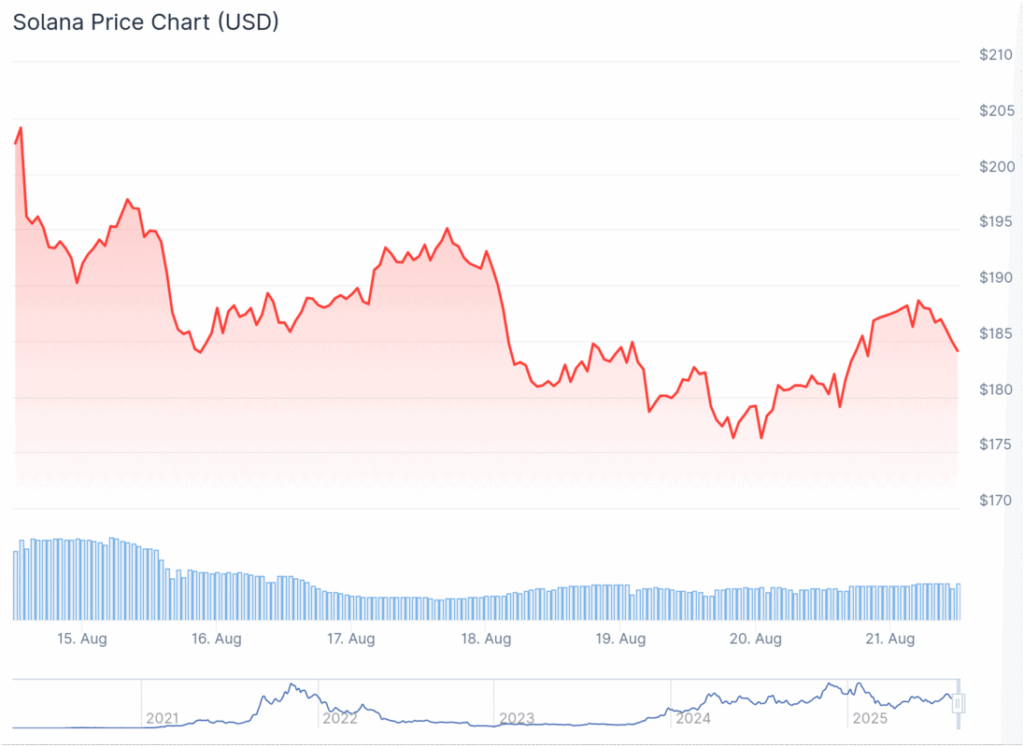

- Solana rebounded from $175 assist to commerce above $182, breaking previous a bearish development line.

- The community processed Bullish alternate’s $1.15B IPO absolutely on-chain with stablecoins, marking a serious institutional milestone.

- SOL now targets $188–$195 resistance, supported by rising addresses and a 100,000 TPS efficiency peak.

Solana has bounced again from its $175 assist stage, now buying and selling above $182 after breaking via a bearish development line at $183. The restoration comes proper because the community made headlines for settling Bullish alternate’s $1.15 billion IPO solely on-chain with stablecoins. That single transaction marked the primary time a Layer 1 blockchain dealt with a capital-markets scale settlement natively, placing Solana in entrance of institutional gamers who’ve principally leaned on conventional rails till now.

Community Handles $1.15B IPO Settlement

The IPO settlement wasn’t only a flashy quantity—it was a proof level. Bullish selected Solana’s chain to course of over a billion {dollars} in stablecoins, a transfer that alerts confidence within the community’s capacity to deal with large-scale, high-stakes monetary flows. For Solana, it’s a shot at legitimacy within the eyes of Wall Avenue, exhibiting that past NFTs and DeFi, the chain can arise as an institutional-grade settlement layer. It’s a milestone that many argue might speed up adoption from exchanges, funds, and banks taking a look at blockchain for actual capital markets exercise.

Technicals and Adoption Tendencies

From a technical standpoint, SOL faces resistance round $188, with additional targets at $192 and $195 if momentum retains up. MACD is bullish, RSI sits comfortably above 50, and the worth is holding above the important thing $180 stage. On-chain, Solana reached a verified throughput peak of 100,000 TPS, flexing efficiency capabilities, although community utilization stays blended. Each day lively addresses jumped by half 1,000,000 in three days, climbing from 3.1M to three.6M, at the same time as broader exercise dipped earlier within the week.

Can SOL Push Greater?

Regardless of the bounce, Solana remains to be lagging Ethereum in month-to-month returns—posting 5% positive aspects in comparison with ETH’s 15%. Nonetheless, with institutional-scale settlement now in its again pocket, SOL’s narrative might shift rapidly. If bulls handle to clear $195 resistance, the subsequent leg towards $200 and even $210 comes into play. If not, assist at $184 and $180 might be retested. For now, the mix of technical resilience and Wall Avenue consideration is conserving Solana firmly within the highlight.