Crypto markets regained momentum over the previous 24 hours, with the market cap of ‘made in USA’ cash rising 7%. The rebound adopted Jerome Powell’s Jackson Gap remarks. The Fed Chair struck a notably dovish stance, acknowledging growing dangers within the labor market and signaling openness to September price cuts.

Whereas no agency commitments had been made, the prospect of easing has already lifted main property, although not each token has reacted equally. In opposition to this backdrop, there are three made in USA cash to look at earlier than September price cuts probably unlock the subsequent wave of liquidity.

XRP (XRP)

XRP is buying and selling close to $3, up 6.5% prior to now 24 hours, however its rally stays subdued in comparison with Ethereum and Solana. That underperformance means that September price cuts is probably not absolutely priced in, making XRP one of many cash to look at earlier than September price cuts materialize.

On the every day chart, the Chaikin Cash Movement (CMF) has been pushing larger. This displays stronger inflows, whereas the Relative Energy Index (RSI) sits round 49 — a impartial studying that exhibits the token is much from overbought.

Chaikin Cash Movement (CMF) measures shopping for and promoting strain by combining worth and quantity, with larger readings signaling stronger inflows.

Relative Energy Index (RSI), then again, tracks the pace and alter of worth strikes to gauge momentum, with values above 70 seen as overbought and beneath 30 as oversold.

Technically, holding above $3.10 would enhance probabilities of a transfer to $3.34. And breaking by that resistance may ignite a stronger rally to the north of $3.65. A dip below $2.78, nevertheless, dangers deeper losses.

Past worth, fundamentals are in play. Ripple secured a authorized victory with the dismissal of its SEC attraction, and a cluster of amended XRP ETF filings has revived hypothesis round institutional inflows.

Collectively, these components set the stage for XRP to reply sharply if September price cuts are confirmed.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

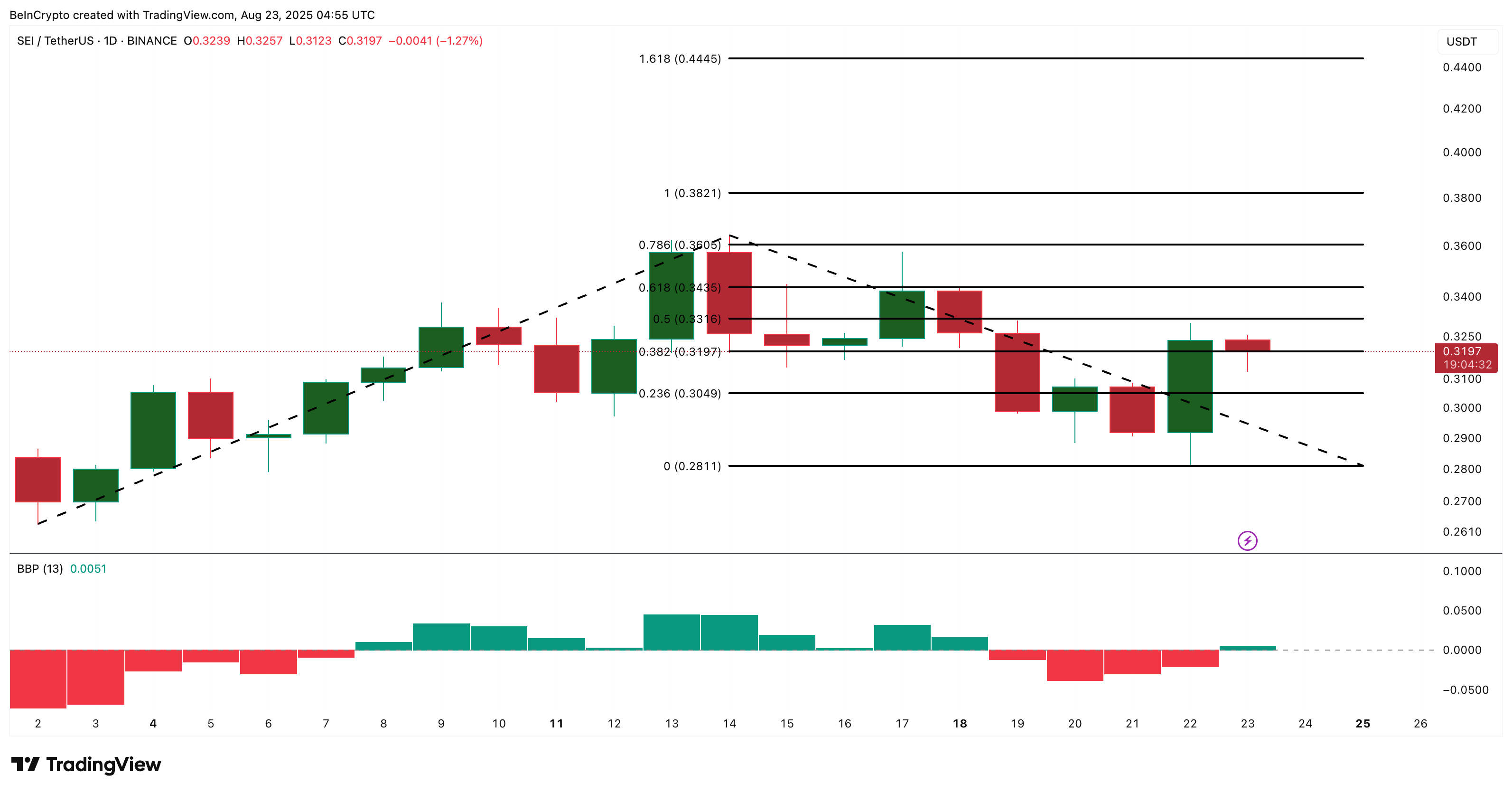

Sei (SEI)

SEI Community, a US-developed Layer-1 constructed for buying and selling purposes, has quietly gained traction in current months. Ondo Finance’s determination to launch tokenized treasuries on SEI highlights its relevance within the real-world property narrative.

The token has climbed almost 10% prior to now day, now buying and selling at $0.31. It appears the bulls might need lastly regained management after 4 periods of fading momentum.

This shift was confirmed by the bull-bear energy indicator flipping inexperienced. And that too reinforces SEI’s inclusion amongst cash to look at earlier than September price cuts.

Bull Bear Energy (BBP) highlights the stability between bullish and bearish momentum, with rising inexperienced bars exhibiting bulls gaining management

Over a three-month span, SEI has delivered 44% positive aspects, supported by an intact uptrend. Fibonacci projections present resistance between $0.33 and $0.36, with a breakout opening the door to $0.44.

On the draw back, slipping beneath $0.30 and $0.28 would weaken the setup. With broader sentiment leaning dovish, SEI’s muted rally leaves scope for acceleration if liquidity expands in September.

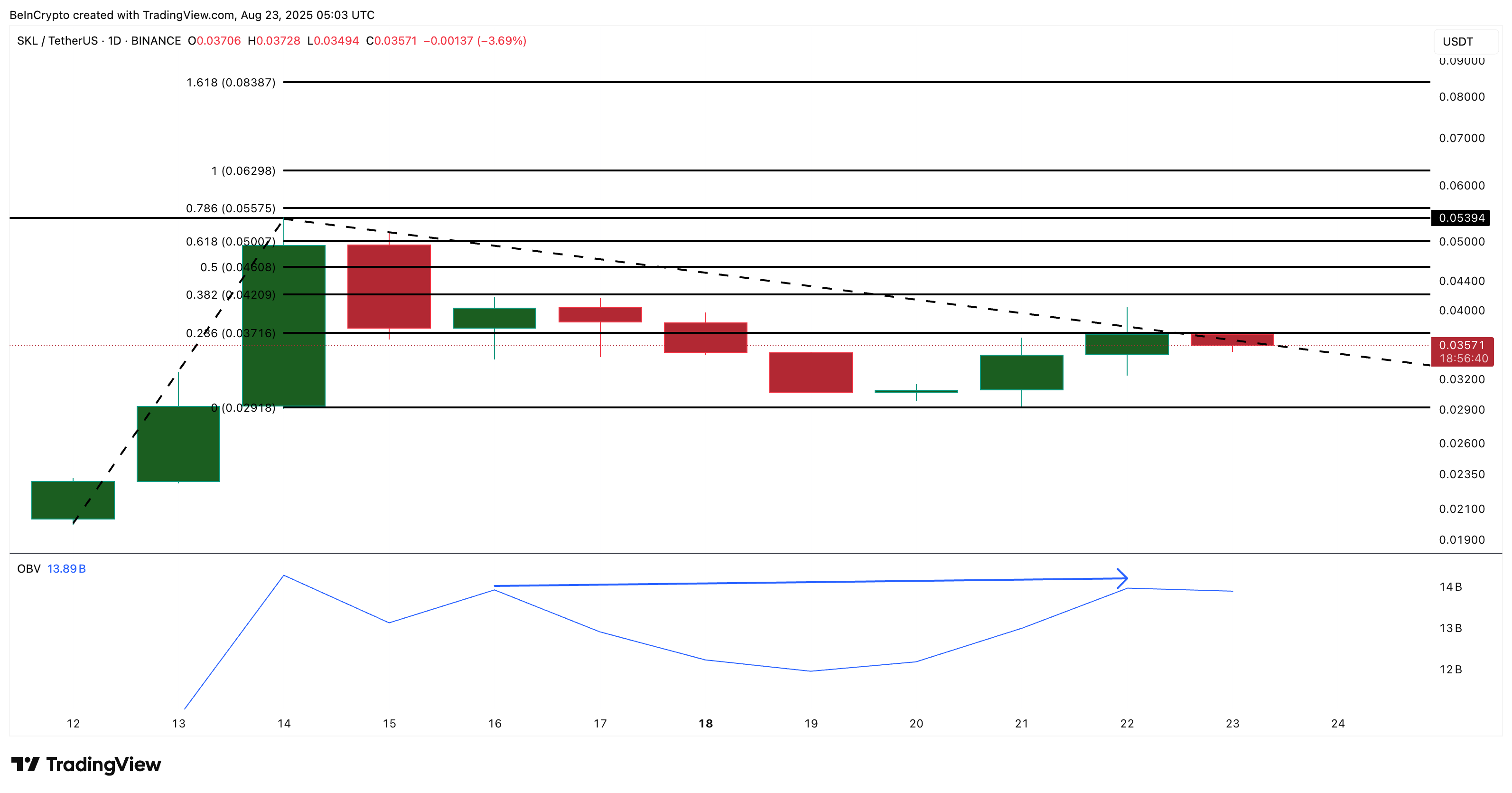

SKALE (SKL)

SKALE, a US-based Ethereum scaling answer, has drawn consideration after a 50% rally earlier this month pushed by whale exercise and hypothesis of a Google link-up.

Whereas the value has since cooled, it trades steadily close to $0.035, with positive aspects below 5% prior to now 24 hours. The broader construction exhibits patrons are quietly re-emerging.

On-balance quantity rose from 13.93 billion on August 16 to 19.98 billion on August 22, whilst costs made a decrease excessive. It is a signal that accumulation is underway. Netflow information additionally exhibits regular outflows, suggesting sell-side strain is easing.

On-Stability Quantity (OBV) provides quantity on up days and subtracts on down days to indicate whether or not shopping for or promoting strain is driving the development.

Key ranges lie at $0.037 and $0.055, with a confirmed breakout above $0.055 leaving little resistance as much as $0.083.

With September price cuts prone to inject liquidity into threat property, SKALE’s enhancing technicals and mission relevance in Ethereum scaling make it some of the compelling cash to look at earlier than September price cuts.

Nonetheless, a dip below $0.029 may invalidate the bullish outlook, priming the SKL worth for brand new lows.

General, these three ‘made in USA cash’ present notable volatility in anticipation of the potential September price cuts.

The put up 3 Made In USA Cash To Watch Earlier than September Fee Cuts appeared first on BeInCrypto.

(@FilanLaw)

(@FilanLaw)