Regardless of the broader market displaying indicators of fatigue, the BNB value prepare remains to be on observe. Over the previous 24 hours, Binance Coin has slipped 1.5%, now buying and selling at $877. Given its relentless efficiency, this pullback, nevertheless, appears to be like extra like a scheduled pause than a derailment.

Prior to now month alone, BNB has gained 15%, whereas three-month returns sit at 30%, and the yearly swing is a powerful 51%. At simply 2% beneath its all-time excessive of $899, the token remains to be inside hanging distance of a breakout that would carry it into four-digit territory for the primary time.

Spot Demand Builds By means of HODL Waves

Supporting this regular climb is the growth throughout a number of HODL wave cohorts: a metric that tracks the share of circulating provide held throughout totally different holding durations.

Between July 24 and August 23, three key cohorts all grew their holdings: one-year to two-year wallets rose from 6.55% to 7.52%, three-month to six-month holdings surged from 1.62% to 7.30%, and one-month to three-month wallets ticked barely increased from 2.29% to 2.306%.

These will increase affirm that each long-term and mid-term traders are shopping for into power slightly than ready for dips, including contemporary gasoline to the BNB value prepare.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Futures Open Curiosity Retains Momentum Alive

It isn’t simply spot markets which can be feeding the rally. BNB futures open curiosity has been climbing steadily alongside costs, hitting a three-month peak of $1.27 billion on August 22. The present ranges are nonetheless across the identical zone.

Rising open curiosity means leveraged merchants are piling in, amplifying the potential for each upward surges and sudden squeezes. If momentum favors the bulls, brief liquidations may speed up the transfer previous $899 and unlock increased value discovery ranges.

On the flip facet, a sudden lengthy squeeze may set off volatility and pullback, however the present alignment of spot and derivatives suggests the bias stays upward.

Futures open curiosity measures the whole variety of excellent futures contracts that haven’t been settled, displaying how a lot capital is tied to derivatives.

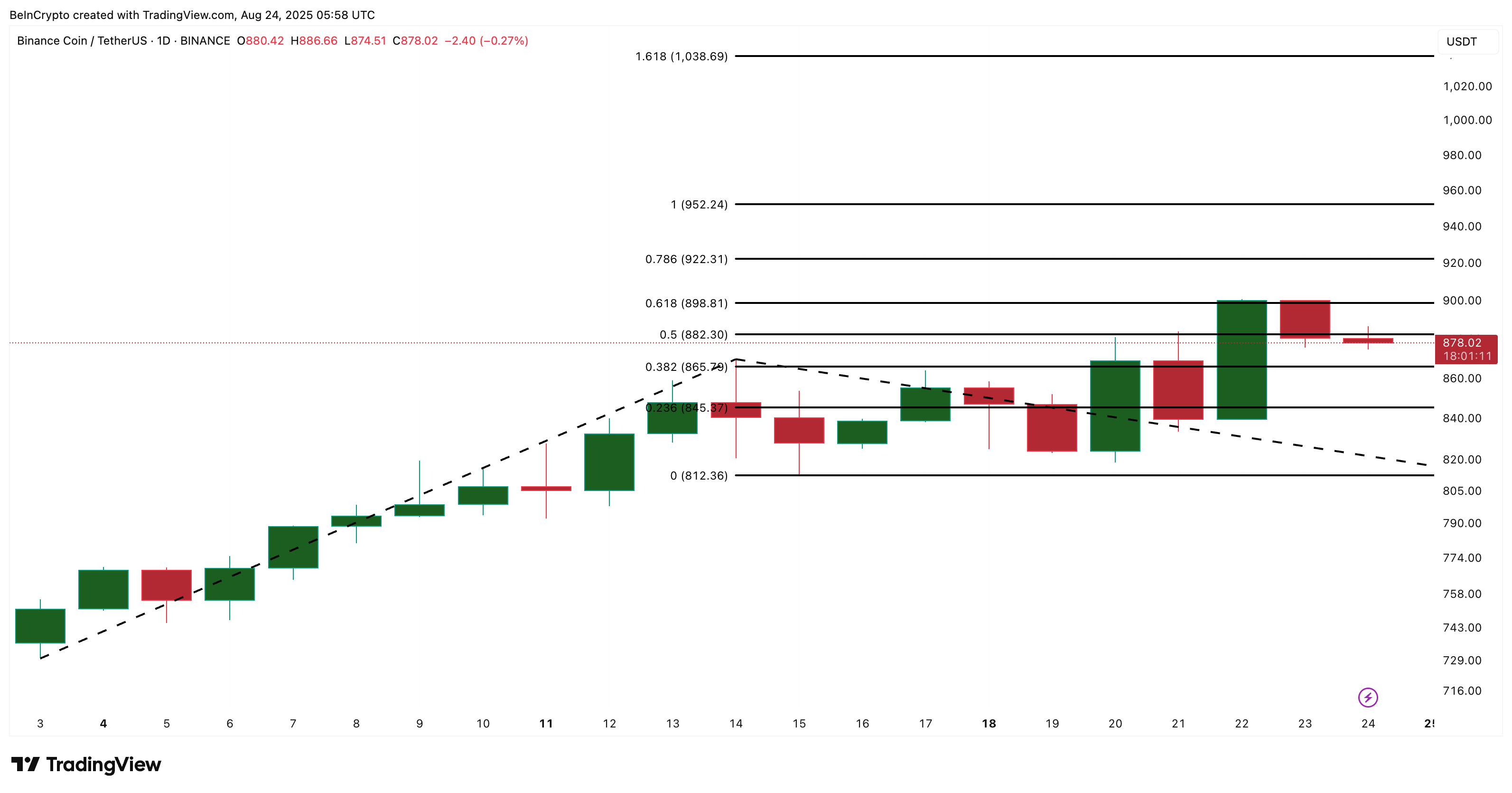

BNB Value Motion: $898 Is the Gateway to 4 Digits

BNB is testing vital resistance zones that would outline its subsequent transfer. The token not too long ago pulled again from $898, which aligns with the 0.618 Fibonacci extension, usually seen because the strongest barrier in an uptrend. The BNB value is at the moment buying and selling a notch underneath one other key resistance degree of $882.

With $898–$899 marking its historic excessive and one of many hardest resistance zones, a decisive candle shut above that degree may open the tracks towards $922 and $952.

As soon as BNB breaks previous $898 strongly and into value discovery, the primary four-digit goal stands at $1,038. If spot and derivatives momentum holds, this will likely solely be the start of an extended rally, the place $1,000 is much less a vacation spot and extra a milestone on the journey.

Nonetheless, if the BNB value breaks underneath $812, a key retracement zone, it could invalidate the bullish speculation within the brief time period. That might momentarily put a halt to the BNB value prepare.

The put up BNB Value Prepare Steams Towards $1,000 as Consumers Gas the Rally appeared first on BeInCrypto.