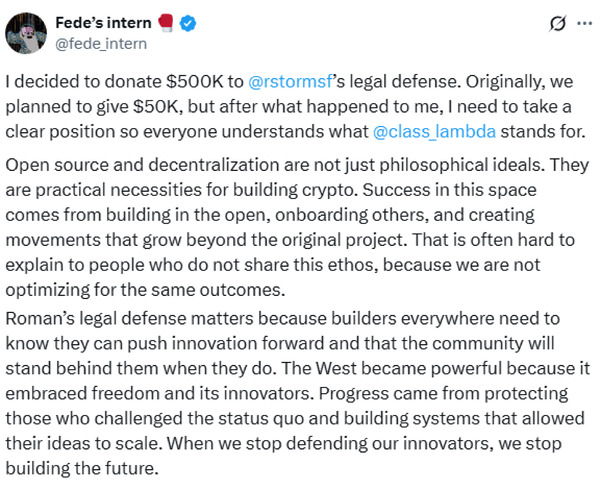

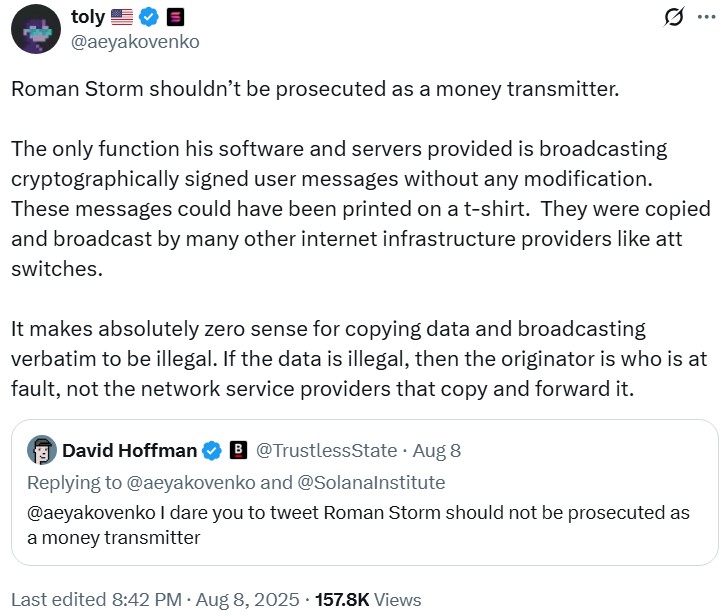

Roman Storm’s conviction over Twister Money has sparked a debate about whether or not US authorities are narrowing crypto privateness rights regardless of the White Home’s current report emphasizing the significance of self-custody and particular person freedoms.

The case has drawn comparisons to earlier battles over Silk Highway, elevating questions on felony intent, management of immutable good contracts and whether or not privateness itself can ever outweigh safety considerations. In the meantime, the White Home is pushing for a transparent taxonomy of digital belongings — commodity or safety — highlighting how unresolved definitions and legal responsibility requirements proceed to form US crypto coverage discussions.

To discover the authorized implications of Storm’s conviction and the broader coverage context, Journal spoke with Joshua Chu of the Hong Kong Web3 Affiliation, Yuriy Brisov of UK legislation agency Digital & Analogue Companions and Charlyn Ho of US legislation agency Rikka.

The dialog has been edited for readability and size.

Journal: Does Storm’s conviction spotlight the stress between US coverage suggestions on privateness rights and the way in which legal responsibility is assigned in crypto instances?

Chu: If I’m placing on my asset restoration lawyer hat, we all the time say we goal the infrastructure to safeguard our purchasers’ pursuits. There are crypto mixers that argue the character of their exercise doesn’t routinely imply they’re all the time used for illicit functions.

I do quite a lot of these instances, and I all the time say that it doesn’t matter if belongings are going by means of centralized or decentralized platforms. Simply because someone purports that it’s a decentralized working car, it doesn’t imply you’re simply publishing codes on the market. On the finish of the day, legal guidelines are legal guidelines. The actual query shouldn’t be whether or not we’d like new ones, however whether or not current legal guidelines have been adopted.

Brisov: I’d additionally add to this dialogue one other case concerning Twister Money, which was Joseph Van Loon, et al. v. Division of the Treasury. It was an important case the place the courtroom discovered that immutable good contracts will not be property and can’t be managed by the individuals who created them in the event that they’re a purely enforceable good contract.

One essential level is: If we will show that nobody controls the expertise, then it isn’t property, which implies nobody can personal it or be held responsible for it. The Storm case with Twister Money is totally different. Within the Howey case, the “financial actuality” precept stated we should always look not simply on the type of a transaction however at its precise financial construction. In the event you create one thing with malicious intent, that adjustments the evaluation.

In US felony legislation, legal responsibility depends upon each actus reus (a responsible act) and mens rea (a responsible thoughts). In the event you design a software to interrupt the legislation, that exhibits felony intent. The Silk Highway case illustrates this: Ross Ulbricht argued that he wasn’t personally conducting unlawful transactions, however the courtroom discovered that by creating the platform with the intent for it for use illegally, he was nonetheless liable.

Lack of management right now doesn’t erase the felony intent in the intervening time of creation.

Journal: Do you agree with crypto advocates who criticize Storm’s conviction as an assault on privateness?

Ho: I don’t suppose it’s correct to border this conviction merely as an assault on privateness. As an alternative, it underscores this ongoing, unresolved stress, with totally different stakeholders falling at totally different factors on the spectrum of how a lot privateness versus how a lot safety is suitable.

Crypto purists argue that the expertise exists to scale back the facility of centralized authorities by enabling self-custody and peer-to-peer transfers with out intervention. However on the identical time, main banks have begun adopting crypto in ways in which run counter to that unique philosophy. We see the identical stress play out with Twister Money and even discussions round central financial institution digital currencies (CBDCs). Privateness is a key objective, however in observe, governments and courts have persistently taken the place that privateness can’t come on the expense of public security.

A helpful analogy is encryption. When encrypted messaging platforms like WhatsApp first appeared, or when Apple refused to unlock the San Bernardino shooter’s iPhone, the identical arguments have been raised: particular person rights to encryption versus legislation enforcement’s want for entry. Over time, courts and regulators have developed clearer boundaries round when communications can stay personal and when legislation enforcement can compel entry. That precedent might in the end assist information how courts take into consideration crypto privateness instruments like Twister Money.

Journal: With privateness now central to US crypto coverage, are there any legal guidelines that immediately shield crypto privateness right now?

Ho: There isn’t a particular “crypto privateness legislation.” What now we have as a substitute are basic privateness legal guidelines that may apply to crypto. For instance, a pockets deal with would probably be thought of private info beneath the California Shopper Privateness Act. The definition of private info there — just like the EU — is broad: Basically, any information that identifies or might be linked to a pure individual.

This ties into the ideas of nameless versus pseudonymous information. Nameless information can’t be traced again to a person, even when mixed with different info. Pseudonymous information, alternatively — like a pockets deal with — can usually be related again to an individual when mixed with sufficient different items of information.

So, whereas there isn’t a legislation written particularly for “crypto privateness,” there are binding privateness legal guidelines that completely apply to crypto-related info. Within the US, the complexity is that it depends upon components like the kind of info, the way it’s collected, the way it’s used and who’s gathering it. The identical pockets deal with would possibly fall beneath totally different regulatory obligations if it’s being collected by a financial institution, a retail firm or a healthcare supplier.

Learn additionally

Options

Actual life yield farming: How tokenization is remodeling lives in Africa

Options

Open Supply or Free for All? The Ethics of Decentralized Blockchain Growth

Journal: The White Home report additionally really helpful a ban on CBDCs, reiterating privateness considerations. How do totally different authorized traditions form the way in which international locations method stablecoins and CBDCs?

Chu: Within the US, the controversy is deeply tied to the widespread legislation custom, which tends to be extra favorable towards stablecoins. In contrast, civil legislation techniques — notably in continental Europe — lean extra towards CBDCs. China’s authorized system, for instance, is closely influenced by German legislation, which helps clarify its place.

In China, we actually have to consider two worlds. There’s the government-facing world, after which there’s the retail-facing world. China’s bans have all the time been geared toward its personal residents, stopping them from partaking in speculative economies. On the identical time, they wish to protect residents from overindulgence in speculative belongings whereas nonetheless partaking with international markets. That duality explains current studies: Brokers in China are being instructed to cease providing stablecoin programs to most people, whereas in Hong Kong, the federal government overtly encourages growth.

This displays China’s lengthy historical past of compartmentalized engagement with the surface world. Within the nineteenth century, port metropolis techniques like Shanghai and Canton served as contained hubs for international commerce. What we’re seeing now’s a contemporary model of that very same method with crypto.

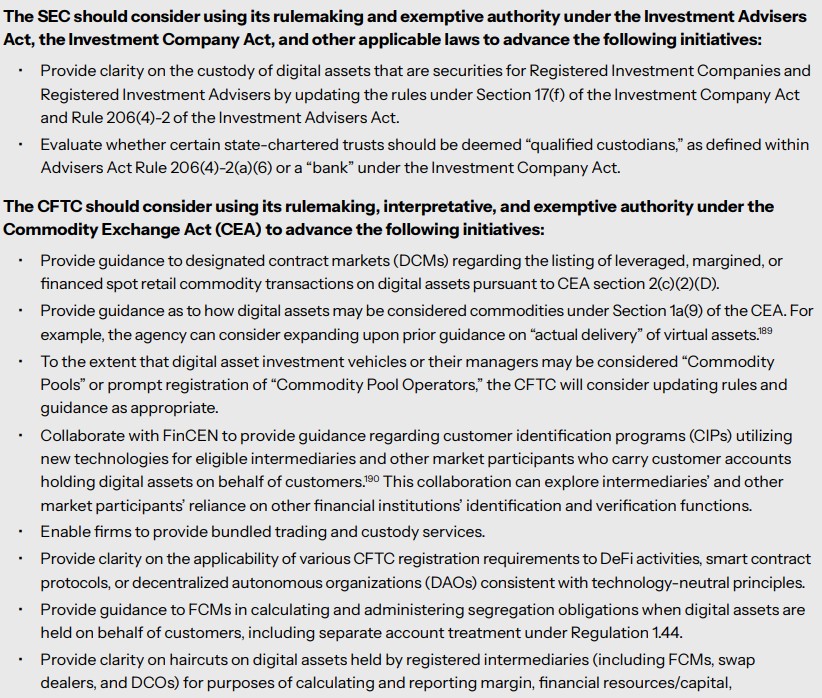

Journal: What’s driving the White Home’s deal with classifying digital belongings into a transparent taxonomy?

Ho: I feel that’s form of the crux of the problem is that there are commodities and securities beneath US legislation. The White Home crypto report says that the present Inside Income Service steerage doesn’t deal with whether or not a digital asset is taken into account a safety or commodity for federal earnings tax functions. It goes on to say that the code, which is the IRS code and case legislation, defines safety in numerous methods for various tax functions and likewise doesn’t outline the time period commodity or defines it in a round method and doesn’t cross-reference the commodities legislation that means of the time period.

So, there’s the commodities legislation, there’s the securities legal guidelines after which there’s tax legal guidelines. I feel the problem is that none of those legal guidelines are harmonized. That’s type of the purpose of the CLARITY Act proposal: to make clear when a digital asset is a safety and when it’s a commodity as a result of the scope of the Securities and Alternate Fee’s jurisdiction is that it’s the regulator for securities, whereas the Commodity Futures Buying and selling Fee is the regulator for commodities. But when the central query of “What’s a commodity?” versus “What’s a safety?” is complicated, then that naturally results in stress between the 2 companies.

Learn additionally

Options

‘Slaughterbot’ drones in Ukraine, MechaHitler turns into horny waifu: AI Eye

Options

Decentralized social media: The following massive factor in crypto?

The opposite complication is, keep in mind we have been speaking about Choose Torres and the way she, in her choice on the Ripple case, had made a remark that whether or not a digital asset is a safety not solely depends upon the character of the digital asset and the way it’s marketed, but additionally how it’s offered. And in order that provides much more complexity as a result of which means it may very well be each, relying on various factors.

Journal: Why is the dialogue across the classification of digital belongings as securities or commodities not echoed in different main crypto legal guidelines like MiCA?

Brisov: It’s really fairly simple. The US falls beneath widespread legislation jurisdictions. Normally, in widespread legislation, it’s the precedent — the choice of courts or case legislation — that units the laws. In widespread legislation jurisdictions, there will not be so many statutes as a result of it’s simpler to make legal guidelines step-by-step, altering regularly.

So, the securities legal guidelines within the US are very broad. In the event you learn what a safety is beneath the 1933 Securities Act, it’s a really lengthy listing. Something that falls into this listing can or can’t be a safety, and it’s for the courts to resolve. That’s why courts invent exams just like the Howey check.

However in Europe, we don’t have this downside as a result of Europe is a civil legislation jurisdiction. If it’s written within the legislation that this can be a safety, then it’s. We’ve got Markets in Crypto-Belongings regulation now in Europe that regulates stablecoins and utility tokens. And there’s Markets in Monetary Devices Directive that regulates all securities. So, it’s a must to resolve from the start whether or not you subject securities or utility tokens.

After all, to some extent, there’s a type check and an financial actuality check, nevertheless it doesn’t apply as a legislation. It simply applies for attorneys drafting papers. In any other case, they are going to simply be fined for issuing the unsuitable safety providing. It’s a lot simpler: You select the way in which from the start, select the laws, file the paperwork and current it to the authority.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist protecting blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has lined Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.