In keeping with a Commonplace Chartered report, stablecoins are shifting from preliminary use in crypto exchanges to broader functions in world finance.

The research signifies that stablecoins are more and more used for functions akin to conventional finance, equivalent to saving and transacting in U.S. {dollars} and facilitating cross-border funds.

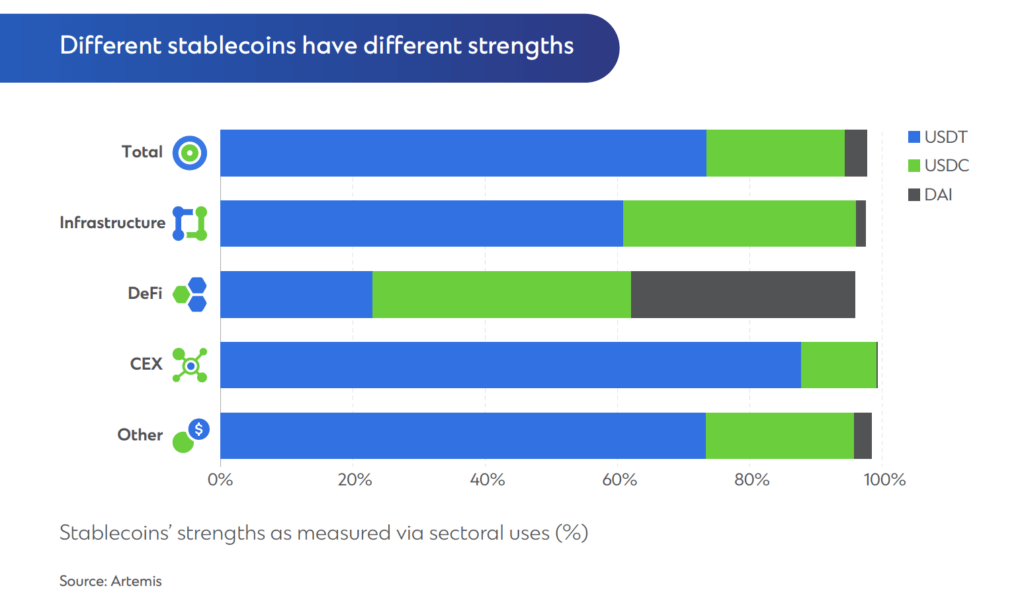

Commonplace Chartered feedback on how stablecoins’ dominant use case is evolving.

“There may be rising proof of accelerating stablecoin use for quite a lot of functions akin to these offered in conventional finance.”

In keeping with the report, one vital issue driving this shift is the demand for quicker and extra accessible cross-border transactions. Conventional correspondent banking methods have limitations, particularly in rising markets with declining entry. Stablecoins provide an answer by enabling the switch of digital greenback belongings at speeds similar to electronic mail, bypassing the gradual and typically unreliable conventional methods.

The report highlights that stablecoins at the moment are being adopted for saving in USD phrases, transacting in USD, and cross-border USD-to-USD transactions. A survey cited within the research discovered that in nations like Brazil, Turkey, Nigeria, India, and Indonesia, 69% of respondents use stablecoins for forex substitution, 39% for paying for items and companies, and one other 39% for cross-border funds.

Whereas U.S. dollar-pegged stablecoins dominate the market, accounting for 99.3% of the market capitalization, there’s a rising curiosity in non-USD stablecoins. The emergence of stablecoins linked to different nationwide currencies, such because the Turkish lira, signifies a possible shift in direction of extra various choices within the stablecoin ecosystem.

The report additionally notes that the stablecoin market cap is presently $163 billion, which is small in comparison with the general monetary markets however has vital room for progress. The potential for enlargement is tied to regulatory developments. The report suggests,

“We count on this use case to proceed to develop, notably if U.S. stablecoin regulation is handed, as now seems to be doubtless beneath a Trump administration.”

Commonplace Chartered argues that the rising adoption of stablecoins for real-world functions highlights their position as a “first killer app” in digital belongings. They supply an alternate for the unbanked and provide efficiencies in cross-border transactions that conventional methods have but to match.

Per the Commonplace Chartered report, the way forward for stablecoins seems promising, with alternatives for elevated adoption in each developed and rising markets. The mixture of technological development and regulatory assist could place stablecoins as a major factor of the worldwide monetary infrastructure.

Commonplace Chartered has been bullish on Bitcoin and the broader crypto market lately, recommending buyers buy Bitcoin beneath $60,000 no matter this month’s election final result. With Bitcoin rallying towards $100,000, buyers who adopted this recommendation have garnered appreciable returns in a brief interval.