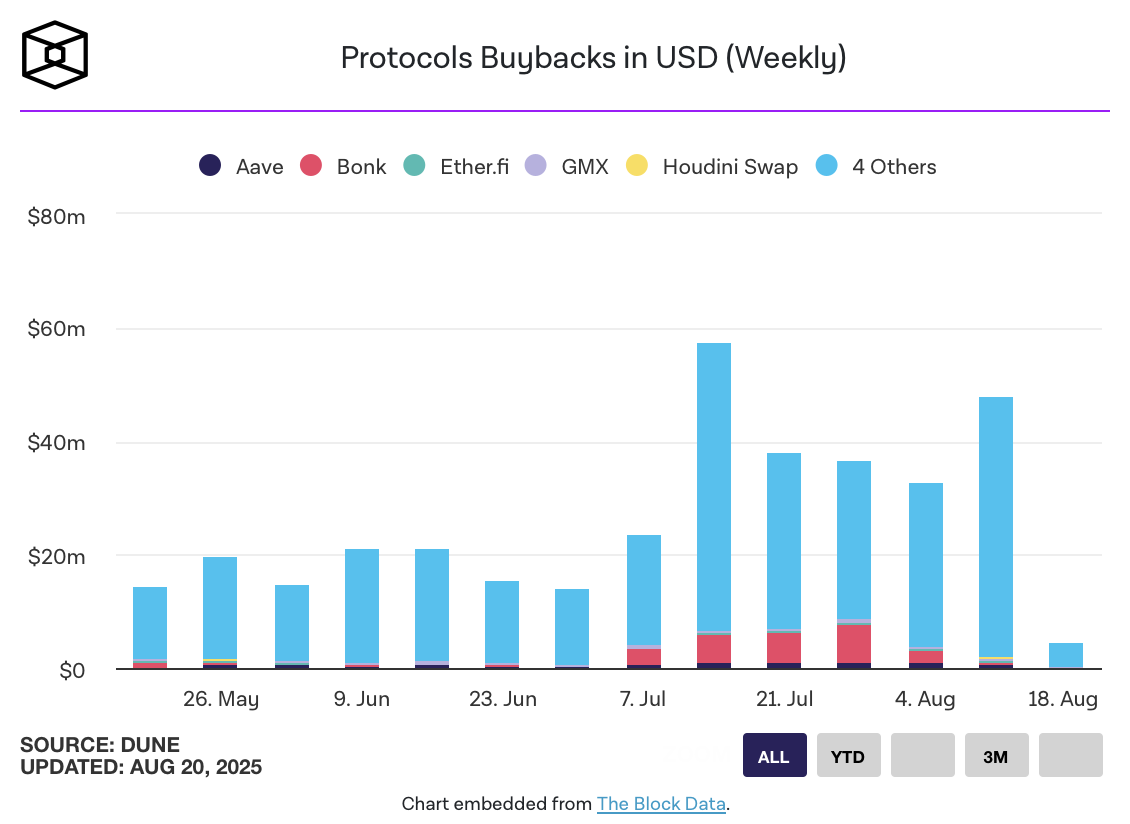

Protocol-led token buybacks have gotten a defining technique in crypto treasury administration, with new information exhibiting practically $40 million in repurchases throughout the previous week.

Platforms are more and more utilizing income or treasury reserves to accumulate their very own tokens from secondary markets, a tactic designed to restrict circulating provide and supply a buffer towards volatility.

The development highlights how buybacks, lengthy related to conventional finance, are being tailored by decentralized protocols as a type of worth stabilization and investor confidence constructing. Analysts notice that these strikes replicate a maturing method to capital allocation, notably for initiatives producing substantial payment revenue.

In response to monitoring information from Dune, Hyperliquid dominated final week’s exercise, accounting for $24 million in repurchases. Meme-focused launchpad Pump adopted with an extra $10 million, underscoring how even community-driven platforms are adopting buyback methods to strengthen token worth.

Weekly charts present that buyback exercise has spiked a number of occasions since early July, with peaks exceeding $50 million on a number of events. A lot of this exercise has come from high-revenue protocols, suggesting that constant payment era is enabling initiatives to recycle capital again into their ecosystems.

Trade observers level out that these repurchases serve a number of functions. Past tightening provide, buybacks can ship a sign of confidence from core groups, probably attracting outdoors buyers throughout unsure market situations. Nonetheless, skeptics warn that buybacks alone can not offset broader macroeconomic pressures or extended downturns in crypto markets.

Nonetheless, the rising scale of those applications suggests they’re turning into a staple within the sector. With buyback totals now frequently surpassing tens of hundreds of thousands every week, protocols are positioning themselves to climate volatility whereas laying the groundwork for long-term token sustainability.