The Cardano value is up 2.9% prior to now 24 hours, displaying shocking power whereas most high altcoins stay flat. However on the 7-day chart, ADA continues to be down over 12%.

ADA’s short-term chart reveals a robust bullish sample with upside potential. But when we zoom out or test on-chain knowledge, there’s a visual weak point forming beneath the floor. A bullish sample alone isn’t sufficient—particularly when key assist metrics are vanishing. Cardano could also be holding construction, however it’s shedding vital floor.

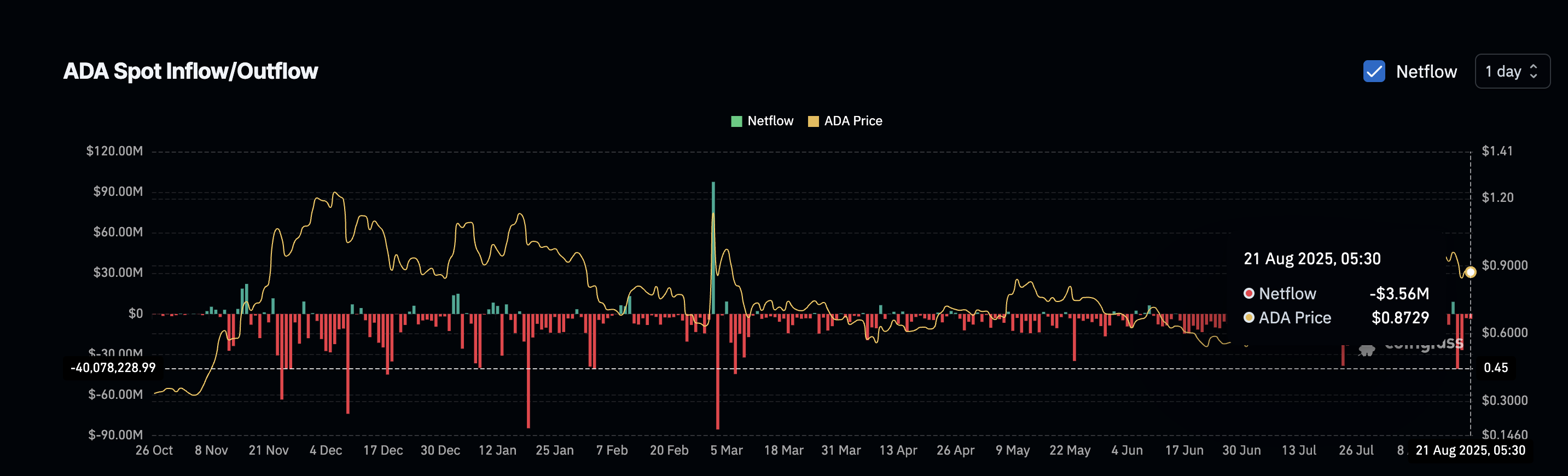

Cardano’s 90% Drop in Outflow Hints at Purchaser Weak spot

Over the previous few days, internet outflows from ADA spot exchanges have slowed drastically. At its native peak, Cardano recorded $40.07 million in every day outflows: a transparent signal of robust shopping for conviction, as merchants have been pulling cash off exchanges.

That conviction has pale. By August 21, ADA’s internet outflow dropped to simply $3.56 million. That’s a 91% decline from peak demand. Whereas this nonetheless represents internet outflow, the plunge in dimension suggests consumers are stepping apart. There’s nonetheless no aggressive influx, however momentum has stalled.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

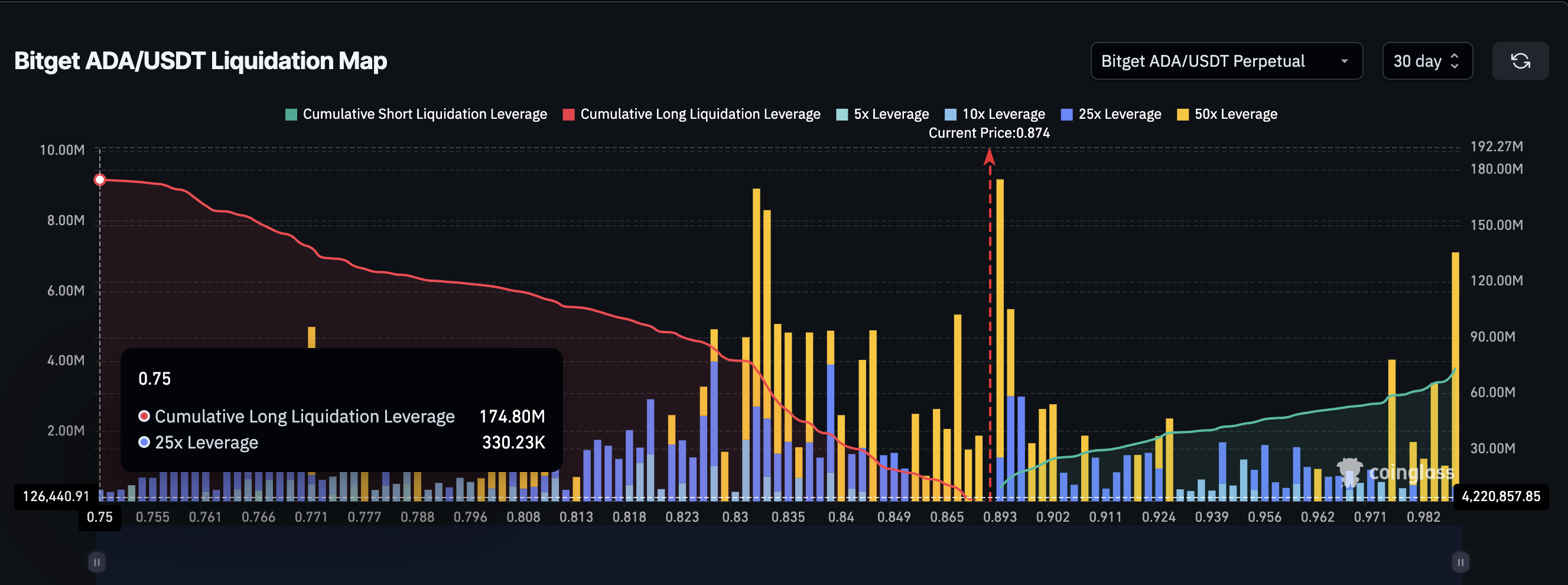

Too Many Longs? Leverage Stack May Add Gas to the Hearth

Liquidation map knowledge reveals ADA’s lengthy positions are stacked dangerously tight. On Bitget, over $174.80 million in lengthy leverage is constructed up, in comparison with simply $73.56 million in shorts.

The largest leveraged cluster sits close to $0.83 to $0.85, that means if the Cardano value drops to that vary, liquidations may snowball. Though too many Lengthy positions signify constructive bias however an imbalance as this will result in a protracted squeeze.

With many of the market betting lengthy, a dip beneath the important thing assist degree may trigger quick unwinding and volatility.

It’s a traditional overload setup. Bullish merchants might unknowingly be fueling a sudden transfer down, particularly for the reason that value is sitting proper on high of key lengthy clusters, and sellers are beginning to achieve power.

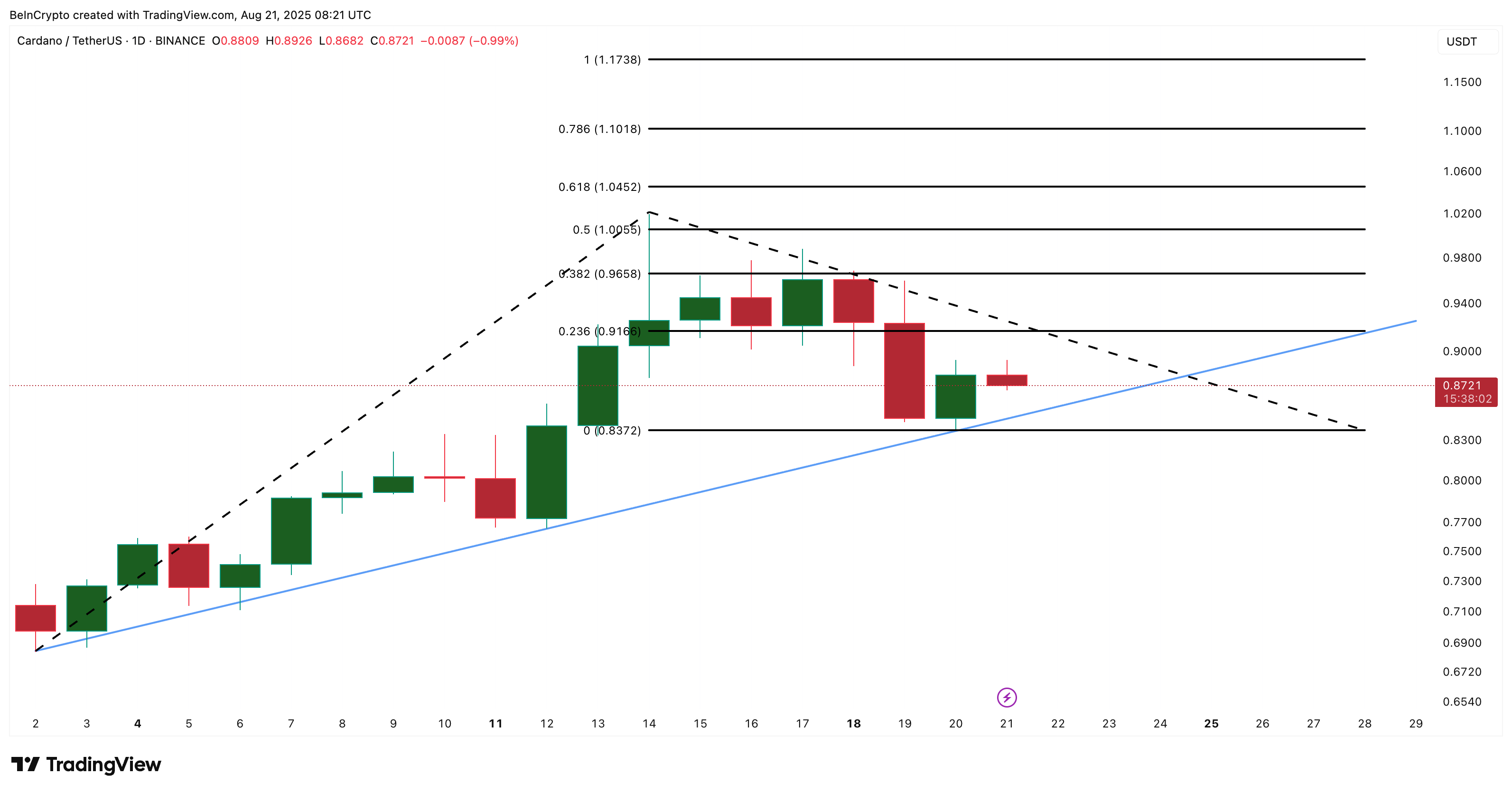

Cardano Value Sample Stays Intact, However Strain Factors Are Constructing

On the every day chart, the Cardano value continues to commerce inside an ascending triangle. The rapid breakout degree sits at $0.91. If that clears, ADA may run towards $1.01–$1.10, backed by a very powerful 0.5 and 0.618 Fibonacci extension ranges.

However the assist line at $0.83 is now vital. If the ADA value breaks beneath this, the triangle sample breaks down, and all bullish setups turn out to be invalidated.

With diminished outflow assist and leverage imbalance, this degree is now not well-defended. The Cardano value might look bullish structurally, however it’s leaning on weakening legs.

The put up Cardano Value Holds Bullish Sample—However a 90% Drop in Key Metric Could Spell Bother appeared first on BeInCrypto.