Be a part of Our Telegram channel to remain updated on breaking information protection

Federal Reserve Vice Chair for Supervision Michelle Bowman mentioned Fed workers needs to be allowed to carry small quantities of cryptocurrency to realize firsthand expertise with blockchain know-how.

Talking at a blockchain occasion in Wyoming, Bowman argued that the central financial institution ought to contemplate letting workers personal “minimal quantities of digital property” to realize a greater understanding of the way it works.

She careworn that direct participation is one of the simplest ways to know how possession and transfers operate on the blockchain

“There’s no substitute for experimenting and understanding how that possession and switch course of flows,” Bowman mentioned. “I definitely wouldn’t belief somebody to show me to ski in the event that they’d by no means placed on skis, no matter what number of books and articles they’ve learn, and even wrote, about it.”

She didn’t say what forms of merchandise or what quantities she would counsel the Fed ought to permit.

Fed Employees, Spouses Not Allowed To Personal Crypto

Her feedback come regardless of guidelines launched in 2022, when the Fed banned workers and their spouses from holding crypto or associated merchandise after revelations that three senior officers engaged in controversial buying and selling throughout the early phases of the pandemic.

As a results of these tightened guidelines, Fed workers and their spouses will not be allowed to personal crypto or merchandise which might be linked to digital property, together with crypto ETFs (exchange-traded funds) and shares in digital asset firms.

By easing the restrictions, Bowman additionally believes that it will likely be a lot simpler to recruit and retain “examiners with the required experience.”

Regulators ”Overly Cautious” About New Monetary Merchandise

Bowman added that regulators stay “overly cautious” about adopting new monetary merchandise, however urged her friends to acknowledge the advantages of “embracing know-how within the conventional monetary sector.”

Bankers have grown more and more involved that the know-how will render their legacy methods out of date and negatively influence their present enterprise fashions, particularly given the truth that Bitcoin and its blockchain know-how was invented to chop out middlemen in monetary transactions.

Feedback at present from *Fed Governor* Bowman on banks, regulators, & crypto…

“Change is coming”

“It’s important that banks & regulators are open to participating in new applied sciences and departing from a very cautious mindset”

Learn this.

Shift in the direction of crypto is occurring *quick*. pic.twitter.com/TdL6liBPhc

— Nate Geraci (@NateGeraci) August 20, 2025

Since Donald Trump entered the White Home for a second time period, a number of banks and monetary establishments have turn into extra concerned in digital property below the President’s pro-crypto coverage.

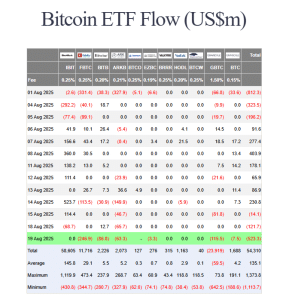

Most notably, asset administration large BlackRock now manages the most important spot Bitcoin and spot Ethereum (ETFs) globally by way of cumulative inflows. Since every of the product’s respective launches, BlackRock’s spot Bitcoin ETF (IBIT) has seen over $58.6 billion in cumulative inflows, whereas the determine for BlackRock’s ETH ETF (ETHA) stands at over $12 billion.

US spot Bitcoin ETF flows (Supply: Farside Buyers)

Bowman mentioned that know-how will inevitably “change the banking system no matter how banks and regulators select to reply.”

Regulators and monetary establishments must select whether or not to embrace the change and assist form a “dependable and sturdy” framework for crypto, or “stand nonetheless and permit new know-how to bypass the normal banking system altogether,” she added.

Bowman acknowledged that dangers include adopting new applied sciences, however mentioned these perceived dangers will be offset by “the doubtless in depth advantages of latest know-how.”

SEC Additionally Altering Its View On Crypto

The Securities and Alternate Fee (SEC) can be embracing crypto. Talking on the similar occasion as Bowman, SEC Chair Paul Atkins advised that solely a small variety of crypto tokens needs to be thought of securities.

That marks a serious pivot from the views of former Chair, Gary Gensler, who opted for a regulation-by-enforcement strategy to regulating the digital asset business and alleged that the “overwhelming majority” of crypto firms have been promoting unregistered securities.

“There are only a few, in my thoughts, tokens which might be securities, however it will depend on what’s the bundle round it and the way that’s being bought,’ Atkins mentioned.

I had a terrific dialog with @TeresaGoody at @SALTConference’s Wyoming Blockchain Symposium at present about my priorities as @SECgov chairman, together with Mission Crypto and making IPOs nice once more. It’s a brand new day on the SEC.

Thread 🧵⬇️ pic.twitter.com/I7UIrjQFpT

— Paul Atkins (@SECPaulSAtkins) August 19, 2025

Atkins’ feedback come as members of Congress plan to go a brand new legislation, referred to as the Digital Asset Market Readability (CLARITY) Act, to determine a crypto market construction subsequent month.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection