Bitcoin has already had an enormous yr – new highs, billions flowing into ETFs, and a crypto market that’s been buzzing nonstop. However the previous week hasn’t been so type. BTC’s worth has slid again beneath $114,000, down greater than 8% from final week’s peak.

Strikes like this aren’t uncommon. Crypto tends to maneuver in bursts, and pullbacks usually flush out the overleveraged earlier than the subsequent leg larger. The query now’s whether or not we see yet another dip earlier than Bitcoin pushes towards a brand new goal – doubtlessly as excessive as $130,000.

That form of rebound would set the stage for Bitcoin-linked altcoins to run even tougher. One which’s getting plenty of consideration is Bitcoin Hyper, a brand new Layer-2 community constructed to carry Solana-like pace and sensible contracts to the Bitcoin blockchain.

Bitcoin’s Worth Slides on ETF Outflows and Greenback Energy

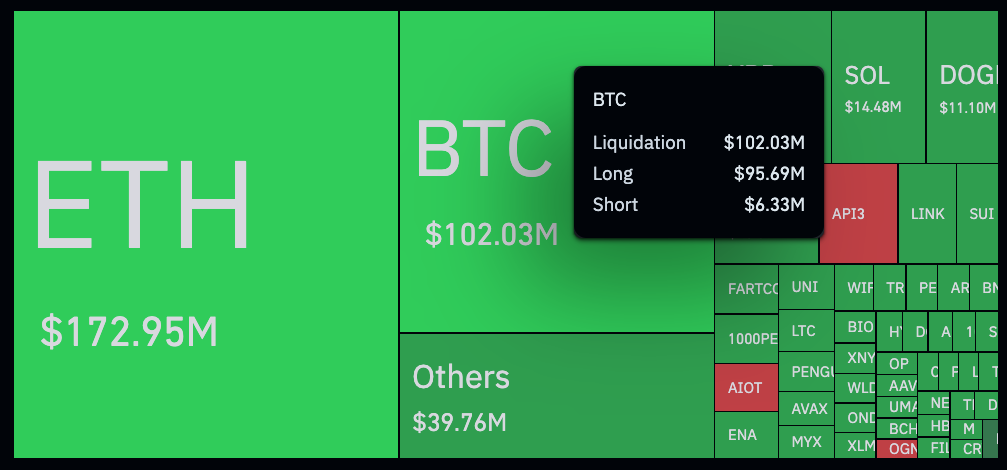

Bitcoin is presently sitting round $113,800, its lowest worth in two weeks after a pullback from Thursday’s all-time excessive. The 4-hour chart has rolled right into a downtrend, open curiosity is scaling down, and almost $100 million in longs acquired liquidated up to now day alone.

The largest headwind is coming from spot ETFs. Yesterday, these ETFs noticed $523 million move out – the most important single-day withdrawal in over a month. Constancy’s FBTC led with almost $247 million in redemptions, whereas Grayscale’s GBTC shed about $115 million.

Plus, the U.S. greenback is wanting robust once more. New tariffs have pushed the DXY up about 3%, and with Bitcoin’s correlation to the greenback sitting at -0.76, it’s not shocking to see weak point right here.

A stronger greenback equals a weaker Bitcoin, at the very least within the quick time period. Long term, although, those self same commerce frictions may enhance Bitcoin’s use case as a hedge towards inflation.

Bitcoin Worth Prediction – Might BTC Attain $130K Quickly?

The charts counsel that Bitcoin may not be completed with its pullback simply but. Its subsequent main help degree sits round $100,000 – a degree the market hasn’t seen since late June. A transfer all the way down to there would shave one other 12% off the present BTC worth.

What makes $100,000 so vital is the sheer quantity of demand ready there. Market depth exhibits a stack of purchase orders clustered round that degree, and when Bitcoin dipped to $100,000 in June, patrons stepped in aggressively and drove a pointy rebound.

If historical past repeats itself, such a rebound may type a head-and-shoulders sample on the day by day chart. This setup usually indicators the potential for a breakout. And will that occur, the subsequent large round-number goal is $130,000, which might symbolize a 30% rally from $100,000 help.

Why Low-Cap Altcoins Like Bitcoin Hyper Might Profit From a BTC Rebound

If Bitcoin does pull again to $100,000 after which rallies, altcoins will nearly actually react. It’s a sample the market’s seen numerous instances: as soon as Bitcoin finds its footing, cash begins spilling into smaller tokens. And proper now, the highlight is on Bitcoin-linked altcoins like Bitcoin Hyper.

Bitcoin Hyper is constructing a Layer-2 community that runs the Solana Digital Machine (SVM) on prime of Bitcoin, which implies larger throughput, decrease charges, and sensible contracts all anchored to BTC’s blockchain. In easy phrases, it’s about making Bitcoin quicker and extra versatile.

Think about utilizing Bitcoin not only for funds however for DeFi protocols, NFT marketplaces, and even crypto gaming apps. That’s the form of enlargement Bitcoin Hyper’s staff is pushing for.

It’s nonetheless early days, however the response has been spectacular. Bitcoin Hyper’s presale has already raised over $10.8 million, with HYPER tokens obtainable for simply $0.012765 every. Specialists at 99Bitcoins have even advised HYPER may 100x after hitting the open market.

On prime of that, staking rewards are nonetheless sitting at 101% per yr, giving early traders loads of incentive to HODL. That helps clarify why greater than 517 million HYPER tokens have been staked already.

By combining Bitcoin’s model power with Solana-like efficiency, Bitcoin Hyper is pitching itself because the “bridge” between Bitcoin’s safety and the programmability traders have lengthy needed. It’s an formidable aim – and it may reshape how individuals consider using Bitcoin.