Bitcoin’s 30-day lively provide has cooled off, in response to new information from Alphractal, highlighting a slowdown in market exercise after latest volatility.

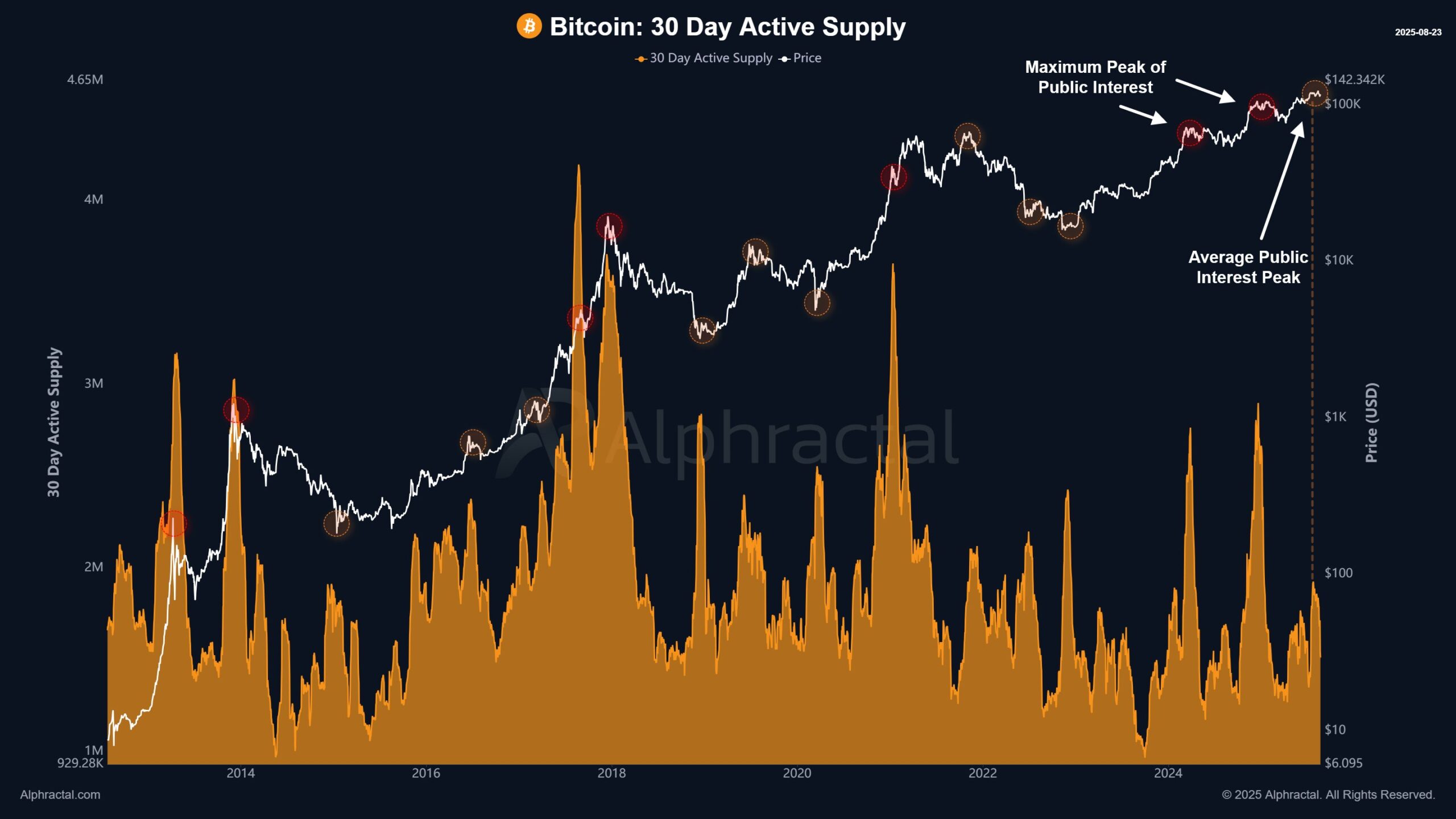

The 30-day lively provide measures the variety of distinctive cash which have moved a minimum of as soon as up to now month. Analysts usually view it as a “thermometer” of market curiosity in BTC. When the metric rises, it sometimes alerts new cash coming into circulation and stronger investor exercise, circumstances that usually coincide with market tops or bottoms, as worry and greed drive merchants to maneuver their holdings.

Conversely, when lively provide declines, it displays a calmer market with decrease circulation. Such durations usually observe phases of maximum stress or enthusiasm and might mark consolidation zones earlier than the following main transfer.

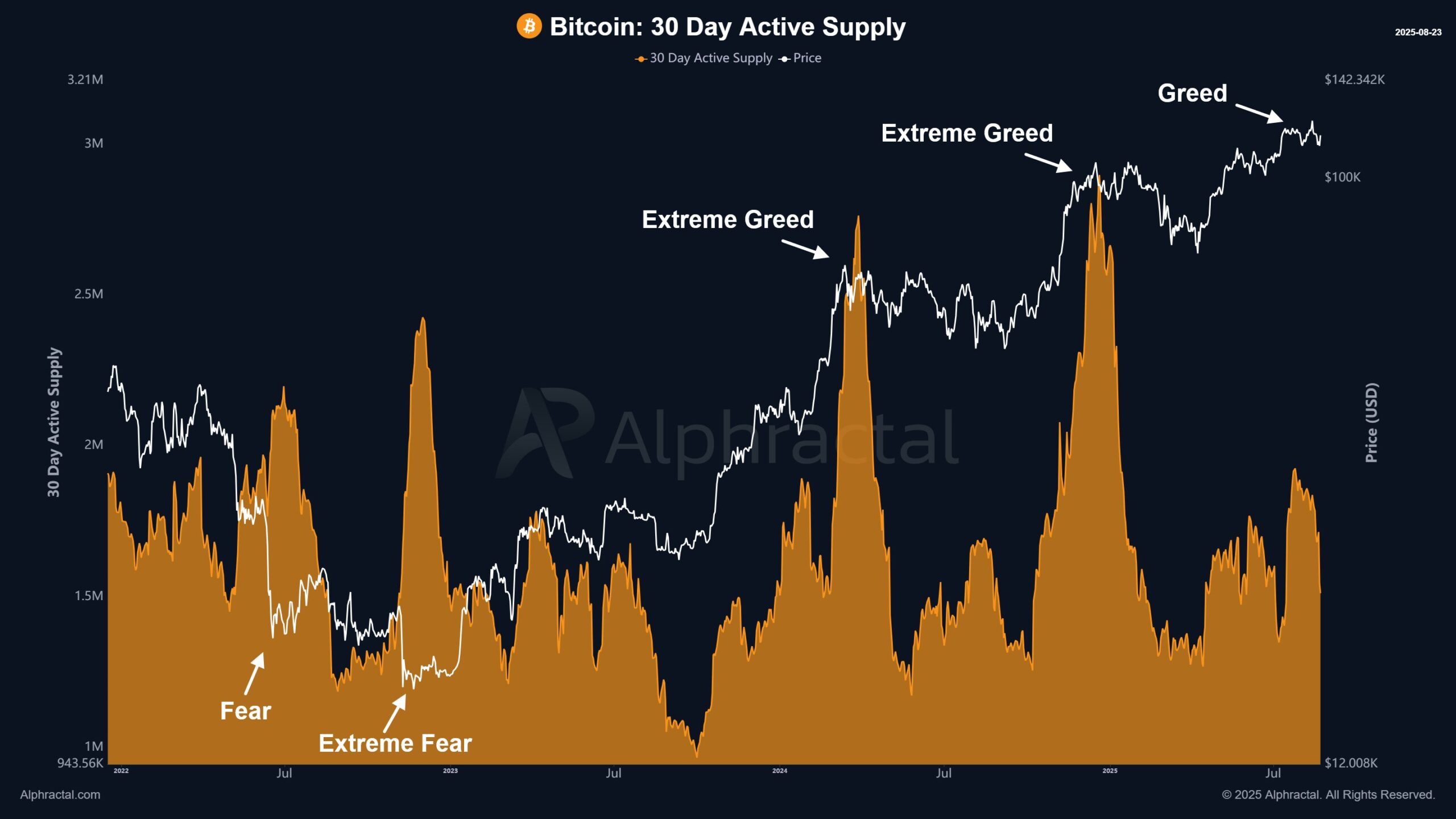

Alphractal famous that the present decline in lively provide reveals precisely this cooling development. In different phrases, Bitcoin provide actions have slowed, decreasing fast volatility and leaving room for market forces to form the following breakout.

Traditionally, peaks within the 30-day lively provide have aligned with excessive greed phases the place fast worth appreciation tempted traders to maneuver cash. Likewise, sharp downturns usually appeared close to capitulation occasions, when worry spiked.

The current calm might subsequently symbolize a transitional stage, positioning Bitcoin for its subsequent vital directional push.

With Bitcoin buying and selling above $115,000 and market contributors carefully monitoring macro elements like Fed coverage shifts and ETF inflows, the cooling of lively provide means that conviction is robust. As Alphractal put it, the market might now be in “reset mode,” awaiting the circumstances to drive BTC’s subsequent massive transfer.